How Much Do Accountants Charge for Year-End Accounts In The UK?

May 2025

How much do accountants charge for year-end accounts, and why do prices vary so much? Understand the key cost drivers and avoid common pitfalls.

See what Accountancy Cloud can do for you

- Get the best value for bookkeeping, CFO, and tax services

- UK's award-winning startup accountant

- Trusted by over 100 clients with 5-star reviews

You shouldn’t have to guess what your year-end accounts will cost. But if you’ve ever been quoted anything from £500 to over £3,000, you’ve probably wondered: what’s the real price, and what am I actually paying for?

The cost of year-end accounts in the UK depends on far more than just your turnover.

So let's break it down: how much accountants typically charge, what influences those fees, and how to avoid overpaying for services you don’t need. You'll also learn how bundled packages can offer value, especially if you're scaling fast and need more than just compliance.

What Are Year-End Accounts and Why Do They Matter?

Year-end accounts do more than keep you compliant, they reflect how well your business is run.

While they include essentials like your balance sheet, profit and loss, and tax calculations, their true value lies in how they support better decisions, not just better filings.

Here’s why they matter:

- They shape investor perception. Clean, accurate accounts help prove traction and financial discipline- critical if you're fundraising or preparing for exit.

- They surface inefficiencies. Patterns in cost, revenue, or margins become clearer, giving you insight into what's working — and what’s not.

- They impact your tax bill. Poorly structured records can lead to missed reliefs or overpayment. Strategic year-end accounting supports smarter tax planning.

- They build trust. Lenders, partners, and buyers will review your accounts. Transparency here often speeds up financial approvals and deal cycles.

You don’t just file accounts to meet a deadline- you use them to prove your business is credible, scalable, and investor-ready.

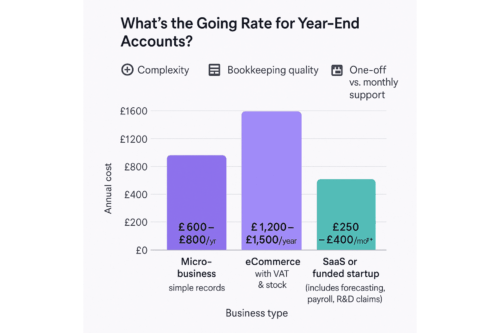

What’s the Going Rate for Year-End Accounts?

The cost of year-end accounts isn’t fixed, but for most small UK limited companies, it typically falls between £500 and £1,500.

What moves the price?

- Complexity- More transactions, income streams, or tax elements = more accountant time

- Bookkeeping quality- If your records are messy, you’ll pay for cleanup

- One-off vs. monthly support- Monthly packages often include year-end filing and cost less over time

Typical price ranges by business type:

- Micro-business (simple records): £600–£800/year

- eCommerce with VAT & stock: £1,200–£1,500/year

- SaaS or funded startup: £250–£400/month (includes forecasting, payroll, R&D claims)

