How to Calculate the R&D Credit & Reclaim Costs In 2025?

Aug 2021

When you're building a startup, every resource counts. Whether you're launching a new platform, engineering a smarter supply chain, or experimenting with product improvements, chances are you're doing work that qualifies as R&D.

But too many founders miss out on claiming what's rightfully theirs.

With the latest updates to the UK’s R&D tax relief scheme, there's even more opportunity to unlock cash or reduce your tax bill, especially if your business is loss-making or investing heavily in innovation.

These credits aren't just a tax perk. They're a tool to help extend your runway, reinvest in your roadmap, and buy time for what matters most. Building.

Read on to break down what’s changed, how the new merged scheme works, and how to calculate what you could claim without getting lost in HMRC-speak.

What’s New in 2025? A Quick Recap

R&D tax credits are a government incentive designed to reward UK companies for investing in innovation. Whether you're building a new product, improving an internal system, or solving a technical challenge, a portion of those costs may be claimable either as a cash credit or a reduction in your Corporation Tax.

The UK’s R&D tax relief system has undergone major changes, and if you're planning a claim this year, it’s important to understand what’s different.

A Single, Merged R&D Scheme

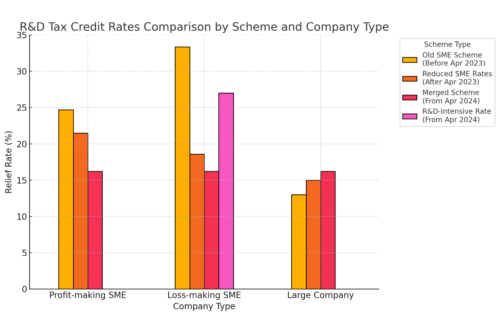

From 1 April 2024, the old SME and RDEC schemes will be replaced by a single merged scheme. While the structure is more unified, outcomes still differ depending on your company’s size, profit status, and R&D intensity.

Enhanced Support for R&D-Intensive Startups

If 30% or more of your total business spend goes into R&D, you now qualify for a higher cash credit up to 27% of eligible costs. This is a major boost for early-stage and product-heavy startups reinvesting in innovation.

How to Calculate Your R&D Tax Credit (Startup-Friendly Steps)

Calculating your R&D tax credit doesn’t need to be overwhelming. Here’s how to approach it with a founder’s mindset, focusing on what you’ve invested and what you could get back.

Step 1: Total Your Eligible R&D Spend

Start by gathering costs that directly supported eligible R&D activities. This may include:

- Staff costs (salaries, employer NIC, pensions)

- Contractor invoices (up to 65% claimable)

- Software licenses, prototypes, and consumables

- Cloud infrastructure or staging environments

Tip: Don’t forget to apportion costs used partly for R&D (e.g. software used across teams).

Step 2: Apply the Correct Rate

Your company’s financial status determines which rate applies:

- Profit-making SME: Up to 16.2% (Corporation Tax reduction)

- Loss-making SME: 16.2% (cash credit)

- R&D-intensive SME: Up to 27% (enhanced cash credit)

Note: The 27% applies if 30% or more of your total business spend goes into R&D.

Step 3: Adjust for Corporation Tax

If you're profit-making, remember: the credit is taxable. The actual benefit is slightly lower after applying the Corporation Tax rate.

Example:

If you spent £100,000 on qualifying R&D and are an R&D-intensive, loss-making SME, you could receive up to £27,000 back in the form of a cash credit.

Why Use an R&D Calculator and Why It’s Not Enough

An online calculator can help you gauge the ballpark value of your claim. But that's all it is, a starting point.

What calculators can't do:

- Spot missed costs hiding in project budgets or contractor invoices

- Apply nuanced rules around subcontractors, overseas work, or apportionment

- Optimise your claim with strategic structuring or technical documentation

- Account for edge cases like IP ownership or intercompany R&D

That’s where specialist-led approaches like that at Accountancy Cloud make the difference. They combine tax expertise with startup fluency, so you claim the right amount, with no compliance roadblocks.

