Annual Accounts Deadline: What UK Businesses Need to Know

Jun 2025

The annual accounts deadline catches more UK businesses off guard than you’d think. Between chasing invoices, managing payroll, and growing your company, it’s easy to push the filing of accounts dates to the bottom of the list, until it’s too late.

However, missing the deadline doesn’t just mean fines; it can damage your credibility with Companies House and HMRC. Whether you run a limited company or manage finances for one, knowing what’s due and when can save you stress, time, and money.

This blog breaks it down simply so you can stay compliant and focused on what really matters: running your business.

When Are Annual Accounts Due Date?

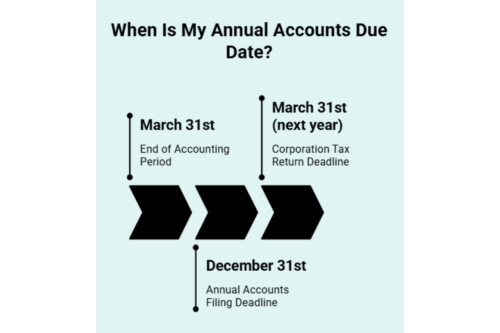

For most UK limited companies, your annual accounts are due 9 months after your company’s financial year ends. So, if your accounting period ends on March 31st, your deadline to file with Companies House is December 31st. Miss it, even by a day, and you’re looking at automatic penalties, starting from £150 and going up fast.

But here's the catch: your Corporation Tax Return deadline is different; it’s usually due 12 months after your accounting period ends, and that goes to HMRC.

So yes, there are two deadlines. Two departments. Double the admin, unless you’ve got a sharp accountant keeping tabs. Knowing these dates early gives you breathing room to prepare, file, and avoid last-minute panic.

What Do Annual Accounts Include?

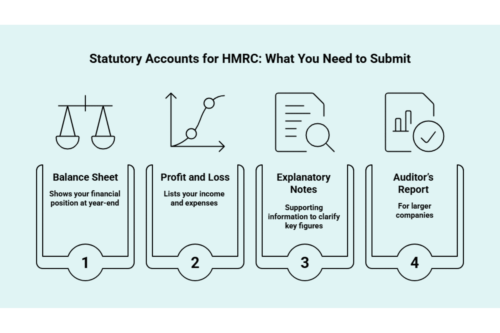

Annual accounts typically include a balance sheet, profit and loss account, explanatory notes, and, for larger companies, an auditor’s report. These documents provide a snapshot of your company’s financial position, income, and expenses for the year and help ensure compliance with legal and tax obligations. The exact content may vary depending on the size of your company, with micro-entities often being exempt from certain reports.

Your statutory accounts must be submitted to HMRC along with your corporation tax return. These accounts form part of your official tax filing and are required even if your company is small or dormant.

Here’s what’s typically included:

- Balance Sheet – Shows your financial position at year-end

- Profit and Loss Account – Lists your income and expenses

- Explanatory Notes – Supporting information to clarify key figures

- Auditor’s Report (for larger companies)

If you're a micro-entity or small business, you might be exempt from preparing a full profit and loss account or an auditor’s report. Regardless, your statutory accounts must align with your Corporation Tax Return. Inconsistencies can lead to penalties or compliance issues.

Company Accounts for Companies House: Key Filing Requirements

The accounts filed with Companies House serve a different purpose; they’re about transparency and public record. That means what you submit here may differ from what you send to HMRC.

If you qualify as a micro-entity, your filing is even more streamlined. Here’s what’s generally required:

- A confirmation statement (verifies that the company info is up to date)

- A simple balance sheet (assets, liabilities, capital)

- A note stating that your accounts are prepared under micro-entity provisions

Unlike with HMRC, profit and loss statements and directors’ reports aren’t required for micro-entities, giving you more privacy and less paperwork. Once submitted, certain financial information becomes publicly available via Companies House.

Micro Entity Status: Do You Qualify?

Knowing whether your company qualifies as a micro-entity can save you time and effort on reporting.

To qualify, your business must meet at least two of the following:

| Condition | Threshold | |

|---|---|---|

| Turnover | ≤ £632,000 | |

| Balance Sheet Total | ≤ £316,000 | |

| Average Employees | ≤ 10 |

Nevertheless, if your business exceeds any of these thresholds, you will no longer qualify as a micro-entity. In that case, UK GAAP (Generally Accepted Accounting Practice) / FRS 102 applies to your financial reporting. However, an audit will only be required once the thresholds are exceeded, not before.

Can I Change the Annual Reference Date?

Yes, you can change your company’s accounting reference date, but there are rules you need to follow.

You can shorten your financial year as many times as you like. But if you're looking to extend it, you can only do that once every five years unless there's a valid exception (like joining a group or entering administration). Most importantly, you cannot extend the accounting period beyond 18 months from the start date, even with permission.

To make the change, you must notify Companies House before your current filing deadline, either online or by filing Form AA01.

