Crack the Code: Moves for Financial Forecasting Retail

Aug 2025

Running a retail business requires clear financial visibility and data-driven planning. Financial forecasting provides a structured approach to predicting your company's future performance based on historical data, market trends, and operational inputs.

It plays a critical role in managing cash flow, guiding resource allocation, informing pricing and inventory strategies, identifying potential risks, and setting measurable growth targets. This article outlines the key steps in retail financial forecasting, explaining its importance and how to apply it effectively across your operations.

What Is Financial Forecasting?

Financial forecasting is the process of estimating a company's future financial projections and outcomes by analyzing historical data, current market trends, and expected business conditions, including the income statement. Businesses use forecasting to predict revenues, expenses, cash flow, and other key financial metrics over a specific time period, typically monthly, quarterly, or annually.

The goal of financial forecasting is to support strategic decision-making, such as budgeting, investment strategic planning, and resource allocation. It helps companies prepare for growth, manage risks, and communicate with stakeholders by offering a data-driven outlook on financial performance.

There are two main types of financial forecasting:

- Quantitative forecasting relies on numerical data and statistical methods to generate projections.

- Qualitative forecasting incorporates expert judgment, market research, and industry insight, often used when past data is limited or unreliable.

In practice, companies may create multiple forecast scenarios—best case, worst case, and most likely—to remain flexible and ready for change.

Let’s Break Down the Core Drivers of Retail Financial Forecasting!

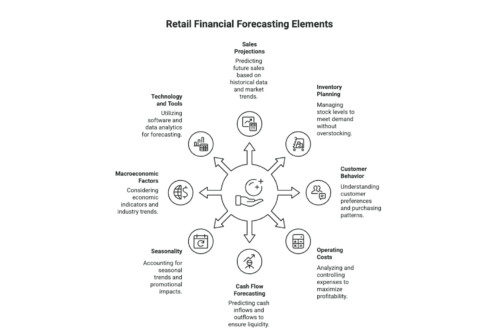

Financial forecasting in retail requires a detailed understanding of both internal operations and external market forces. Here are the key elements that drive accurate and actionable forecasts in the retail sector:

1. Sales Projections

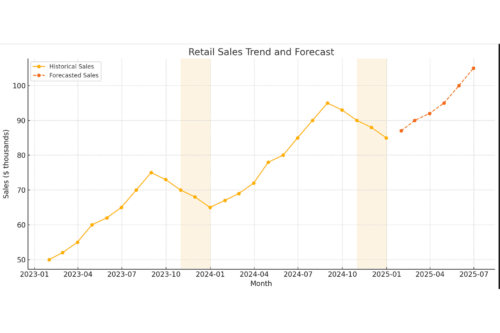

Retail forecasting begins with predicting future sales based on historical performance, seasonal trends, promotional plans, and market conditions. This includes analyzing the amounts of products sold by category, product, region, and channel (e.g., in-store vs. online).

2. Inventory Planning

Accurate forecasting depends on knowing how much inventory is needed to meet demand without overstocking. This involves tracking stock turnover rates, lead times, and supplier reliability, and aligning inventory levels with sales expectations.

3. Customer Behavior and Trends

Understanding changes in consumer preferences, buying habits, and market trends is critical. Retailers use loyalty programs, POS data, and online analytics to anticipate demand shifts and personalize product offerings.

4. Operating Costs

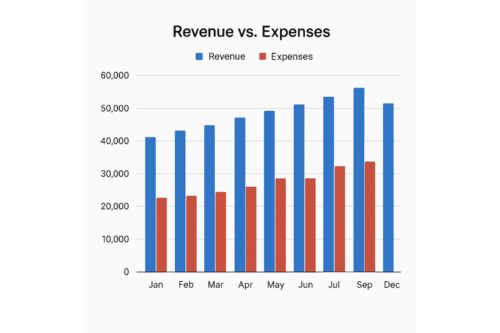

Retailers must account for fixed and variable costs such as rent, utilities, labor, marketing, and logistics. Forecasting these expenses helps maintain healthy margins and avoid surprises that could affect profitability.

