How Much Should Annual Accounts Cost UK?

Jun 2025

Are you a founder, freelancer, or small business owner in the UK, and your year-end accounts are due? But every accountant you speak to gives a different quote, and none can explain why. One charges £300, another £1,200, and suddenly, compliance feels like a black box. Sound familiar?

Then this blog is for you. You’ll learn exactly how much annual accounts should cost in the UK, what affects the price, and how to spot when you’re being overcharged.

Avail real numbers, real benchmarks, and practical guidance so you can budget smart, stay compliant, and avoid wasting money on bloated accounting packages you anyway don’t need.

What Are Annual Accounts and Why Do They Matter?

Annual accounts aren’t just paperwork; they’re your business’s financial truth laid bare. These financial statements sum up your company’s performance over the past year, typically including a balance sheet, profit and loss statement, and cash flow report.

If you're a UK business owner, filing annual accounts with Companies House isn’t optional. You must submit them within nine months after your financial year ends or face penalties, warnings, or even forced dissolution.

However, the real value of annual accounts goes far beyond compliance.

Here’s why they matter:

- Build Credibility Through Clarity: Investors, lenders, and partners require clear, accurate financial information. Annual accounts build credibility fast.

- Stay Ahead of Compliance Risks: Avoid fines and stay off HMRC’s radar by filing accurate reports on time.

- Business Insights: Understand your cash flow, profit margins, and debt levels at a glance.

- Make Moves Backed by Data: Utilise financial data to confidently plan hiring, growth, pricing, or product shifts.

How Much Does an Accountant Cost for Annual Accounts in the UK?

Now let's move to the straight talk on accountant fees.

For annual accounts, you must expect to pay between £750 and £3,000 a year. This typically covers:

- Statutory accounts

- Profit & loss statements

- Balance sheets

If you also require payroll, VAT, or tax filing services, prices can range from £1,000 to £5,000, especially for growing limited companies.

Still, a good accountant doesn’t just crunch numbers; they save you money with smart tax planning and keep you on the right side of HMRC.

What’s the Average Hourly Rate for UK Accountants?

Need ad-hoc support? Here’s what it’ll cost by the hour:

- £45–£60/hr for bookkeeping and admin

- £200–£360/hr for a tax strategy or complex advice

However, note that London firms usually charge at the higher end due to demand and overheads. Outside the city? You’ll likely get better rates.

Pro tip: Many offer fixed-fee packages, perfect for small businesses that need reliable, ongoing support without unexpected costs. Consider them if you are running a small firm.

How Much Do Accountants Charge for Tax Returns?

For a simple personal tax return preparation, you must expect to pay between £150 and £300, ideal if you’re a sole trader or PAYE employee with minimal extras. However, if your finances include rental income, dividends, or multiple income streams, that figure can quickly rise to £ 1,000 or more.

Running a limited company? A corporate tax return will typically cost between £400 and £3,000, depending on complexity, turnover, and how organised your books are. While it’s an added expense, a smart accountant often pays for themselves, spotting tax savings, avoiding penalties, and keeping your business HMRC-compliant.

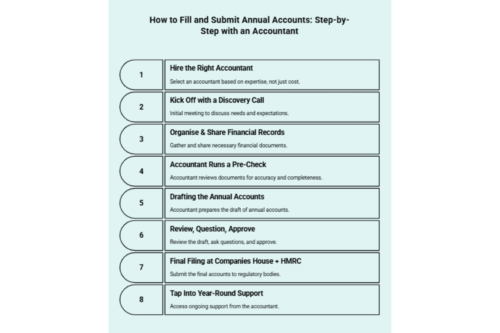

How to Fill and Submit Annual Accounts: Step-by-Step with an Accountant

Navigating annual accounts filing doesn’t have to be a maze. With the right accountant, the process becomes faster, cleaner, and penalty-free. Here's how it works, step by step.

Step 1: Hire the Right Accountant (Not Just the Cheapest)

Skip the generalists. Look for an accountant with experience in your industry and the same business size as yours. ACCA or ICAEW credentials are helpful, but case-specific expertise is more important. Ask about fixed fees, turnaround times, and how they’ll support you year-round.

Step 2: Kick Off with a Discovery Call

This first meeting sets the tone. Your accountant will thoroughly examine your business model, transaction volume, and compliance requirements. You’ll clarify expectations, ask about tax strategies, and determine if their workflow aligns with your business goals.

Step 3: Organise & Share Your Financial Records

Your job? Bring the data: invoices, payroll reports, expense receipts, bank statements, all of it. Use accounting software to streamline this step and save hours of manual follow-up.

Step 4: Let the Accountant Run a Pre-Check

Before diving into filings, a good accountant scans your records for gaps, red flags, or missed deductions. This early review protects against rejected submissions and helps tighten your overall financial hygiene.

