Struggling with Finances? Master Hotel Accounting

Aug 2025

Running a small hotel is a rewarding challenge, but staying on top of your finances is non-negotiable. Hotel accounting isn't just about crunching numbers; it's how you track performance, control costs, and make smarter decisions. Whether you're managing a boutique inn or a growing property, understanding the basics can make or break your success.

This guide simplifies the essentials of hotel accounting—from key metrics to best practices—so you can manage your books with confidence, cut financial risk, and boost profitability.

What is Hotel Accounting?

Hotel accounting is the specialised branch of accounting that manages and tracks the financial operations of a hotel or hospitality business. It involves the process of recording, analysing, and interpreting financial data related to room bookings, food and beverage sales, payroll, maintenance costs, and other revenue streams and expenses unique to the hospitality industry, ultimately impacting the hotel’s financial reporting.

Unlike general accounting, hotel accounting must handle complex revenue cycles that include variable occupancy rates, seasonal pricing, service charges, and various departments operating under one roof—like restaurants, spas, and event services. It also ensures compliance with financial regulations, internal audits, and tax requirements specific to hospitality businesses.

Key components of hotel accounting include:

- Daily revenue reports: Tracking income from rooms, food, bar sales, room rentals, and other services.

- Payroll management: Handling compensation for a diverse staff, including full-time, part-time, and seasonal employees.

- Inventory and cost control: Managing stock and expenses for food, linen, toiletries, and supplies.

- Accounts payable and receivable: Monitoring outgoing expenses and incoming payments from guests, vendors, or corporate clients.

- Financial statements and forecasting: Preparing balance sheets, profit and loss statements, and cash flow forecasts to guide strategic decision-making.

Effective hotel accounting helps management maintain profitability, improve operational efficiency, and deliver exceptional guest experiences while staying financially sound.

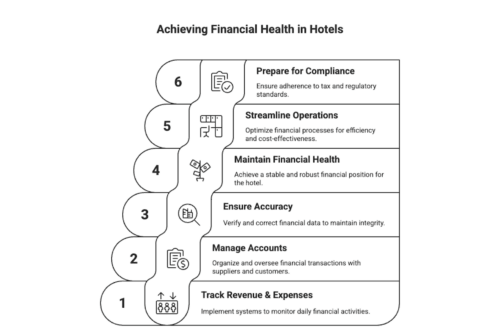

How to Apply Key Accounting Procedures in Your Hotel?

Applying key accounting procedures in your hotel is essential for maintaining financial control, ensuring compliance, and improving overall profitability. Whether you're running a boutique inn or a large hotel chain, these procedures create a solid financial foundation that supports daily operations and long-term growth.

1. Track Daily Revenue and Expenses

Start with daily revenue tracking from all income sources—room bookings, food and beverage sales, spa services, parking, and more. Use a property management system (PMS) integrated with your accounting software and revenue management software that employs dynamic pricing strategies to automatically record and categorize these transactions. At the same time, monitor daily expenses to catch overspending early.

2. Implement a Night Audit Process

The night audit is a crucial procedure that reviews and reconciles all financial transactions at the end of each day, including posting charges such as checking room charges, payments, tax calculations, and refunds. A consistent night audit ensures your financial data is accurate and up to date every morning.

3. Manage Accounts Payable and Receivable

Maintain clear records of all outstanding bills (accounts payable) and incoming payments (accounts receivable). Set up a calendar or system for vendor payment schedules to avoid late fees. Follow up promptly on unpaid invoices from corporate clients or event organizers.

4. Monitor Inventory and Cost of Goods Sold (COGS)

Track your inventory—especially for high-turnover areas like kitchens, minibars, and housekeeping supplies. Monitor COGS regularly to identify waste, theft, or inefficiencies. Inventory management software can automate this process and integrate with your accounting system.

5. Reconcile Bank Statements Monthly

Each month, reconcile your bank statements against your internal records. This step helps catch any discrepancies, such as unauthorized transactions, bank fees, or accounting errors that could affect your cash flow and reporting accuracy.

