12 Smart Cafe Financial Planning Tips to Increase Profits

May 2025

Opening a coffee shop is exciting, but without strong financial planning, it can quickly become overwhelming. Many café owners underestimate startup costs and run into cash flow issues before they ever turn a profit.

That is why a clear financial plan is important since it shows you how much money you need to start, what your monthly expenses will be, and how to price for profit when considering your target audience. It also prepares you for slow seasons, unexpected costs, and funding conversations.

In this guide, we’ll break down everything from startup budgets to revenue projections, so you can turn your café dream into a profitable reality. Let’s dive in.

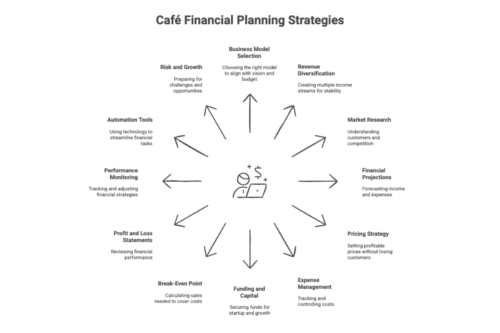

12 Actionable Tips for Café Financial Planning: A Step-by-Step Guide to Profitability

Strong financial planning is the backbone of every successful coffee shop venture. Without a solid coffee shop financial plan, even the most passionate café owners risk running into cash flow issues, overspending, or pricing mistakes that hurt profitability.

This guide simplifies the process. From startup costs to profit margins, here are 10 clear, practical steps to build a financially sound and sustainable coffee shop business.

1. Choose a Business Model That Supports Your Vision and Budget

Your business model determines your cost structure, revenue potential, and operating style. Will you run a cosy dine-in café, a drive-thru, a grab-and-go kiosk, or a mobile coffee truck, estimating the number of people you expect to serve?

Each model has different financial requirements that can be analysed through a different financial model.

Once you decide, develop a business plan that outlines:

- Store layout and equipment needs

- Location strategy and rent expectations

- Target customer flow and average order value

- Branding, menu offerings, and customer experience goals

Align your model with customer demand, local competition, and scalability to avoid misaligned investments.

2. Create Multiple Revenue Streams to Boost Stability

Don’t rely solely on coffee sales. Strong cafés that provide good customer service diversify income to smooth out seasonal dips and improve margins.

In addition to core offerings like drinks and snacks, consider:

- Selling branded merchandise (mugs, beans, tote bags)

- Hosting paid events (coffee tastings, barista workshops)

- Offering catering for offices and events

- Subscription-based delivery or coffee bean memberships

Include these streams in your financial plan, and regularly review what works based on sales data and customer feedback.

3. Research Your Market and Customers Before You Spend

Detailed market research helps you make smart financial decisions before launch. Therefore, it is important to research and understand:

- Who your ideal customers are (age, income, habits)

- What they value most (quality, speed, ambience, etc.)

- Local competitors such as what are they doing right or missing?

- Seasonal foot traffic trends in your location

This insight guides your pricing, menu, staffing, and even hours of operation, helping you avoid costly mistakes.

4. Build Clear Financial Projections from Day One

Your financial projections are the heart of your business plan. They show how you’ll make money and when, so be realistic about your financial assumptions.

Include factors such as:

| Projection Type | Purpose | ||

|---|---|---|---|

| Cash Flow Statement | Tracks money in vs. out each month | ||

| Income Statement | Shows profitability (revenue – expenses) | ||

| Balance Sheet | Summarises assets, liabilities, and equity |

Also, estimate when you’ll break even and factor in seasonal trends. These projections help you plan for lean months and secure investor confidence.

5. Set Profitable Prices with a Clear Strategy

Price your products to cover the cost of goods and leave room for profit, without driving away customers.

How to do it:

- Calculate all direct costs (beans, milk, cups, etc.)

- Factor in indirect costs (rent, wages, utilities)

- Research competitors and match or slightly undercut them if possible

- Consider your value proposition, i.e., are you premium or budget-friendly?

Adjust prices as needed to protect margins without losing customer trust.

6. Manage Expenses and Cash Flow Like a Pro

Even a busy café can lose money if spending isn't tracked. Build strong financial habits early:

- Forecast monthly expenses and revenue

- Separate fixed costs (rent, salaries) from variable ones (inventory, utilities)

- Monitor your cash flow weekly. Don't just wait until the end of the month

- Use software or tools to automate tracking and get reports

Staying on top of your finances prevents shortfalls and builds long-term stability.

7. Plan Ahead for Funding and Startup Capital

Securing funds is one of the first big steps. Start by estimating your total startup costs, including:

- Equipment purchases

- Lease deposits and renovations

- Licensing and permits

- Marketing and launch expenses

- Working capital for the first 3–6 months

Once you have a number, decide how to fund it: savings, small business loans, investor partnerships, or crowdfunding. Make sure your funding pitch includes solid projections and a clear repayment plan.

8. Calculate Your Break-Even Point

Your break-even point tells you how much you need to sell each day or month to cover your costs. It’s a critical metric that helps you stay focused.

