R&D Claim Deadline: How Far Back Can You Go?

Mar 2021

How much eligible R&D spend is your business leaving on the table?

Many UK companies miss out on substantial tax relief simply because they don’t fully understand the last date of the claim. Under HMRC guidelines, businesses have a strict time limit to file or amend a corporation tax return and include a qualifying R&D claim.

Failing to meet this accounting year deadline could mean losing thousands in potential relief, especially for companies with consistent technical innovation over several years.

Whether operating under the SME R&D scheme or the RDEC (now merged for most claimants as of April 2024), understanding how far back you can retrospectively claim is important for planning and compliance.

In this blog, we’ll explain the R&D claim window, how it aligns with your company’s accounting periods, and what steps to take if you’ve already submitted your CT600 but haven’t claimed what you’re entitled to.

How Do Accounting Periods Impact Your R&D Claim Deadline?

Your accounting period isn’t just a reporting formality but determines your R&D tax credit deadline.

Most UK companies have a 12-month accounting period. For example, if your year ends on 31 March, your accounting period runs from 1 April to 31 March each year. That means your R&D tax credit claim for the period 1 April 2022 to 31 March 2023 must be submitted by midnight on 31 March 2025.

Sounds simple, but here’s the catch: once that deadline passes, you lose the right to claim R&D tax relief for that period. No exceptions. That’s potentially thousands in unrecoverable costs.

And if you’re a new business? Your first accounting period might run longer than 12 months. Even then, HMRC’s two-year rule still applies; you’ve got two years from the end of that accounting period to file your claim.

The window is strict. Miss it, and the benefit is gone.

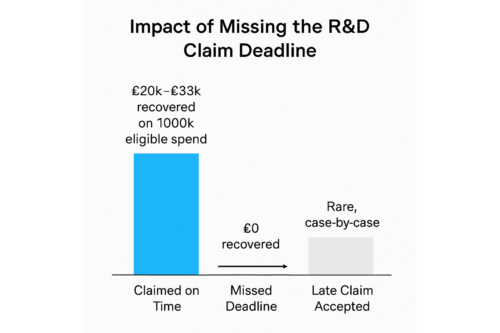

What is the Impact of Missing the R&D Claim Deadline?

Missing the R&D claim deadline can be costly, quite literally. If you don’t submit your claim within two years from the end of your accounting period, HMRC will typically reject it. In most cases, there’s no going back.

However, in rare situations, HMRC may consider a late claim, but only if you can prove that exceptional circumstances were genuinely outside your company’s control.

When Might HMRC Accept a Late R&D Claim?

You may be able to appeal if you can show that:

- Your finance team was unaware of eligible profits or claim potential until after the deadline.

- Ongoing discussions with HMRC over profit or loss have delayed your submission, without fault on your part or your accountant’s.

These exceptions are rare and subject to scrutiny. Documentation matters.

What HMRC Looks for in a Valid Claim?

To qualify for R&D tax relief, your project must:

- Seek a scientific or technological advancement

- Involve technical uncertainty and a structured development process

- Clearly outline qualifying activities and costs in the claim notification form

For SMEs, aligning their R&D records with their accounting periods and filing within that two-year window is critical.

In short: don’t wait until it’s too late. Missing the deadline can mean missing out entirely.

Can You Claim R&D Relief After Filing Your Tax Return?

Yes, you can still claim R&D tax relief after submitting your company’s corporation tax return. HMRC allows retrospective claims, but you must follow a specific process to amend your filing.

Here’s how it works:

- Amend your CT600: You must revise your corporation tax return for the relevant accounting period before the two-year deadline.

- Submit an Additional Information Form (AIF): This is mandatory and must include detailed technical and financial data to support your R&D claim.

The AIF helps HMRC assess whether your project meets the criteria for tax relief, so accuracy and clarity are key. Any gaps or inconsistencies could result in the claim being rejected.

While this retrospective route is helpful, HMRC does not grant extensions lightly. Claims made after the statutory deadline are only considered under exceptional circumstances, so acting quickly and correctly is critical.

How Long Does It Take to Prepare an R&D Claim?

There’s no one-size-fits-all timeline. Preparing an R&D claim depends on your company’s internal processes, project complexity, and available documentation. For businesses new to the scheme, it can quickly become overwhelming.