6. Generate Financial Reports Regularly

Use your accounting system to create and review financial statements like profit and loss reports, balance sheets, and cash flow statements. These reports, which are crucial in managerial accounting, provide insights into your hotel’s financial performance and financial health and help guide budgeting and investment decisions.

7. Prepare for Tax and Regulatory Compliance

Hotel businesses must comply with local tax regulations, including occupancy tax, sales tax, and payroll tax. Keep detailed records throughout the year to make tax filing easier and avoid penalties. Consider working with a CPA who specializes in hospitality to ensure full compliance.

8. Use Budgeting and Forecasting Tools

Create monthly and quarterly budgets to manage expenses and plan for future growth. Use forecasting tools to predict seasonal revenue changes, upcoming maintenance costs, or staffing needs based on historical data and trends.

9. Maintain Internal Controls and Audit Trails

Set up internal controls such as manager approvals for large purchases, restricted system access, and audit logs. These procedures reduce fraud risk and improve financial transparency, especially important in a multi-department hotel environment.

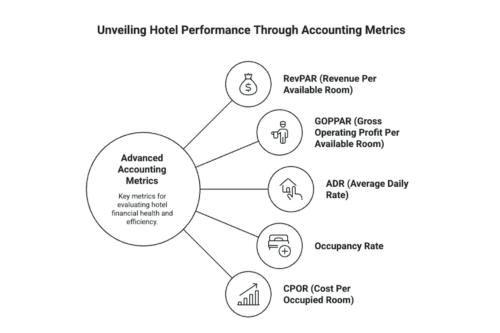

Track These Advanced Accounting Metrics to Improve Hotel Performance

Beyond basic financial statements, advanced hotel accounting metrics offer sharper insights into operational efficiency, profitability, and long-term financial health. When tracked consistently, these metrics help hotel owners and managers make smarter, data-driven decisions that drive sustainable growth.

Here’s a breakdown of the most important advanced financial metrics for accounting to monitor in your hotel:

1. RevPAR (Revenue Per Available Room)

Formula:

RevPAR = Total Room Revenue ÷ Number of Available Rooms

Example:

If a hotel earns $50,000 in room revenue over a month and has 1,000 available room nights:

RevPAR = $50,000 ÷ 1,000 = $50

This means the hotel earned $50 per available room during that period.

This key performance indicator reflects how well you’re filling rooms and how much revenue you're generating per room. A rising RevPAR usually signals strong pricing strategy and demand, while a dip may indicate underperformance or mispricing.

2. GOPPAR (Gross Operating Profit Per Available Room)

Formula:

GOPPAR = Gross Operating Profit ÷ Number of Available Rooms

Example:

If a hotel’s gross operating profit is $30,000 for the month and there are 1,000 available room nights:

GOPPAR = $30,000 ÷ 1,000 = $30

This means the hotel earned $30 in operating profit per available room.

Unlike RevPAR, GOPPAR accounts for operating expenses, giving a clearer picture of your hotel’s profitability. It’s one of the best metrics for comparing performance across properties or benchmarking against industry standards.

3. ADR (Average Daily Rate)

Formula:

ADR = Total Room Revenue ÷ Number of Rooms Sold

Example:

If a hotel earns $40,000 in room revenue and sells 800 rooms in a month:

ADR = $40,000 ÷ 800 = $50

This means the Average Daily Rate is $50 per room sold.

ADR helps you evaluate how much guests are paying on average. Use it to adjust pricing strategies during high and low seasons, or to assess the effectiveness of marketing campaigns and promotions.

4. Occupancy Rate

Formula:

Occupancy Rate = (Rooms Sold ÷ Rooms Available) × 100

Example:

If a hotel sells 750 rooms out of 1,000 available in a month:

Occupancy Rate = (750 ÷ 1,000) × 100 = 75%

This means the hotel had a 75% occupancy rate during that period.

