8 Reasons Why Should I Outsource My Bookkeeping Today

Jun 2025

As a business owner, you know the pressure of balancing growth, strategy, and daily operations. However, when it comes to managing finances, particularly bookkeeping, it can quickly become overwhelming. You’ve invoices to track, receipts piling up, and financial records that need to be accurate and up-to-date.

You might be thinking, "I can handle this myself," but as your business grows, those hours spent on bookkeeping could be better used on what you do best. That's where outsourcing comes in. In this post, we'll break down the top 8 reasons why outsourcing your bookkeeping now will save you time, reduce stress, and ultimately boost your bottom line.

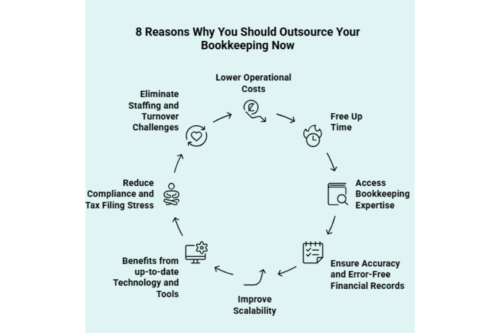

8 Reasons Why You Should Outsource Your Bookkeeping Now

Outsourcing bookkeeping saves time and money, offering flexible services and expert financial reporting. It lets you focus on growing your business while ensuring accurate, tech-driven financial management. Below are the eight solid reasons that will help you understand the importance of outsourcing.

1. Lower Your Operational Costs Instantly

Want to slash your costs without compromising on quality? Outsourcing your bookkeeping means no full-time team, no office expenses, and no unnecessary overheads. You pay only for what you need, helping you stay in control of your budget.

By leveraging a bookkeeping firm, you can save money and time spent on hiring, training, and managing an in-house team. Those savings can be invested in operations or marketing, fueling growth while keeping your finances in check. It’s a game-changing way for businesses to keep costs low while maintaining high profits.

2. Free Up Time to Focus on Core Business Activities

Bookkeeping is a time drain. Instead of getting bogged down in records, let professionals handle it. This frees up precious time to focus on growing your business, connecting with customers, and making impactful decisions.

By outsourcing, you’re not just delegating tasks; you’re gaining time to innovate, market, and drive profit. With expert bookkeepers taking care of the details, you’ll have less stress and more time to shape the future of your business. Think of what you could achieve if bookkeeping were no longer on your to-do list.

3. Gain Access to Professional Bookkeeping Expertise

Why settle for less when you can have the best? Outsourcing gives you instant access to a team of bookkeepers and CFOs who know your business inside and out. You get their top-tier expertise without the hefty cost of full-time employees.

These professionals don’t just handle your books; they provide tailored financial advice to help you navigate complex challenges and ensure your business stays compliant. It's like having a financial team on demand, pushing your growth forward with precision and insight.

4. Ensure More Accurate and Error-Free Financial Records

Mistakes in bookkeeping can be costly. With an outsourced team, you eliminate the risk of errors that could affect your financial statements and cause issues during tax time. Professional bookkeepers use advanced accounting systems to ensure your records are always accurate and reliable.

By leveraging the latest technology and automated tools, your business stays on track with error-free, real-time financial reports. This accuracy gives you the confidence to make informed decisions and plan for growth with clarity. Your numbers will be spot on every time.

5. Improve Scalability as Your Business Grows

As your business grows, so do your accounting needs. Outsourced bookkeeping allows your financial processes to scale seamlessly without the need to hire and train more staff. Need extra support during peak periods? No problem. Outsourced teams flex to match your needs, handling the surge while you focus on growth.

With expert tools and systems in place, your business can easily expand its services, from advanced reporting to tax support, without skipping a beat. Whether it’s adding payroll systems or upgrading your reporting, outsourcing scales with your business every step of the way.

6. Benefit from Up-to-date Technology and Tools

Outsourcing doesn’t just save you time; it gets you access to cutting-edge accounting software and virtual tools. Say goodbye to clunky systems and hello to real-time tracking and instant reports. With cloud-based tools like QuickBooks, your financial data is always accurate and accessible.

The best part? You don’t need to worry about buying, updating, or securing these systems yourself. By partnering with an outsourced team, your business can leverage the latest technology without the hefty price tag. It’s a smarter way to get precise bookkeeping without the overhead.

7. Reduce Compliance and Tax Filing Stress

The end of the tax year doesn’t have to be a nightmare. Outsourced bookkeeping ensures your financial records are always compliant and ready for filing, reducing the stress of last-minute paperwork and potential fines. With expert bookkeepers handling your taxes, you’ll always stay ahead of deadlines.

Besides, by working with professionals who understand the ins and outs of tax laws, you get more than just accurate reports; you get a strategic advisor guiding you through complex regulations. When audits come around, you're prepared, making tax filing a breeze and saving you time in the long run.