5. Cash Flow Forecasting

Retail businesses are especially sensitive to cash flow and cash balances. A forecast should map out expected inflows (from sales) and outflows (like payroll, inventory purchases, and rent), allowing for better liquidity management and contingency planning.

6. Seasonality and Promotional Impact

Holidays, weather patterns, and promotional events have a significant impact on retail performance. Historical data helps model how these factors will influence future demand, enabling more accurate short-term forecasts.

7. Macroeconomic and Industry Factors

Inflation, interest rates, consumer confidence, and supply chain disruptions can all affect retail performance. A good forecast takes these macro trends into account to remain realistic and responsive.

8. Technology and Tools

Using forecasting software and analytics platforms can greatly improve accuracy. Machine learning models, POS integrations, and ERP systems help retailers analyse data in real time and make more informed predictions.

By focusing on these elements, retailers can create robust financial forecasts that support better decision-making, reduce risk, and drive sustainable growth.

What Are The Common Methods of Financial Forecasting You Need To Know?

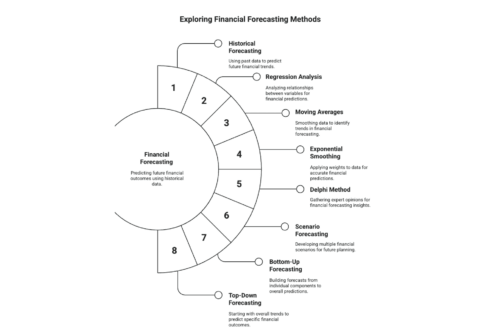

Financial forecasting methods vary in complexity and accuracy, depending on the data inputs and business environment. In retail, where margins are tight and demand is often volatile, choosing the right forecasting technique is critical for precision in planning and execution. Below are the key methods every retail operator or financial analyst should be familiar with:

1. Historical Forecasting

Historical forecasting relies on time-series data to project future performance. Just like in real life, it assumes that past trends will continue unless disrupted by external variables. While straightforward, this method is sensitive to anomalies and does not account for market shifts or business changes unless manually adjusted.

2. Regression Analysis

Regression forecasting models the relationship between the dependent variable and independent variables—for example, the effect of pricing, promotions, or economic indicators on sales volume. Linear or multiple regression techniques can quantify the impact on the dependent variable and provide a more nuanced, data-driven forecast. Use case: Understanding how advertising spend or discounting strategies influence sales.

3. Moving Averages

This method calculates the average of past data points over a defined period to smooth out volatility and predict future values. Retailers commonly use simple moving averages (SMA) or weighted moving averages (WMA) to track product performance trends, particularly for demand planning.

4. Exponential Smoothing

Exponential smoothing improves on moving averages by applying decreasing weights to older data. This gives more relevance to recent activity without discarding historical context. Variants like Holt-Winters exponential smoothing account for seasonality and trend simultaneously.

Use case: Weekly sales forecasting for fast-moving consumer goods (FMCG).

5. Delphi Method

This structured qualitative method gathers forecasts from a panel of experts through multiple rounds of anonymous input. While not statistically driven, it’s useful for projecting outcomes in new markets or for product launches where data is scarce.

Use case: Estimating market demand for new product categories.

6. Scenario Forecasting

Scenario forecasting builds multiple financial outcomes based on different assumptions, such as economic shifts, supply chain disruptions, or policy changes. It enables retailers to prepare for a range of possible conditions and align contingency strategies accordingly.

Use case: Planning inventory levels under optimistic, conservative, and neutral economic outlooks.

7. Bottom-Up Forecasting

This method begins at the granular level, individual products, stores, or sales teams, and aggregates data to build a full business forecast. It’s detailed and data-intensive, but can offer high accuracy when operations are segmented.