Who Qualifies for R&D Tax Relief?

f you're a UK-based startup investing time and resources into developing new products, systems, or technology, there’s a strong chance you qualify for R&D tax relief (2024 budget) even if you're not turning a profit yet.

Here’s a quick snapshot of the general criteria:

- Fewer than 500 employees

- Annual turnover under €100 million or gross assets below €86 million

- Actively working on technical or scientific development that involves uncertainty or experimentation

You don’t need to be a deep-tech business to qualify. If your team is solving real-world problems in a way that requires custom development, design iteration, or infrastructure testing, you’re likely doing eligible R&D.

R&D-Intensive? There’s More for You

If 30% or more of your total business spend goes toward R&D, your company may qualify as R&D-intensive, and that opens up access to enhanced relief rates. We cover exactly how this works later in the post under credit rates and calculation steps.

What Activities Count as R&D? (It's More Than You Think)

R&D tax credit in HMRC’s eyes isn’t about research papers or patents, it’s about tackling technical challenges where the solution isn’t straightforward. If your team is experimenting, trialling, or trying to make something work in a way that hasn’t been done before (at least in your context), you’re probably doing qualifying R&D.

Eligible activities typically include:

- Building or optimising a digital product, such as writing custom code or APIs, where off-the-shelf solutions fall short

- Improving the performance, stability, or scalability of existing software or systems

- Developing hardware or tech infrastructure that involves physical testing or iterations

- Refining manufacturing processes for new food, beverage, or physical goods

What Can Influence Your R&D Tax Claim?

Beyond eligibility, several factors can directly affect the size and success of your R&D tax credit claim:

- Your current tax position

Whether you’re profit-making or loss-making determines if your benefit is a reduction or a cash credit. - R&D intensity

Spending over 30% of your total expenditure on qualifying R&D can unlock the enhanced 27% rate for loss-making companies. - How well you document activity

Clear records of time spent, technical challenges faced, and project scope can make or break your claim. - The treatment of subcontractors and overseas work

Only certain subcontractor costs are claimable (and usually at 65%), and overseas R&D is more restricted under the new rules. - Apportioning shared costs accurately

Cloud tools, software, and utilities used across departments must be fairly allocated — over-claiming can lead to HMRC pushback.

Examples That Hit Home for Founders:

- A SaaS startup creating a real-time collaborative feature that requires novel backend architecture

- A food tech brand working to extend shelf life while meeting clean-label standards

- An eCommerce business testing packaging formats that reduce breakage and are biodegradable under tight budget constraints

- A healthtech company improving API integrations with NHS systems while meeting strict data and latency benchmarks

Even if your innovation didn’t “work” the first time, the attempt and process of experimentation is still eligible.

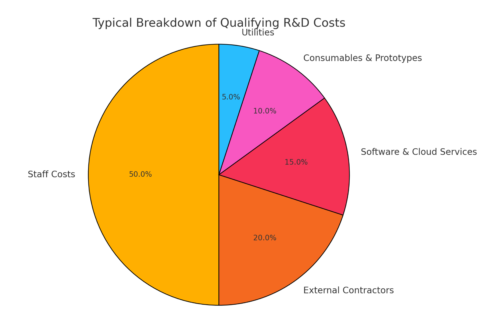

What Costs Can You Actually Claim? (Here’s Where the Value Is)

dentifying eligible R&D activities is only half the equation; knowing what costs you can claim makes the difference between an average claim and one that unlocks real financial value. HM Revenue & Customs outlines a specific set of categories, but the key is applying them correctly to your business model.

Below are the most commonly claimable costs, with context on how they apply to startup operations:

1. Staff Salaries, Employer NIC & Pensions

If your team is hands-on in R&D, writing code, testing prototypes, analysing data, or overcoming technical challenges, their salaries, employer NIC, and pension contributions are claimable.