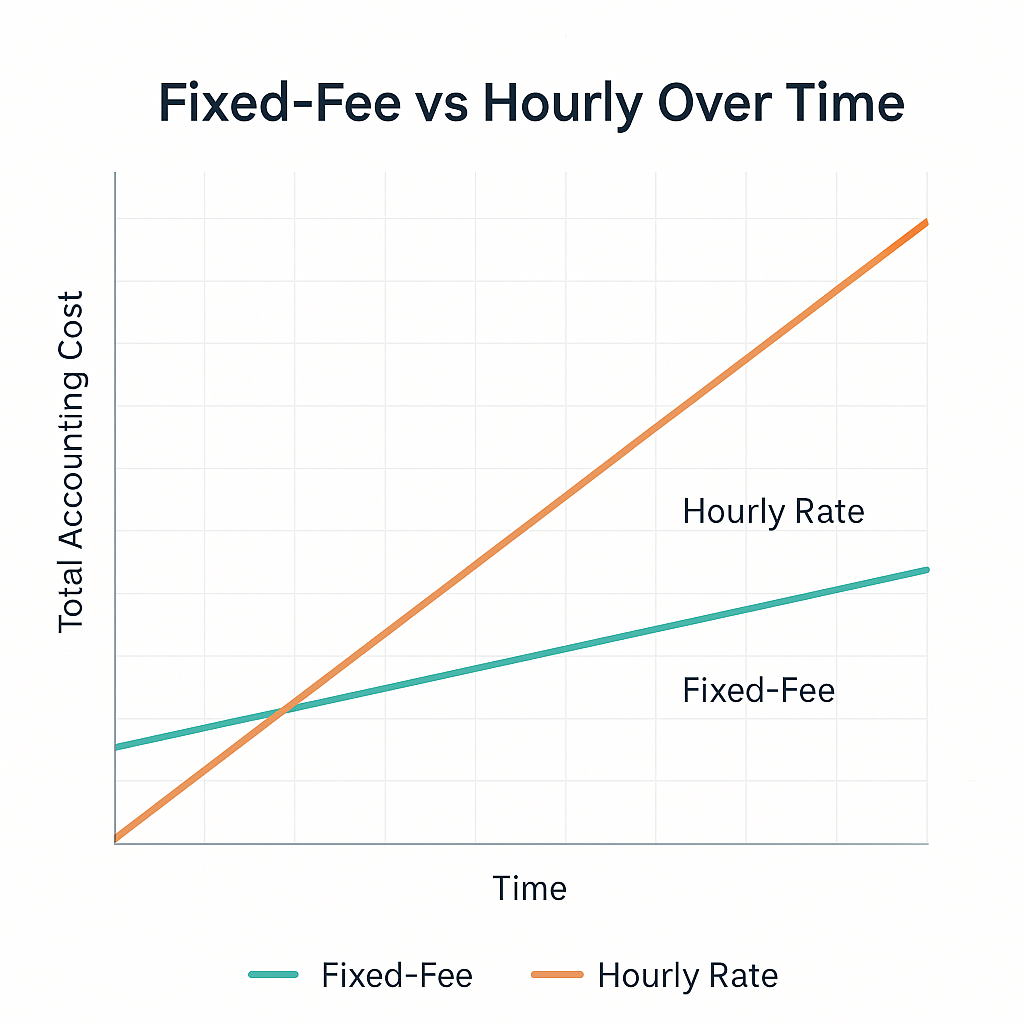

One-off filings may look cheaper upfront, but businesses with any complexity tend to save more in time and errors with bundled, year-round support.

How Much Should Annual Accounts Ideally Cost in the UK?

There’s no one-size-fits-all price. What you pay should reflect the structure, size, and stage of your business, not just a flat rate.

Here’s what to expect:

- Sole trader: £250–£500 (basic tax return preparation only)

- Single-director limited company: £500–£800

- Small business with payroll and VAT: £1,000–£1,500

- Growth-stage company (needs advisory): £250–£400/month

A fixed-fee package typically delivers more value than ad hoc filings, fewer errors, better tax handling, and ongoing advice as your business evolves.

If you're scaling, fundraising, or just want visibility over your numbers, a one-off accountant won’t cut it. You need a partner who supports you beyond tax season.

How Much Do Other Accounting Services Cost?

Many startups need more than just year-end accounts. Here's what other common services typically cost when billed separately:

| Service | Typical Fee | |

|---|---|---|

| Bookkeeping | £20–£50/hour | |

| Tax return preparation | £150–£500 per return | |

| Financial planning or forecasting | £100–£300/hour | |

| Part-time CFO services | £750–£5,000/month |

Fees tend to increase with company turnover, payroll size, or financial complexity. That’s why fixed-fee bundles often offer better value, especially if you're growing or need regular support across multiple areas.

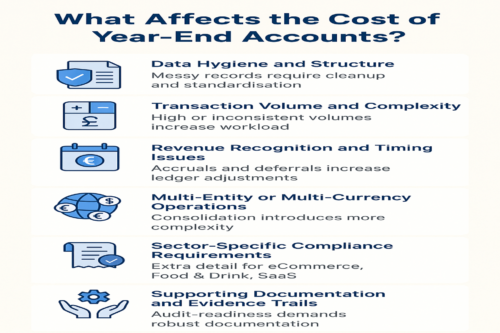

What Affects the Cost of Year-End Accounts?

Year-end accounting isn’t priced from a flat-rate menu, there are hidden variables behind every quote. Here are seven factors that influence what accountants charge, including some less obvious ones worth knowing:

1. Data hygiene and structure

If your chart of accounts is clean, transactions reconciled monthly, and expense categories consistent, year-end becomes a roll-up task.

But if you're handing over unreconciled bank feeds, Excel cashbooks, or duplicate entries, expect a higher fee to clean and standardize your records.

2. Transaction volume and complexity

Accountants don’t just count transactions, they assess the format, frequency, and clarity.

- 500 well-tagged invoices? Manageable.

- 500 unlabelled Shopify transactions with inconsistent VAT logic? That’s a multi-hour problem.

High volume, high variability = higher cost.

3. Revenue recognition and timing issues

If you operate on accrual accounting or deferred revenue (common in SaaS and subscriptions), your accountant has to align income across reporting periods. That means ledger adjustments, journal entries, and time-matching, all of which increase complexity.

4. Multi-entity or multi-currency operations

Businesses with international accounts or multiple entities require consolidation, FX adjustments, and intercompany reconciliation. This introduces scope far beyond single-entity, GBP-only filings.