This classic metric shows how full your hotel is over a given period. It's essential for capacity strategic planning and helps correlate changes in pricing or marketing with guest demand.

5. CPOR (Cost Per Occupied Room)

Formula:

CPOR = Total Operating Costs ÷ Number of Rooms Sold

Example:

If a hotel incurs $20,000 in operating costs and sells 800 rooms in a month:

CPOR = $20,000 ÷ 800 = $25

This means the Cost Per Occupied Room is $25.

CPOR helps identify how much it costs to service an occupied room. A high CPOR might suggest inefficiencies in housekeeping, utilities, or maintenance that could be optimised.

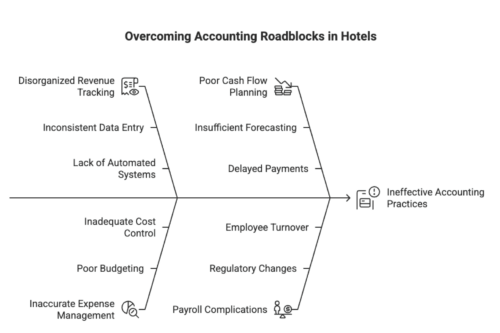

How to Overcome the 4 Most Common Accounting Roadblocks in Your Hotel?

Even the most well-run hotels face accounting challenges that can slow down operations or eat into profits. From managing complex revenue streams to staying compliant with tax laws, these roadblocks can pile up quickly if not addressed early. Here’s how to identify and overcome the most common accounting issues in hotel management:

1. Disorganised Revenue Tracking

Hotels often deal with multiple revenue streams—room bookings, dining, spa services, events, and more. Without a clear system, it’s easy to lose track of where your money is coming from.

Solution: Use integrated property management and accounting software to automatically categorise and consolidate revenue from all departments in real-time.

2. Inaccurate Expense Management

Poor tracking of operational costs like housekeeping, utilities, and maintenance can lead to budget overruns and unexpected shortfalls.

Solution: Set up expense categories, assign budget limits, and review them weekly to catch discrepancies before they become major issues.

3. Poor Cash Flow Planning

Hotels often experience seasonal fluctuations, making it difficult to maintain steady cash flow year-round.

Solution: Build monthly cash flow forecasts based on historical data and upcoming bookings. Maintain a reserve fund for low-season operations.

4. Payroll Complications

With full-time, part-time, and seasonal employees, payroll can get complex quickly—especially when factoring in overtime, tips, and benefits.

Solution: Automate payroll using specialised software to ensure accuracy and compliance while saving time.

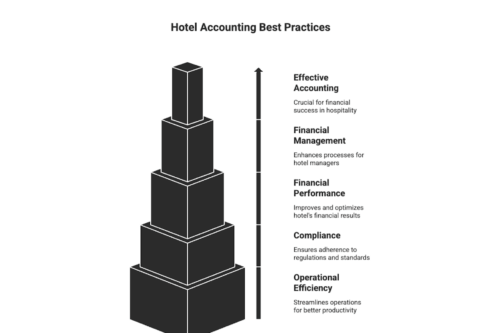

8 Ways To Implement Hotel Accounting Best Practices for Financial Success

Implementing best practices in hotel accounting is key to maintaining accurate financial records, improving cash flow, and maximising profitability. By following proven methods tailored to the hospitality industry, you can make smarter financial decisions that will help you understand the main benefits of how much money supports your hotel’s growth and stability. Here’s how to get started:

1. Automate Your Accounting Processes

Manual bookkeeping can lead to errors and wasted time. Use specialised hotel accounting software for your hotel accounting that integrates with your property management system and other hotel software to automate invoicing, payroll, revenue tracking, and expense management. Automation reduces mistakes and provides real-time financial insights.

2. Maintain Clear Revenue Segmentation

Hotels generate total revenue from various sources like rooms, food and beverage, events, and amenities. Separately tracking each revenue stream helps identify which areas are most profitable and where to focus improvement efforts.