This includes:

- Developers writing or optimising code

- Engineers or product teams working on new features or infrastructure

- Data scientists resolving algorithmic limitations

- Technical leads managing uncertainty-driven R&D projects

Admin, marketing, and commercial roles are excluded unless they directly support qualifying R&D.

2. External Contractors & Agencies (up to 65%)

Using freelancers, consultants, or specialist agencies to support development? You can claim up to 65% of their eligible costs, a huge opportunity for lean teams relying on outsourced expertise.

Examples include:

- Software developers or UX specialists hired to build a new product feature

- Technical research consultants or food technologists

- Hardware engineers contracted for prototyping or custom tooling

Ensure you retain IP rights and project control to remain compliant.

3. Prototypes, Testing Materials, & Consumables

If you’re physically or digitally experimenting, any materials used in the R&D process are claimable, provided they’re consumed or rendered unusable during development.

- Consumables used in recipe testing (food & beverage startups)

- Raw materials for physical prototypes (e.g. packaging, hardware shells)

- Small-scale trial batches or destroyed units from product tests

Finished goods sold to customers are excluded. The focus is on what’s consumed during R&D.

4. Software Licenses & Cloud Computing Costs

R&D today rarely happens without cloud infrastructure. Costs for hosting, testing, and computing environments may qualify, especially when supporting technical development.

Eligible items often include:

- Cloud platforms (AWS, Azure, GCP) used for development or testing

- SaaS tools directly supporting the R&D process (e.g. collaborative codebases, testing environments)

- Environments used for staging, prototyping, or running data models

Costs must be apportioned if tools are used for both R&D and operational purposes.

5. Utilities: Heat, Light, and Power

For R&D that takes place in a physical environment, lab testing, manufacturing trials, or prototyping, you can claim a proportional share of utilities that support those activities.

This applies more to food tech, consumer product labs, and hardware companies.

What You Could Get Back: R&D Credit Claim Rates at a Glance:

| Company Type | Old Scheme (up to) | Merged Scheme (2025) | Enhanced R&D-Intensive Rate |

|---|---|---|---|

| Profit-making SME | 0.215 | Up to 16.2% | Not eligible |

| Loss-making SME | 0.186 | 0.162 | Up to 27% (if eligible) |

| Large company (RDEC) | ~13% | ~15%–16.2% (net) | Not eligible |

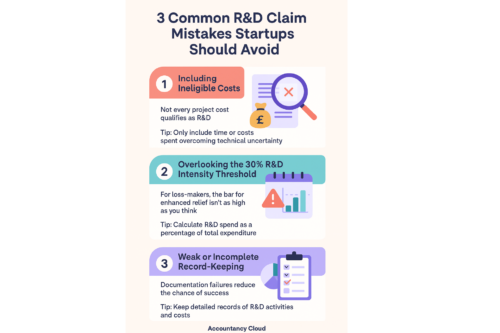

3 Common R&D Claim Mistakes Startups Should Avoid

Even the most innovative startups can underclaim or, worse, trigger unnecessary HMRC scrutiny, simply by misinterpreting the rules or overlooking key details. Here are the top pitfalls we help founders avoid:

1. Including Ineligible Costs

Not every cost tied to a project qualifies as R&D. It's a common mistake to include:

- Marketing spend (launch campaigns, ad creative, copywriting)

- Customer support or sales time

- Product management or admin hours, unless directly tied to eligible R&D supervision

These can inflate your claim and raise red flags. Tip: Only include time or costs spent overcoming technical uncertainty, not commercial execution.

2. Overlooking the 30% R&D Intensity Threshold

The new enhanced rate of up to 27% is reserved for loss-making companies that are truly R&D-intensive, but the bar isn’t as high as many assume.

If your startup is early-stage, heavily reinvesting in dev, engineering, or formulation work, you may hit the 30% threshold without realising it. We often find founders underclaiming simply because they don’t calculate R&D intensity properly.

