How to Do a Cash Flow Forecast That Actually Works?

May 2025

Running out of cash is one of the biggest reasons businesses fail, even profitable ones. Without a clear view of your incoming and outgoing funds, it’s easy to miss payment deadlines, fall behind on payroll, or pass up growth opportunities due to poor planning.

That’s where cash flow forecasting comes in. This simple but powerful technique helps you predict when cash will move in and out of your business, so you can avoid shortfalls, plan ahead, and make confident financial decisions based on exact estimates.

In this blog, we’ll walk you through how to create a cash flow forecast, the tools that make it easier, and practical tips to make your forecasts more accurate and actionable. Let’s get started.

What Is Cash Flow Forecasting?

Cash flow forecasting is the process of predicting how much money will come into and go out of your business over a set period of time, usually weekly, monthly, or quarterly. It helps you understand the flow of cash and whether you’ll have enough cash to cover expenses, invest in growth, or manage through slow periods.

By analysing past financial data and upcoming income and expenses, a forecast gives you a clearer view of your financial position. This is especially useful for seasonal businesses or startups with uneven cash cycles since it helps answer key questions like:

- Will there be enough cash to pay suppliers and employees?

- Can the business afford to invest or expand?

- Are funding gaps likely, and when?

One of the biggest risks startups face is mismanaging cash, poor cash flow management can even lead to business failure, no matter how profitable things look on paper. That is why regularly reviewing your forecast allows you to spot cash shortfalls before they happen and adjust spending or strategy in advance.

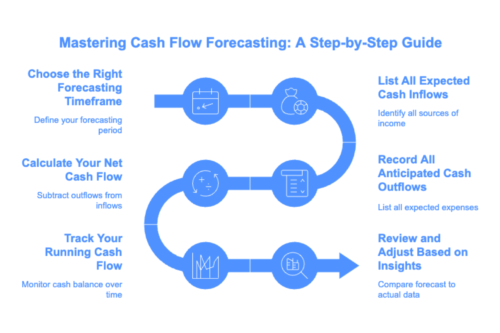

Step-by-Step Guide on How to Forecast Cash Flow

Building a cash flow forecast is straightforward when broken into manageable steps. Taking these steps is critical for developing a reliable forecast. Let's explore each step

Step 1: Choose the Right Forecasting Timeframe

Start by setting the period you want to forecast. This could be weekly, monthly, or quarterly, depending on your business needs.

- Short-term forecasts (e.g., 4–12 weeks) help with day-to-day cash management

- Long-term forecasts (up to 12 months) are useful for planning growth, budgeting, and funding.

Defining your timeframe gives structure to your forecast and ensures it reflects your actual business cycle.

Step 2: List All Expected Cash Inflows

Next, identify every source of money coming into the business. This includes:

- Sales revenue

- Customer payments

- Loan proceeds

- Grants or investment income

- Other one-off receipts

- Tax refunds

Be realistic and base your estimates on previous trends, confirmed orders, or reliable projections. The more accurate your inflow data, the more useful your forecast will be.

Step 3: Record All Anticipated Cash Outflows

Now, list all the expected expenses for your forecasting period. Include:

- Fixed costs (e.g., rent, salaries, loan repayments)

- Variable costs (e.g, raw materials, utilities, shipping)

- Occasional costs (e.g., tax payments, equipment purchases)

Use historical data, budgets, or accounting software to estimate your figures. This step helps identify periods when cash might be tight and where costs could be reduced.

Step 4: Calculate Your Net Cash Flow

To find your net cash flow, subtract total outflows from total inflows for each period:

Net Cash Flow = Total Inflows – Total Outflows

The calculation shows whether your business will have a surplus or shortfall.

For Example:

If your retail business brings in £25,000 in a month (total inflows) and your total expenses for the same period are £18,000 (total outflows), your net cash flow would be:

Net Cash Flow = £25,000 – £18,000 = £7,000

This means you have a positive cash flow of £7,000 for the month.

Keep a running total to track your cash balance over time and monitor patterns, since a consistently negative cash flow may signal the need to cut costs or secure funding.

Step 5: Track Your Running Cash Flow

Once you've calculated your net cash flow for each week or month, start building a running total to forecast your cash position over time.

Here's how to do it:

- Subtract total outgoings from total income for each period

- Record whether the result is a positive or negative cash flow

- Add this to the previous period’s balance to track your ongoing cash position

This step will help you:

- Spot early warning signs of cash shortages

- Plan ahead for low-cash periods

- Ensure you have enough working capital to cover essentials like stock, rent, salaries, and loan payments

Use accounting software like Accountancy Cloud will help you keep it updated, and revisit regularly to adjust based on actual performance.