5. Sector-specific compliance requirements

Certain sectors require granular breakdowns:

- eCommerce: VAT by region, marketplace integration, and inventory adjustments

- Food & drink: cost of goods sold, spoilage, batch tracking

- Tech/SaaS: deferred income schedules, R&D tax credit prep

Your accountant needs sector context or more time to figure it out.

6. Supporting documentation and evidence trails

If your accountant is expected to handle audit-readiness, investor reporting, or defend figures in a due diligence round, they’ll require documentation trails for key items: contracts, receipts, payroll reports, and system exports. That documentation review is billable work.

Which Type of Accountant Is Right for Your Business: Boutique, Online, or Traditional?

Choosing an accountant isn’t just about price—how they work matters just as much as what they charge. Here's how the three main service models compare for small and scaling businesses.

| Feature / Criteria | Boutique Firm | Online Accountant | Traditional Practice |

|---|---|---|---|

| Best for | Startups, scale-ups, founder-led teams | Micro-businesses, low-complexity operations | Local, legacy businesses |

| Pricing Model | Fixed monthly or retainer-based | Low-cost fixed monthly | Often hourly or tiered fixed fees |

| Support Style | High-touch, strategic | Reactive, platform-based | In-person, generalist |

| Pros | Industry-specific advice Strategic input Personalised service | Low cost Fully digital Easy onboarding | Face-to-face service Local insights Full-service legacy support |

| Cons | Limited capacity Higher cost | Limited customisation Impersonal feel | Higher overhead Often not tech-focused |

| When it’s worth it | Need help with growth planning, R&D, funding, or board reporting | Just need core compliance done affordably | Prefer in-person meetings and traditional workflows |

Not sure where your finances stand heading into year-end?

Work with a team that brings clarity, not just compliance.

See what Accountancy Cloud can do for you

Get the peace of mind that comes from partnering with our experienced finance team.

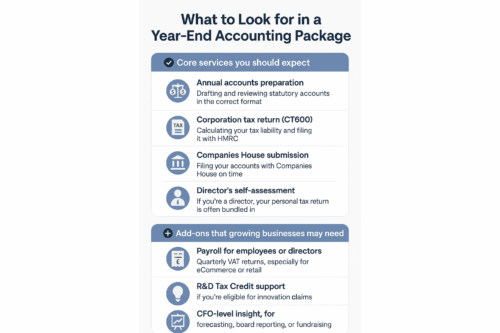

What to Look for in a Year-End Accounting Package?

Not all accounting packages offer the same value. Before you commit, make sure the essentials are covered and be clear on what’s extra.

Core services you should expect:

A good year-end package for UK limited companies should always include:

- Annual accounts preparation is a legal requirement.

Drafting and reviewing statutory accounts in the correct format - Corporation tax return (CT600)

Calculating your tax liability and filing it with HMRC - Companies House submission and HM Revenue & Customs (HMRC) compliance Filing your accounts with Companies House on time

- Director’s self-assessment

If you’re a director, your personal tax return is often bundled in

Add-ons that growing businesses may need:

Depending on your operations, your business might also benefit from:

- Payroll for employees or directors

- Quarterly VAT returns registration, especially for eCommerce or retail

- R&D Tax Credit support, if you’re eligible for innovation claims

- CFO-level insight, for forecasting, board reporting, or fundraising

These may be included in higher-tier packages or billed separately. Always confirm what's in your plan to avoid surprise costs.

Why fixed-fee or monthly packages make sense:

- You spread costs evenly across the year

- You get year-round advice, not just a year-end deadline crunch

- Your records stay investor-ready, tax-efficient, and error-free

If your business is scaling or fundraising, monthly packages can offer far more strategic value than pay-per-service plans.

What are Some Alternative Ways to Pay Your Accountant?

Not every business needs (or wants) the same billing structure. Depending on your goals, stage, and complexity, there are four main ways accountants charge for their services:

| Payment Model | How It Works | Best For | |

|---|---|---|---|

| Fixed monthly fee | One flat rate covering tax returns, filings, support, and bookkeeping | Startups and scaling businesses | |

| Hourly billing | Billed only for time used — £35–£60/hour for basic services | Very small businesses or one-off tasks | |

| Per-service pricing | Pay separately for tax returns, VAT filings, etc. (£150–£500 per task) | Businesses with simple or seasonal needs | |

| Hybrid model | Core services at a flat fee + add-ons like CFO advisory billed hourly | Customised or evolving financial needs |

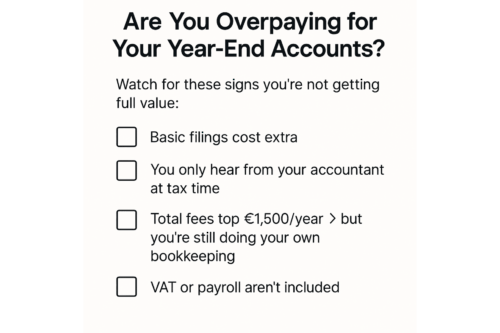

Are You Paying Too Much for Your Year-End Accounts?