Keep in mind: changing the date affects more than just your accounts. It could impact your Corporation Tax return, VAT periods, and other filing responsibilities, so plan the timing carefully to avoid penalties.

How Does This Affect HMRC and Corporation Tax?

Your company’s Corporation Tax return is directly tied to your statutory accounts. While you have 12 months after your financial year ends to file the return (CT600), the actual tax payment is due earlier, within 9 months and 1 day after the period ends.

Most businesses work with accountants to submit both the accounts and company tax returns well before this deadline. The CT600 includes your financial data, profits, losses, and debts, supported by your annual accounts.

If you miss the deadline, penalties from both HMRC and Companies House can follow. Whether you’re a small limited company or a larger private firm, staying ahead with accurate, timely filing is the simplest way to avoid late fees and keep your business running smoothly.

What If You Miss the Annual Accounts Deadline?

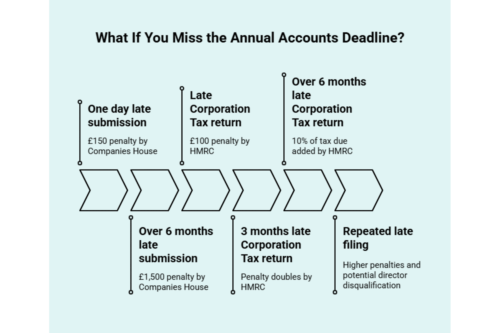

Submitting your annual accounts late can result in significant financial penalties and legal consequences.

- Companies House charges £150 for being even one day late, and the fines escalate to £1,500 if you delay for over 6 months.

- HMRC also penalises late Corporation Tax returns, starting at £100, doubling after 3 months, and adding 10% of your tax due if you’re still late after 6 months.

- But it’s not just about the fines. Repeated late filing can result in higher penalties, and in severe cases, directors may face disqualification for up to 15 years.

To avoid this, businesses should plan, keep track of filing deadlines, and consider using accounting software or a professional accountant to stay compliant and avoid unnecessary risks.

Accountancy Cloud: The Smart Choice for Annual Accounts and Compliance

Worried about the annual accounts filing deadline and managing the overall stuff? Choose Accountancy Cloud, which provides expert accounting solutions tailored for UK businesses seeking accuracy, speed, and peace of mind. Our award-winning team of specialist accountants and CFOs handles everything from annual accounts preparation and filing to corporation tax returns and strategic financial advice.

With Accountancy Cloud:

- You avoid costly penalties

- Stay compliant with Companies House and HMRC

- Gain real-time insights into your business finances

Trusted by fast-growing startups and established companies alike, Accountancy Cloud combines powerful digital tools with hands-on expertise, so you can focus on growing your business. At the same time, we handle the deadlines and details. Unlock stress-free accounting, proactive support, and the confidence that your filings are always in safe hands. Get in touch with us today!

Final Thoughts: Don’t Let the Annual Accounts Deadline Catch You Off Guard

Understanding your annual accounts deadline isn’t just about avoiding penalties; it’s about running your business with clarity, compliance, and confidence. Timely submission reflects financial discipline and builds trust with HMRC, Companies House, investors, and even your customers.

Whether you're a growing limited company or a small micro-entity, keeping your records in order and knowing key dates, such as your accounting reference period, can save you from stress, surprise fines, or worse, reputational damage.

As your business evolves, so do your accounting needs. If you’re unsure about exemptions, filing requirements, or how to align your financial reporting with your business goals, getting expert advice isn’t just smart, it’s strategic. Partnering with a professional accountant can give you the clarity, accuracy, and peace of mind you need to plan for growth, stay compliant, and make confident decisions all year long.

Frequently Asked Questions

When are my company’s first annual accounts due?

Your first annual accounts deadline links to your date of incorporation. If your first accounting period is longer than 12 months, you have up to 21 months from the date you started to file your annual accounts. If the accounting period is shorter, private companies must file within nine months after their accounting reference date. To obtain the exact details, refer to the Companies House guidelines on annual accounts, accounting periods, and the reference date.

Do dormant or non-trading companies need to file annual accounts?

Yes, even if a company is dormant or is not trading, it still has to file a set of accounts with Companies House. This rule applies even when there is no money coming in or going out. Using simple accounts can make things easier. However, if the company fails to keep up with this, it may face fines or be removed from the list.

What penalties apply for late filing of annual accounts?

Late filing of your annual accounts can result in penalties if you fail to provide the necessary accounting information. The penalty is £150 if you are even one day late, and it can increase to £1,500 if you are more than six months late. HM Revenue will also give you a fine of at least £100. This can increase significantly if you do not file for an extended period. To avoid penalties, always submit your documents to Companies House and HMRC on time.

How long do you have to keep annual accounts?

In the UK, you have to keep annual accounts for six years. There are some exemptions where you might not need to do this. It is essential to maintain detailed records, including those from your auditor or accountant. Doing this helps show that you are following the rules. Some jobs and situations, like disputes, may ask you to keep your records for a longer time.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.