Use case: Forecasting sales by store location or department, then rolling up tothe corporate level.

8. Top-Down Forecasting

Top-down forecasting starts with macro-level estimates (such as total market size or category growth rates) and allocates expected performance across the business based on historical ratios or strategic goals, including planning production cycles. A base case use case: Estimating potential revenue for entering a new geographic market.

How To Implement Financial Forecasting in Retail?

Implementing financial forecasting in a retail environment requires a structured approach, the right tools, and access to reliable data. The goal is to produce forecasts that support decision-making across inventory, staffing, cash flow, and growth planning. Here’s a step-by-step breakdown of how to implement financial forecasting effectively:

1. Define Objectives and Forecasting Scope

Start by identifying what you need to forecast—sales revenue, operating costs, inventory demand, cash flow, or all of the above. Determine the time horizon (monthly, quarterly, annually) and the level of detail required (by store, product line, or region).

2. Gather and Clean Historical Data

Collect relevant financial and operational data, including sales records, inventory reports, marketing spend, staffing costs, and return rates. Ensure the data is accurate, consistent, and formatted for analysis. Outliers, missing values, and duplicate records should be resolved before modeling.

3. Choose Appropriate Forecasting Methods

Select forecasting models that align with your goals, data availability, and business complexity. For example:

- Use time-series models for sales trends.

- Apply regression analysis for campaign impact.

- Use scenario forecasting for strategic planning.

For best results, combine methods to validate forecasts against multiple inputs.

4. Incorporate External Variables

Integrate external data such as seasonality, economic trends, competitor activity, and consumer behavior. Retail forecasts are heavily influenced by holidays, weather, inflation, and supply chain disruptions—ignoring these can result in major inaccuracies.

5. Build the Forecasting Model

Use spreadsheet models, business intelligence tools, or dedicated forecasting software to develop your forecast at the right time and across different scenarios. Define the variables, formulas, and assumptions clearly. If using machine learning or statistical software (e.g. Python, R, Power BI), ensure the models are trained on relevant datasets and continuously refined.

6. Review and Validate Forecasts

Compare forecast outputs against historical benchmarks or known performance targets. Run sensitivity analyses to test how changes in key inputs affect the results. Involve cross-functional teams (finance, sales, supply chain) to review assumptions and validate feasibility.

7. Integrate with Business Planning

Link the forecast to budgeting, procurement, staffing, and marketing calendars. This ensures that financial expectations directly inform operational decisions and that resource allocation is aligned with demand projections.

8. Monitor and Adjust in Real Time

Set up regular review cycles—weekly or monthly—to compare forecasts with actual performance. Track variance, identify the root cause of any gaps, and adjust models accordingly. Agile forecasting is essential in retail due to rapid market fluctuations.

9. Automate and Scale

As your forecasting process matures, automate data collection, model updates, and reporting through forecasting platforms or ERP integrations. This reduces manual effort and enhances accuracy over time.

Let's Discuss Roadblocks! What Are The Challenges in Retail Financial Forecasting?

Financial forecasting in retail is complex and prone to several challenges that can affect accuracy and reliability. Understanding these roadblocks is critical for improving forecasting processes and outcomes. Here are some of the most common financial challenges in forecasting retailers face:

1. Data Quality and Availability

Accurate forecasting depends heavily on clean, comprehensive, and timely data. Retailers often struggle with incomplete sales records, inconsistent data formats across systems, or outdated information. Poor data quality leads to unreliable forecasts and misguided decisions.

2. Demand Volatility

Retail demand can be highly volatile due to factors like seasonality, promotions, trends, and economic shifts, especially during the holiday season. Sudden changes in consumer behavior—triggered by social trends or external shocks—can be difficult to predict and model effectively.

3. Complex Product Portfolios

Retailers often carry thousands of SKUs across multiple categories and locations. Forecasting demand and costs at such granularity increases complexity and requires sophisticated tools to avoid oversimplification or overfitting.