That’s where working with an R&D tax specialist makes a real difference. An experienced advisor can accelerate the process, identify all eligible costs, and help you avoid common pitfalls, especially with the 2025 compliance changes now in effect.

Remember: the claim must be submitted within two years of the end of your accounting period. Delays can cost you the entire benefit.

Starting early is critical. Whether you’re revisiting old projects or claiming for the current period, the sooner you begin gathering technical and financial evidence, the smoother and safer our claim will be.

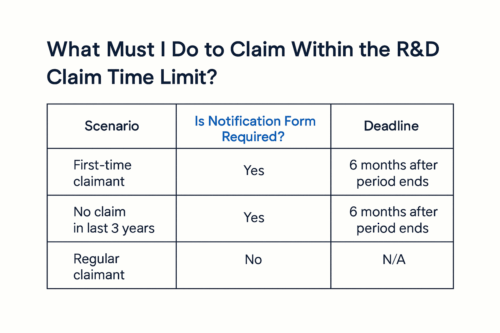

What Must I Do to Claim Within the R&D Claim Time Limit?

To stay within the R&D claim window, timing and documentation are everything. One of the first key steps is submitting a claim notification form, a mandatory requirement if:

- You’re claiming for the first time, or

- You haven’t submitted an R&D claim in the past three years.

This form must be submitted within six months of the end of the accounting period you’re claiming for. That’s well before the two-year claim deadline, so missing it could jeopardise your eligibility.

Beyond the notification, you must also prepare and submit robust technical and financial documentation to support your claim. HMRC expects clarity, structure, and evidence.

If you miss the notification deadline, your only remaining path is to appeal under exceptional circumstances but that’s far from guaranteed.

It's essential to start early and stay organised to stay compliant, protect your benefits, and avoid risk.

Stay Ahead of the R&D Claim Deadline with Accountancy Cloud

Navigating R&D tax relief deadlines isn’t just about ticking boxes; it’s about protecting the money you’ve already invested in innovation. With strict time limits and new compliance rules now in play, the margin for error is smaller than ever.

That’s where Accountancy Cloud comes in.

We specialise in helping UK startups and scaleups, especially those in manufacturing, FMCG, and product innovation, maximise their R&D tax relief without the complexity. From claim notifications to technical evidence and CT600 amendments, we manage the entire process so you don’t miss a deadline or leave value behind.

Here’s how we help:

- Map your project timelines against HMRC’s two-year deadline

- File claim notification forms on time; no last-minute panic

- Build robust, compliant documentation for faster approval

- Unlock more value with expert-led, defensible claims

Don’t let paperwork delay your funding. Let’s make sure your innovation gets the credit it deserves.

Talk to an R&D specialist at Accountancy Cloud now!

Conclusion: Missing the Window Means Missing the Opportunity

R&D tax relief is a valuable incentive, part of the corporation tax relief, but it comes with a firm deadline for large companies. Understanding how the two-year window aligns with your accounting period is critical, especially as late claims are rarely accepted without exceptional justification.

With evolving HMRC rules, including mandatory claim notifications and stricter documentation requirements, timing is no longer just a compliance issue; it’s a financial one. Businesses that delay risk losing access to thousands in relief that could otherwise be reinvested into growth.

The key is to stay informed, stay organised, and treat the R&D claim process as a core part of your year-end planning.

Frequently Asked Questions

Can I amend a previously filed R&D claim to include additional expenses?

Yes, you can. Suppose you've incurred additional expenditure related to the qualified R&D work. In that case, it is possible to amend your previously filed R&D claim to incorporate these costs, provided this is done within the R&D claim time limit.

How can I determine if my project qualifies for R&D credits?

Your project must seek scientific or technological advancement, tackle technical uncertainty, and follow a systematic approach to qualify for R&D credits.

What are the consequences of late filing for R&D claims?

Late filing of R&D claims can result in an inability to claim R&D tax relief, leading to potential financial losses. However, depending on the circumstances, HMRC may allow late claims under 'exceptional reasons' or 'acceptable features' in accordance with its Statement of Practice.

What must I do to claim within the R&D claim time limit?

To claim within the R&D timeline, start by filing a claim notification form six months after the accounting period ends or 18 months before the last claim deadline, which could be by June. Compile technical and financial data about the qualified work and contact R&D specialists if necessary.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.