Step 6: Review and Adjust Based on Insights

Once your forecast is in place, compare it regularly to your actual cash data performance. Look at the differences, also known as variances, to see where your estimates were off. This helps improve accuracy over time and supports better financial planning.

For example, if you expected £20,000 in customer payments but only received £15,000, you have a £5,000 shortfall to investigate and plan for next time.

Use simple dashboards or accounting software to visualise cash trends and make faster decisions. Regular reviews also help you spot potential problems early, giving you time to adjust spending or chase late payments.

How to Improve Accuracy in Your Cash Flow Forecast?

To build accurate forecasts, businesses need to follow simple but effective practices:

- Update your forecast regularly: As your business changes, so should your forecast. Adjust for new expenses, delayed payments, or shifts in customer demand.

- Use real-time dashboards: Dashboards connected to your accounting software help you track cash in and out instantly through a suite of dashboards. This gives you up-to-date insights to act quickly when needed.

- Track customer-level data: Knowing who pays late or on time helps you predict future cash inflows more accurately and plan for potential shortfalls.

- Run variance checks: Each month, compare your forecast to what actually happened. For example, if you expected £10,000 in sales but only received £8,000, you can investigate the shortfall and adjust next month’s forecast accordingly.

- Keep a running total of cash: Monitoring your net cash flow over time helps you understand your overall financial health and avoid sudden liquidity issues.

Following these practices will improve your forecast accuracy and give you more control over your business’s cash position.

Struggling to Build a Reliable Cash Flow Forecast? Accountancy Cloud Has Got You Covered.

Whether you're launching a startup or scaling a growing business, knowing where your money is going and when is critical. A clear, accurate cash flow forecast gives you control, confidence, and clarity to make smarter decisions.

At Accountancy Cloud, we don’t just show you how to build a forecast, we build it with you.

Here's why UK business owners trust us:

- Get award-winning accounting today

- Simplify financials in one dashboard

- Certified Xero, QuickBooks, & Sage

- Call, email, or chat anytime

- Simple and straightforward pricing

Let’s build your custom cash flow forecast , starting today.

Conclusion: Secure Your Business’s Financial Future with Effective Forecasting

Understanding cash flow forecasting is essential for every business owner and accountant.

By following the steps in this guide, you’ll gain a clear view of your financial situation, helping you make informed decisions that drive growth. This is because, a well-crafted forecast not only predicts cash flow but also helps you identify financial challenges before they become problems.

Therefore, accurate forecasting is key to maintaining your business’s financial health.

Frequently Asked Questions

What is the best tool for cash flow forecasting?

The best tools combine machine learning and forecast models with features like capturing transactional cash flow data. Cloud-based dashboards and ERP systems integrate seamlessly with banks for tracking variance accuracy, while AP and AR data spreadsheets remain a popular option for beginners due to simplicity.

How often should a cash flow forecast be updated?

It’s ideal to update cash forecasts on a daily basis if possible. Use forecast variance analysis to check discrepancies and refine accuracy estimates. Regular updates ensure continuous improvements and keep predictions aligned with real-time business circumstances.

What common mistakes should be avoided in cash flow forecasting?

Avoid neglecting smaller cash flow categories or working with outdated data. Split huge amounts of data into detailed subcategories to improve forecast accuracy and answer questions clearly. Failure to monitor results and refine estimates leads to poor outcomes.

Can cash flow forecasts predict future financial health?

Yes, cash flow forecasts offer a picture of future financial health by identifying positive cash flow trends and critical problem spots. When paired with the most comprehensive cash forecasting methods, strong forecast models, and variance performance analysis, they can guide sound business decisions for stability or growth.

How do changes in market conditions affect cash flow forecasts?

Market conditions, such as interest rate fluctuations, can heavily influence cash flow forecasting accuracy. Small business owners must adapt forecast models to account for factors like changing customer budgets, new competitors, or economic uncertainty through a single cash flow model. Cash planning remains essential for resilience.

What is the cash flow formula?

The formula for cash flow is simple: subtract cash outflows from cash inflows, yielding either a positive cash flow figure or a negative running total. It accounts for all costs, from operational expenses to raw materials, helping businesses understand their financial stability over a given period.

Why create a cash flow forecast?

Creating a cash flow forecast allows you to stay on top of your cash flow planning, preparing for challenges and exploiting opportunities. It presents a unique way to picture your financial health and plan resources effectively without losing track of commitments.

What are the benefits of cash flow forecast?

A cash flow forecast helps you predict future cash movements, avoid shortfalls, and make informed financial decisions. It also supports budgeting, planning for growth, and managing unexpected expenses.

How to do a cash flow projection?

List all expected cash inflows (like sales or investments) and outflows (such as rent or payroll) over a set period, weekly, monthly, or quarterly. Subtract outflows from inflows to see your net cash position and net outgoings.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.