To calculate:

- Add up fixed monthly costs (rent, salaries, utilities)

- Estimate variable cost per product

- Divide total fixed costs by average profit per sale

Use this number to set realistic sales targets and adjust operations if you’re not hitting them.

9. Use Profit and Loss Statements to Stay on Track

A profit and loss (P&L) statement shows how much money your café is actually making or losing over time. Review it monthly or quarterly to:

- Identify unnecessary expenses

- Spot declining sales trends

- Measure the effectiveness of marketing or promotions

- Track net profit growth over time

If you’re unsure how to create one, accounting software or a bookkeeper can simplify it for you.

10. Monitor Performance Monthly and Make Data-Driven Adjustments

Financial planning isn’t static. Review your business metrics monthly to stay agile and profitable.

Focus on:

- Actual vs. projected income and expenses

- Cash flow stability—are you consistently in the positive?

- Sales patterns—what sells well, and what doesn’t?

- Rising costs—identify early and adjust quickly

- Profit margins—are they shrinking due to rising supplier or labour costs?

Make it a habit to revisit your financials with your manager, accountant, or partner. Adjust pricing, shift marketing focus, or streamline operations based on what the data tells you.

11. Automate Financial Tracking with the Right Tools

Switch from manual spreadsheets to digital tools that save time and reduce errors. Key tools include:

- POS systems to track daily sales and inventory in real time

- Accounting software to manage expenses and generate reports

- Payroll tools to automate employee payments and tax filings

These systems provide accurate, up-to-date financial data that you can access anytime. They also help you spot trends and make faster, data-driven decisions, especially during busy seasons or unexpected slowdowns.

12. Calculate Potential Financial Risks and Growth Opportunities

Your café’s finances should be flexible enough to handle unexpected challenges, while also taking advantage of growth.

To prepare:

- Build a cash reserve for emergencies like equipment repair or supply shortages

- Monitor industry trends like rising bean costs or changes in foot traffic

- Conduct regular SWOT analyses (strengths, weaknesses, opportunities, threats)

- Update your financial forecasts quarterly to stay realistic and adaptable

Having a forward-thinking plan means you're not just reacting to problems, you’re positioned to grow strategically when opportunities arise.

Struggling to Stay on Top of Your Café’s Finances? Let Accountancy Cloud Help

Running a café means juggling a lot, leading to inventory, staff, customer experience, and finances often getting pushed to the side. But ignoring cash flow, tax deadlines, or proper bookkeeping can hurt your bottom line fast.

That’s where Accountancy Cloud comes in.

We offer affordable, startup-friendly accounting, bookkeeping, tax, and CFO services tailored to café owners and small food businesses. From tracking your daily expenses to planning for seasonal sales shifts and claiming eligible tax credits, we handle it all, so you can focus on brewing great coffee and growing your business.

- Expert accounting support tailored for cafés

- Fractional CFO services without full-time cost

- Real-time bookkeeping so you always know your numbers

- Tax planning and filing that saves you time and money

Get your quote today and see how simple, smart financial planning can set your café up for long-term success.

Wrap Up Your Financial Plan and Take Control of Your Café’s Future

Strong financial planning is not just a one-time task, it’s a continuous process that shapes your financial position and the success and sustainability of your café. By following these 12 steps, you’ll build a solid financial plan foundation that helps you manage costs, increase profitability, and make smarter business decisions.

So, whether you're still planning or already running your coffee shop, clear financial planning gives you the insight and flexibility to adapt, scale, and thrive, no matter what challenges come your way.

Frequently Asked Questions

What initial capital is needed to start a cafe in the UK?

Starting a cafe in the UK typically requires an initial capital of £50,000 to £200,000. This amount covers expenses like equipment, permits, inventory, and initial operational costs. However, specific requirements can vary based on location and business model. Always conduct thorough financial planning before launching.

What are the top financial metrics a cafe owner should monitor?

Cafe owners should closely monitor metrics such as gross profit margin, net profit margin, average transaction value, and labor cost percentage to understand their coffee shop’s profitability and monthly expenses, including the coffee shop’s monthly expenses. Additionally, tracking inventory turnover and customer acquisition costs can provide valuable insights into the overall financial health and operational efficiency of the cafe.

Can technology reduce financial management overhead for cafes?

Absolutely! Technology streamlines financial management by automating processes like invoicing, payroll, and expense tracking. This reduces manual errors, saves time, and lowers overall costs, allowing cafe owners to focus more on growth and customer experience rather than tedious administrative tasks.

What are the 5 steps of financial planning?

The five steps of financial planning include setting clear financial goals, assessing your current financial situation, developing a strategic plan, implementing the plan effectively, and regularly reviewing and adjusting the plan to ensure continued progress towards your objectives.

How often should I review and update my cafe's financial plan?

Regularly reviewing and updating your cafe's financial plan and financial results through market analysis and competitive analysis is crucial for adapting to market changes. Aim for quarterly reviews, but adjust as needed based on business performance or significant events. This proactive approach ensures your financial strategies remain effective and aligned with your goals.

What financial metrics should I track for my cafe?

To effectively manage your cafe’s finances, track essential metrics such as revenue per seat, average transaction value, food cost percentage, labour cost percentage, and customer acquisition costs. These metrics provide insights into profitability and operational efficiency for informed decision-making.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.