Small Business Bookkeeping That Works in 2025

Jan 2021

Running a business in 2025 isn’t just about doing what you love; it’s about keeping the numbers from eating you alive. You didn’t start your company for staring at spreadsheets at midnight or untangling mismatched receipts during tax season. But here you are, juggling invoices, chasing payments, and wondering if your “profit” is real or just a number on paper.

If bookkeeping feels like that never-ending task you should be on top of but never quite are, you’re not alone. This blog cuts through the fluff and provides a real-world approach to small business bookkeeping that aligns with the way modern businesses operate: lean, fast, and tech-savvy.

Additionally, you will receive valuable tips to help your business run smoothly. Let's begin!

What Is Small Business Bookkeeping?

Small business bookkeeping is the day-to-day process of recording where your money comes from and where it goes. It covers everything from tracking sales and expenses to reconciling bank statements and filing receipts; the basics that keep your business financially organised.

It’s not just about ticking boxes for tax season. Good bookkeeping gives you clarity on your cashflow, helps you stay compliant with VAT and Making Tax Digital rules, and ensures you’re never guessing about your financial health. With the right habits (and maybe the right tools), it turns chaos into control, and that’s a win for any small business.

What’s the Difference Between Bookkeeping and Accounting?

Although people often confuse bookkeeping basics with accounting, these are distinct concepts. Bookkeeping records all transactions related to a business's financial activities, including every sale, purchase, and payment. It’s the daily tracking of invoices, receipts, and bank statements that keeps your financial data organised and up-to-date.

Meanwhile. Accounting takes that data and makes sense of it. It helps you understand profits, plan for taxes, and make smarter business decisions. Bookkeeping tracks; accounting interprets. You need both.

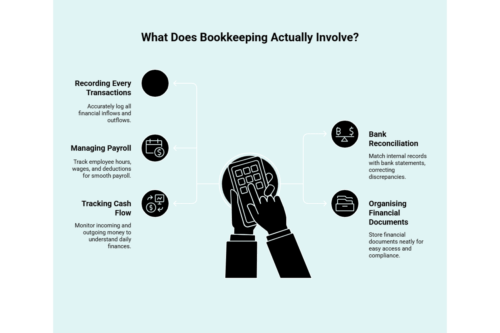

What Does Bookkeeping Actually Involve?

Bookkeeping isn’t just data entry; it’s the foundation that keeps your business financially grounded. Here's what it really includes:

- Recording Every Transaction: Sales, purchases, expenses, every bit of money in or out gets logged accurately.

- Bank Reconciliation: Match your records with actual bank statements to identify and correct errors before they become costly.

- Managing Payroll: Tracking employee hours, wages, and deductions to make sure payroll runs smoothly.

- Organising Financial Documents: Storing invoices, receipts, and statements neatly for easy access and tax compliance.

- Tracking Cash Flow: Keeping a close eye on the money coming in and going out so you know where your business stands daily.

What Are Some Smart Tips to Simplify Business Finances?

Keeping your business finances on track doesn’t have to be overwhelming. With a few strategic moves and the right support, you can save time, reduce costs, and maintain control.

Here’s how to streamline your business finances:

1. Choose Accounting Software That Fits You

The right accounting software doesn’t just save time, it saves headaches. Look for tools that handle invoicing, reconcile bank feeds, and give you a clear picture of your cash flow.

Why it matters:

- Simple Setup: Try before you buy. Some platforms offer free trials.

- Automation Wins: Link your bank to auto-track spending, payroll, and taxes.

- Grows With You: Real-time insights scale with your business.

Smart software does the heavy lifting, so you can focus on running your business, not chasing receipts.

2. Pick an Accounting Method That Matches Your Workflow

Your accounting method affects how and when you record income and expenses, as well as how you perceive your financial health.

Two main options:

- Cash Method: Record income when it’s received and expenses when paid. Simple and cash-flow friendly.

- Accrual Method: Record income when earned and costs when incurred. Great for long-term insight and financial reporting.

Pro tip: Always consider VAT needs and tax obligations before making a choice, or better yet, consult an expert.

3. Track Every Payment

No payment is too small to log. Good records lead to clean reports, stress-free tax filings, and reliable cash flow management.

Best practices to follow:

- Log all sales, expenses, and purchase invoices in real time

- Reconcile your bank statements regularly

- Store receipts and documents securely (paper or digital)

When you track everything, nothing catches you off guard.

4. Respect Deadlines Like Your Business Depends on It (Because It Does)

Late filings = penalties. Missed payments = inadequate cash flow. Avoid both.

How to stay sharp:

- Set reminders for VAT, corporation tax, and self-assessment deadlines

- Create a system for paying suppliers on time

- Monitor how quickly your clients pay, and follow up fast if they don’t

Deadlines aren’t just about compliance; they’re about keeping your business running smoothly.