Tip: Calculate total R&D spend as a percentage of overall business expenditure, not just revenue.

3. Weak or Incomplete Record-Keeping

You can’t claim what you can’t prove. One of the biggest risks to a successful R&D claim is failing to document:

- Which team members worked on which R&D activities

- How much time they spent (timesheets or reasoned estimates)

- The technical challenges faced, and how they were addressed

- Costs tied to specific R&D tasks (especially for contractors or prototypes)

Without this, you risk reduced claim value, or worse, HMRC rejection or delay.

Tip: Keep clear records from day one. Even simple time logs and short tech summaries go a long way

Built Something Innovative? We’ll Help You Claim What You’re Owed

The difference between a decent R&D claim and a fully optimised one often comes down to expertise, structure, and documentation. And with the 2025 changes now in effect, making the most of the scheme is harder to do on your own.

That’s where Accountancy Cloud comes in.

We work exclusively with startups and scaleups, which means we get the realities of limited time, lean teams, and fast-moving product cycles. Our R&D tax specialists are here to take the complexity off your plate and help you:

- Accurately identify eligible activities and costs

- Maximise your benefit under the new merged scheme

- Avoid common compliance risks with HMRC

- Build a defensible claim backed by clear technical evidence

Whether you’re pre-revenue or post-Series A, we’ll guide you from initial assessment to submission, and support you every step of the way.

Conclusion

R&D tax credits aren’t just a compliance box, they’re a powerful funding tool for startups that invest in innovation. Understanding how to calculate the R&D credit accurately can help you reclaim valuable cash, extend your runway, and fuel your next stage of growth.

If you're unsure where to start or want to make sure you're not leaving money on the table, getting expert support can make all the difference.

Frequently Asked Questions

1. How do I calculate the R&D credit for my business?

To calculate the R&D credit, you’ll need to identify eligible development expenditure across your accounting period, including salaries, software, and subcontractor costs. Once you’ve totalled your qualifying R&D costs, apply the relevant rate based on your company’s status under the SME scheme or merged ERIS scheme. A tax credit calculator can give an estimate, but your current tax position, taxable profit, and corporation tax bill will affect your final net benefit. For a successful claim, accurate records and essential information are critical.

2. What is a development expenditure credit and how does it affect my R&D claim?

A development expenditure credit is part of the R&D scheme that allows businesses, especially large companies or certain SMEs under the ERIS scheme, to receive a taxable credit for qualifying R&D activities. When learning how to calculate the R&D credit, it’s important to factor in that this credit is above the line and affects your taxable profit, which may reduce or offset tax liabilities. It can also lead to a cash repayment if your corporation tax liability is low or zero.

3. When should I submit the additional information form for my R&D tax credit claim?

From recent changes onwards, submitting an additional information form is a required step for most companies before claiming the R&D credit. This form includes essential information about your qualifying activities, total expenditure, and financial years involved. Failing to submit it can delay or invalidate a claim. If you’re unsure how to calculate the R&D credit accurately, this form is a crucial checkpoint before final submission.

4. Can I still claim if my startup had no profit in the year end?

Yes. If you’re loss-making, you may still be eligible for a cash repayment through the R&D tax credit scheme. When calculating the R&D credit, your year-end tax position is factored into whether you’ll receive a deduction on future tax liabilities or an immediate cash credit. This applies under both the SME scheme and the merged scheme, depending on your accounting period and whether you meet the criteria for enhanced relief.

5. Why isn’t a tax credit calculator enough for a successful claim?

A tax credit calculator is useful for estimating the R&D credit, but it won’t give you the full picture. It doesn’t account for complexities like national insurance contributions, eligible subcontractor costs, or how your total expenditure aligns with your current tax position. If you’re serious about understanding how to calculate the R&D credit accurately and claim the maximum benefit, working with a specialist can offer valuable insights, and often leads to a stronger, more compliant submission.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.