Accounting fees aren’t always about the price tag, it’s about what you’re getting in return. Here’s how to know if you're overpaying, or missing out on real value.

Watch out for these red flags:

- You’re charged extra for basic tasks (e.g., Companies House filing or director self-assessment)

- You never hear from your accountant unless it’s tax season

- You’re paying >£1,500 annually but still doing your own bookkeeping

When cheap isn’t actually cheaper:

Low-cost packages often exclude:

- Tax advice and planning

- Filing support for VAT or payroll

- Access to an accountant who understands your industry

That may be fine for a side hustle, but if you're building a serious business, cutting corners here can cost you later.

Compare value, not just cost:

Instead of asking “What’s the cheapest option?”, ask:

- Does this include year-round support or just one-off filings?

- Will this accountant help me reduce tax, stay compliant, and grow?

- Do they understand the tools and platforms my business runs on?

An accounting partner who can support your business model is almost always worth the extra investment.

Why Are Year-End Accounts Harder Than They Should Be?

For most early-stage and scaling startups, year-end accounts aren’t just about deadlines, they’re the moment you realize how disconnected your financial setup actually is.

Maybe your bookkeeping was handled by a freelancer, payroll ran through a third-party app, and no one touched forecasting all year. Then, as the year wraps up, you're left with mismatched records, missing documentation, and last-minute clean-up that costs more than expected.

This isn’t just inefficient, it can lead to missed tax reliefs, delayed filings, or even a shaky investor report.

What works better is an integrated approach.

This is why platforms like Accountancy Cloud take a different approach: combining bookkeeping, year-end filings, tax planning, R&D claims, and advisory into one coordinated system. When the same team oversees the entire flow, from monthly records to final filings, it’s easier to:

- Maintain clean financial data

- Spot compliance issues early

- Reduce time (and cost) at year-end

- Make informed decisions throughout the year, not just after year-end

Startups don’t just need an accountant. They need clarity, consistency, and a system that scales with them.

If year-end accounts have become a scramble every year, it’s probably not just your process—it’s the structure.

Talk to an expert who can help you fix it.

Conclusion

When it comes to managing your business accounts, the cost of hiring a professional accountant shouldn't be your only consideration. The true value lies in finding a qualified accountant from reputable accounting firms who understands your specific needs, the complexity of your business, and how to support you through changing tax laws, financial advice, and growth stages.

Whether you’re considering multiple income streams, dealing with intricate financial activities, or simply tired of unclear hourly rates, choosing the right accountant’s expertise pays off in the long run. With the right level of accountant’s expertise, ongoing support and access to professional accounting services, and a clear understanding of your goals, you’ll gain peace of mind—and a financial partner who grows with your business.

Frequently Asked Questions

1. What affects the cost of an accountant for year-end accounts?

Accountant costs for a small business owner are influenced by a number of factors, including the complexity of your business size, your annual turnover, the high volume of transactions, financial, and whether you're engaging in any additional services like payroll, VAT, or R&D tax credits. The more complex your operations, the more time a professional accounting team will need to manage them, which requires a certain level of expertise.

2. Is a fixed-fee accountant better than paying hourly rates?

Yes, especially for business owners who want predictable expenses and year-round support. If you are wondering, how much should annual accounts cost UK, A fixed fee package typically includes ongoing advice, bookkeeping oversight, and better financial planning, whereas an hourly rate can vary widely depending on the accountant’s workload and your needs.

3. What should I expect from a good accountant?

A good accountant will do more than file your assessment tax return. They should help you maintain clean financial records, provide guidance on business decisions, and proactively assist with tax planning and cash flow management, especially if you are seeking professional help. Look for someone with proven experience in your industry and a clear range of services tailored to your operations.

4. Do larger businesses always pay more for accounting services?

Generally, yes. As the size of your business grows, so does the complexity, including more income streams, more transactions, and greater reporting obligations. However, a well-structured package from the right firm can keep the overall cost efficient, even for scaling companies.

5. How can I tell if I’ve outgrown my current accounting provider?

If you're managing complex operations, fundraising, or expanding into new markets, and your accountant is still treating your business like a sole trader setup, it may be time to upgrade. A qualified accountant with a startup-focused approach can better handle evolving needs and support your growth with strategic insights, not just basic compliance.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.