5. File Bank Statements and Invoices the Smart Way

Don’t let paperwork become chaos. Sorted documents = faster accounting.

Do this:

- Organise invoices into “paid” and “unpaid” folders

- File bank statements by date for quick checks

- Update payment records as soon as you pay

Neat files save time, especially when it’s VAT or tax season.

6. Create Monthly Reports (And Actually Use Them)

A once-a-year report won’t cut it. Monthly financial reports help you stay sharp and proactive.

Why it works:

- Spot trends before they become problems

- Compare actuals with targets

- Know when to pivot or invest

Don’t wait for year-end surprises; check your numbers monthly.

7. Know When to Outsource Your Bookkeeping

If bookkeeping is draining your time or full of errors, it’s time to call in for help.

Signs it’s time:

- You’re constantly fixing mistakes

- Payroll and reconciliation stress you out

- Tax deadlines sneak up too often

Outsourcing provides you with accuracy, expert insight, and time to grow your business.

8. Use Tech to Do the Heavy Lifting

Another useful bookkeeping tip is to utilise digital tools that can turn messy finances into clean dashboards.

Why go digital:

- Automate data entry and tax filing

- Access real-time numbers anytime

- Stay compliant with Making Tax Digital

Smart tech = fewer errors, faster tasks, and smoother workflows.

9. Hire an Accountant When It Matters Most

DIY can work until it doesn’t. The right accountant brings depth you can’t get from software alone. They can easily help with small business bookkeeping.

What they offer:

- Tax expertise and audit prep

- Strategic advice for growth

- Risk reduction and regulatory support

Think of it as an investment, not a cost. The right accountants can pay for themselves in value.

Small Business Bookkeeping Doesn’t Have to Be a Struggle with Accountancy Cloud

Juggling receipts, VAT deadlines, and confusing reports shouldn’t eat up your evenings or your peace of mind.

That’s where Accountancy Cloud comes in. We streamline your financial records by integrating with tools like QuickBooks and Xero, so everything from your balance sheet to self-assessment stays accurate and stress-free.

Our expert team handles the heavy lifting while you stay in control with real-time insights, monthly reports, and smart bookkeeping tips tailored for small businesses. Whether you're a sole trader or running a limited company, Accountancy Cloud helps you stay compliant, confident, and ready to grow without the need to worry about your books. Quickly get in touch with us today to get the required help

Final Thoughts: Bookkeeping Isn’t Just a Task, It’s a Growth Lever

Most small business owners don’t start with a love for bookkeeping; they do it out of necessity. But when you shift your mindset from “just keeping records” to “using numbers to drive decisions,” everything changes.

Clean books don’t just help you survive tax season. They show you where money leaks, when to invest, and how to move with confidence. Whether you're still doing it yourself or ready to bring in expert help, your finances should work for you, not the other way around.

So take action. Streamline your process. Use the right tools. And treat your books like the foundation they are because your next smart business move starts there.

Frequently Asked Questions

What records must a UK small business keep?

UK businesses are required to retain sales invoices, purchase invoices, and bank statements for a minimum of six years to comply with HMRC regulations. Keeping these records in order makes everything clearer and helps a lot when there is an audit or when it's time to file your taxes.

Can I do bookkeeping myself, or should I hire a professional?

Small business owners can handle bookkeeping basics on their own by using digital software like Xero. But if you choose to get professional help from a professional bookkeeper, you will get expert advice and lower your chances of making mistakes. This is very important when your business starts to grow, and you need to stay on top of your bookkeeping.

What are the penalties for poor bookkeeping in the UK?

If you do not follow HMRC rules, you may have to pay extra money. This can happen if your tax returns, corporation tax, or VAT are wrong. If you submit your forms late, you may incur a fine. There is also a chance that your accounts will be subject to more scrutiny during an audit.

How to do bookkeeping for small business?

Keep track of your transactions with accounting software or tools like Excel. Sort your invoices to prevent losing them. It is beneficial to reconcile your bank accounts on a regular basis. Store your receipts securely by using a reliable database. You can use them later if needed.

How much does bookkeeping cost for a small business?

The costs of bookkeeping services for small businesses vary depending on the software or service you pick. A tool like Xero offers various subscription options and includes a free trial. When you hire a bookkeeper, you receive special pricing tailored to your needs. This can be particularly beneficial for businesses seeking to expand.

Why do small businesses need bookkeeping?

Efficient small business accounting helps maintain your financial health. It enables you to see your cash flow more clearly and reduces mistakes. Knowing this gives you a clear view of your business’s performance, allowing you to manage it effectively over time.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.