4. External Market Factors

Factors beyond a retailer’s control, such as supply chain disruptions, inflation, regulatory changes, and competitor actions, can quickly render forecasts obsolete. Incorporating these variables into models requires ongoing market intelligence and scenario planning.

5. Integration Across Departments

Financial forecasting requires collaboration across sales, marketing, operations, and finance teams. Siloed data and misaligned objectives between departments can lead to inconsistent assumptions and fragmented forecasts.

6. Technological Limitations

Many retailers rely on legacy systems or manual processes that limit their ability to automate data collection, model updates, and real-time analysis, including foot traffic data. Lack of advanced analytics tools constrains the depth and speed of forecasting.

7. Managing Multiple Forecasting Methods

Selecting and combining appropriate forecasting methods can be challenging. Using a single method risks oversimplification, while managing multiple models requires expertise and resources to reconcile differences and maintain accuracy.

8. Unpredictable External Events

Events such as pandemics, natural disasters, or geopolitical instability can cause rapid shifts in consumer demand and supply chains, making traditional forecasting models ineffective without rapid recalibration.

9. Overconfidence and Bias

Forecasts can be influenced by cognitive biases, such as optimism bias or anchoring, that skew assumptions and projections. Overconfidence in forecasts may lead to overstocking or under-preparation.

Accounting Solutions Designed to Help Startups and Small Businesses Grow

Accountancy Cloud simplifies accounting for startups and small businesses with a full range of services, including bookkeeping, tax compliance, year-end accounts, R&D tax credits, and CFO advisory. Designed to support industries like tech, e-commerce, and retail, it helps you stay compliant, automate finances, and focus on growth.

Why choose Accountancy Cloud?

- Comprehensive services including bookkeeping, tax compliance, year-end accounts, R&D tax credits, and CFO advisory

- Cloud-based platform seamlessly integrates with Xero and Sage

- Automates financial workflows and delivers real-time insights

- Industry-tailored solutions for tech, e-commerce, and retail

- Trusted by leading startups for reliable, expert support

- Simplifies compliance so you can concentrate on scaling your business

- Streamlines finances to reveal growth opportunities

Why Financial Forecasting is Your Retail Business’s Secret Weapon

In retail, financial forecasting is essential for navigating uncertainty and driving success. It enables smarter decisions, optimizes resource use, manages risks, and supports growth strategies, including various marketing efforts. By analyzing past data, applying the right forecasting methods, and overcoming sector challenges, retailers can confidently plan ahead and adapt to change. With effective forecasting, businesses steer steadily toward their goals, no matter how unpredictable the market.

Frequently Asked Questions

How does financial forecasting help in attracting investors?

Accurate financial forecasting presents a transparent picture of your business's future performance, thereby attracting potential investors. They utilize these forecasts to gauge their potential return on investments and ensure you have enough cash to cover your costs. Regular forecasting and updating of forecasts signifies your control over and understanding of the business plans, building trust with investors.

What is the importance of forecasting in strategic financial planning?

Financial forecasting plays a pivotal role in strategic financial planning. It provides valuable metrics like estimated sales, income, and cash flow that guide budgeting and holistic financial planning, ultimately positioning your business for future growth opportunities. Essentially, it serves as a roadmap, directing your efforts towards achieving the financial goals of your retail business.

What are some common pitfalls in financial forecasting for retail?

Common pitfalls include relying too heavily on historical data, neglecting market trends and external factors, overlooking irregularities like seasonal fluctuations, failing to consider hidden costs, and not updating forecasts regularly. Therefore, it’s vital to employ a comprehensive approach that caters to both historical patterns and current market dynamics.

How often should financial forecasts be revised in the retail industry?

Revision frequency depends largely on the prevalent economic climate and individual business needs. However, given the retail industry's dynamic nature, it's generally advisable to revise your financial forecasts quarterly. During uncertain times or significant changes, more frequent updates may be needed for effective planning and decision-making.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.