3. Regularly Reconcile Accounts

Schedule frequent reconciliation of bank statements, credit card transactions, and supplier invoices to catch discrepancies early. This practice keeps your financial records accurate and avoids costly surprises during audits or tax season.

4. Monitor Key Performance Indicators (KPIs)

Track KPIs such as RevPAR, ADR, occupancy rate, and labour cost percentage. These metrics give you a clear picture of your hotel’s financial health and operational efficiency, helping you make data-driven decisions.

5. Establish Strong Internal Controls

Implement procedures like manager approvals for large expenses, segregation of duties, and restricted access to financial data. Strong internal controls reduce the risk of fraud and improve accountability.

6. Plan and Review Budgets Regularly

Create detailed budgets and compare actual performance against them monthly or quarterly. This helps you identify overspending early and adjust your strategies accordingly.

7. Stay Compliant with Tax and Regulatory Requirements

Keep up-to-date with local tax laws and hospitality regulations. Work with a CPA experienced in hotel accounting to ensure you meet all filing deadlines and avoid penalties.

8. Train Your Staff

Ensure your accounting and finance teams are well-trained on industry-specific accounting standards and software tools. Continuous education boosts accuracy and efficiency.

By implementing these best practices, you’ll build a solid accounting foundation that drives financial success and supports the long-term growth of your hotel.

Smarter Accounting for Ambitious Startups — Powered by Accountancy Cloud

Running a fast-growing business? Don’t let outdated accounting slow you down. Accountancy Cloud delivers smart, scalable finance solutions that go beyond bookkeeping—so you can focus on what you do best: building, scaling, and innovating.

Our award-winning platform combines real-time accounting, R&D tax credits, and CFO-level insights in one streamlined experience. From Seed to Series C and beyond, we help startups and digital businesses unlock growth, maximise cash flow, and stay investor-ready every step of the way.

With Accountancy Cloud, you get:

- Smart, real-time financial data to guide better decisions

- Automated bookkeeping that scales with your business

- Specialist support for R&D tax credits—claim up to 33% back

- Strategic finance insights from your dedicated FD team

- Seamless integrations with Xero, Stripe, Shopify & more

Join top UK startups who trust Accountancy Cloud to power their finances—from breakout SaaS companies to high-growth D2C brands. Get in touch now!

Conclusion

Hotel accounting is a must for running a successful hotel, no matter the size. Understanding its core concepts and practices gives you a clear edge—helping you manage finances, track performance, and boost profitability throughout the entirety of his professional life.

Tackling challenges like multiple revenue streams, variable room rates, and vendor contracts becomes simpler with a strong accounting procedures in a robust control environment. Using the right software and conducting regular audits keeps your finances organised, compliant, and insightful.

Mastering hotel accounting leads to better financial control, smoother operations, and smarter decisions that fuel your hotel’s growth and success.

Frequently Asked Questions

What is the best hotel accounting software for small hotels?

The best comprehensive hotel accounting software for small hotels would be one that fits the specific requirements of the business. This includes seamless integration with property management systems, easy-to-understand analytics, real-time reporting, and most importantly, user-friendly interface catered specifically towards the hospitality sector.

How often should financial audits be conducted in a small hotel?

The frequency of financial audits largely depends on the specific policies and practices of the hotel. However, it's good practice to conduct internal audits monthly or quarterly, while comprehensive external audits should be conducted annually for a thorough review of your hotel's financial health and regulatory compliance.

How does multi-department accounting work in hotels?

Hotels often operate several departments (rooms, F&B, spa, events) with separate budgets and revenues. Multi-department accounting tracks each independently to analyse profitability per unit and improve overall management.

What is the impact of seasonal fluctuations on hotel accounting?

Seasonal demand affects cash flow, staffing costs, and pricing strategies. Accurate forecasting and flexible budgeting are essential to manage these ups and downs effectively.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.