8. Eliminate Staffing and Turnover Challenges

Staff turnover and hiring challenges can disrupt even the most organised accounting departments. With outsourced bookkeeping, you avoid these headaches entirely. You gain a dedicated team that’s always in place, providing consistent service and handling your needs with seamless efficiency.

When things get busy, such as during the end of the tax year or periods of rapid growth, outsourced teams can easily adjust, ensuring continuity without the chaos of recruiting or training new staff. With a tailored service, your bookkeeping is always in expert hands, allowing you to focus on what truly matters: growing your business.

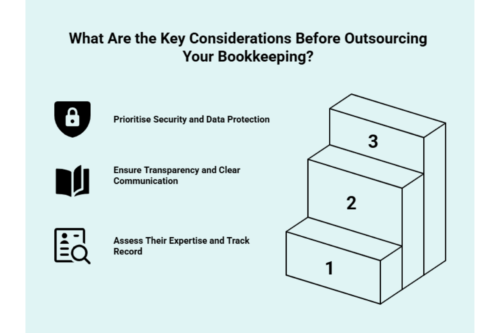

What Are the Key Considerations Before Outsourcing Your Bookkeeping?

Outsourcing bookkeeping is a significant decision, and several essential factors should be considered. To ensure you're entrusting your finances to the right hands, consider the following key areas before choosing a provider.

1. Assess Their Expertise and Track Record

Look for a provider with qualified bookkeepers and Chartered Accountants (CAs). Check their past work, client testimonials, and industry experience. The right firm will provide professional handling of your financial records, giving your business the stability and expertise it needs to thrive and grow.

2. Ensure Transparency and Clear Communication

Choose a firm that offers clear communication and regular updates on your financial status. This ensures you’re always in the loop and can easily track progress. Transparency fosters trust and facilitates the resolution of issues quickly, ensuring your records remain accurate and up to date.

3. Prioritise Security and Data Protection

Your financial data must be protected with bank-level encryption and secure access controls. Ensure the firm complies with GDPR and holds proper certifications, such as ISO 27001. Strong security practices ensure your financial data is safe from unauthorised access, keeping your business and customer information secure.

Choose Accountancy Cloud Bookkeeping Services for Your Needs

Are you struggling to keep up with your financial records while growing your business? It feels like finally giving up and handing over the work to experts. At Accountancy Cloud, we don’t just manage your books; we empower your business. With over a decade of experience, our team of qualified bookkeepers provides hands-on support, ensuring your financial records are accurate and compliant.

We specialise in serving startups and scale-ups across various industries, including tech, SaaS, e-commerce, and food and beverage. Our cloud-based platform offers real-time financial dashboards, seamless communication with your accountant, and access to the latest tools and technologies.

Whether you're looking to reduce costs, gain financial clarity, or scale efficiently, we have a deep understanding of bookkeeping. Ready to transform your financial management? Get in touch today, and let's build a smarter future together.

Conclusion: Why Outsourcing Bookkeeping is Your Business’s Smartest Move

Outsourcing your bookkeeping is about unlocking your business’s full potential. By entrusting professionals with your financial records, you’re freeing up valuable time to focus on growth, innovation, and customer relationships. This allows you to streamline operations and make faster, more informed decisions that drive success.

As your business scales, the flexibility of outsourcing ensures that your financial operations can grow with you without the burden of managing an in-house team. Additionally, you’ll have access to the latest tools and technologies, ensuring your records are always accurate and up-to-date. With a dedicated team by your side, you can always stay ahead of financial challenges and confidently navigate the complexities of growth.

Frequently Asked Questions

How secure is my financial data when I outsource bookkeeping in the UK?

Outsourcing helps keep your financial data safe. Companies follow strict security rules, such as secure remote login and GDPR. They have implemented strong internal controls. This keeps your online accounts and bank details protected at all times. These professional firms work diligently to ensure the data is accurate and secure. So you can feel at ease knowing your information is in good hands.

Will outsourcing affect my control over business finances?

Outsourced bookkeeping services help business owners maintain better financial control. They do not take away any control. You have strong internal controls and can access your online accounts at any time. This lets you always know what is happening with your books. With this, you can make an informed decision about spending and profitability. Bookkeeping services are made to support you in running your business well.

How quickly can I see results after outsourcing my bookkeeping?

The results you get depend on how well the dedicated team works. Many small businesses achieve better cost efficiency, simplify financial reporting, and spend less time on bookkeeping tasks within a given period. If you want quick results, work closely with the outsourced company to ensure everything is done correctly.

Is outsourced bookkeeping suitable for small businesses in the UK?

Yes, small businesses benefit the most from the scalability and cost efficiency that online bookkeeping services offer. When you outsource, it helps your business grow. It also prevents you from overspending on people or tools. Plus, it makes daily jobs in the bookkeeping function much easier to handle.

How much does it cost to outsource bookkeeping?

The pricing for accounting services varies for each individual or business. An outsourced service provider usually charges much less than if you hire your own full-time team. The rates are designed to be affordable and provide the best fit for your needs. You will still get good results. To determine the exact pricing, you can contact us. We can give you a clear estimate of the costs for the accounting services you require.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.