Step 5: Drafting the Annual Accounts

Here’s where the financials take shape: balance sheets, profit and loss (P&L) statements, and cash flow reports. Expect commentary on profit margins, liabilities, and tax exposure. Everything is aligned with UK accounting standards (FRS 105 or 102).

Step 6: Review, Question, Approve

Don’t rubber-stamp it. Go over the draft with your accountant. Question anomalies, understand key numbers, and review potential tax implications. This is your final stop before submitting your formal work.

Step 7: Final Filing at Companies House + HMRC

Once approved, your accountant files the accounts electronically. Expect confirmation from Companies House and a tax breakdown for HMRC. A good accountant will also highlight last-minute tax-saving opportunities.

Step 8: Tap Into Year-Round Support

Great accountants don’t ghost after filing. They offer ongoing advice on cash flow, forecasting, VAT, and compliance. Build this into your working relationship; it pays off with every financial decision you make.

Cost Considerations: Learn What You’ll Actually Pay

Accountant fees vary by business size and complexity, but here’s a rough breakdown:

- Fixed Fees: Predictable pricing for standard services (e.g., annual accounts, payroll). Ideal for startups and SMEs.

- Hourly Rates: Flexible, but harder to budget. Use for one-off consultations or advisory sessions.

- Add-On Charges: Rush jobs, sector-specific compliance (e.g., FCA, charities), or multi-entity businesses may incur additional costs.

Pro Tip: Choose value, not just price. A proactive accountant can save you more in tax than you’ll ever pay in fees.

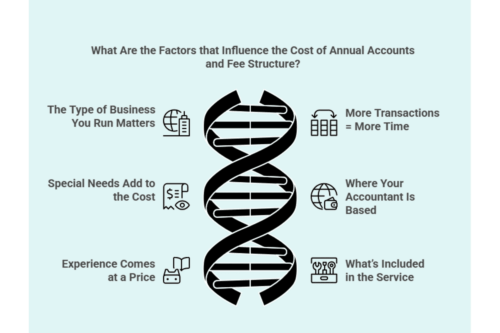

What Are the Factors that Influence the Cost of Annual Accounts and Fee Structure?

Several factors can impact the cost of annual accounts and the determination of accounting fees. This includes:

1. The Type of Business You Run Matters

A small online shop is much easier to handle than a company with multiple branches or international deals. The more complex your business setup, the more time and expertise your accountant will need, which in turn raises the cost.

2. More Transactions = More Time

If your business has hundreds or thousands of payments, sales, and expenses each month, it takes longer to check and organise everything. That extra time shows up in the final fee.

3. Special Needs Add to the Cost

Some businesses require additional assistance, such as managing overseas payments, preparing industry-specific reports, or navigating complex tax regulations. If your accounts are more detailed or unique, the price will usually be higher.

4. Where Your Accountant Is Based

Accountants in big cities like London often charge more than those in smaller towns. This is primarily due to higher demand and local business costs in those areas.

5. Experience Comes at a Price

A new accountant might charge less, but someone with years of experience, especially in your industry, may charge more because they bring more value and fewer mistakes.

6. What’s Included in the Service

Some accountants just prepare your annual accounts. Others offer a comprehensive package that includes tax planning, payroll, and ongoing advice, as well as additional services. The more services you include, the higher the fee; however, it may save you money in the long run.

What Are the Types of Fees Charged by Tax Accountants?

Tax accountants can charge for their work in various ways. Below, we have provided a table to help you better understand the information.

| Service | Estimated Cost | What’s Included / Best For |

|---|---|---|

| Simple Tax Return | £150 – £250 | Great for freelancers or sole traders with straightforward income |

| Annual Accounts Filing | £500 – £1,500 | Covers P&L, balance sheet, and cash flow; ideal for limited companies |

| Monthly Bookkeeping | £150 – £300 per month | Regular tracking of expenses, income, and bank reconciliation |

| Tax Planning Consult | £100 – £300 per hour | Tailored advice for businesses with complex tax or growth plans |

| Payroll Processing | £50 – £250 per month | Employee payslips, tax deductions, and HMRC submissions |

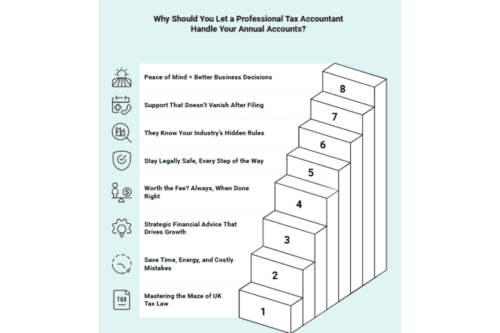

Why Should You Let a Professional Tax Accountant Handle Your Annual Accounts?

Trying to handle annual accounts alone can be risky, time-consuming, and costly. With the right accountant, your business gets smarter, safer, and stronger year after year.

1. Mastering the Maze of UK Tax Law

Tax laws in the UK are frequently updated and cover more than just income. A tax accountant stays updated, so you don’t fall behind. They help you comply, avoid penalties, and plan better.

2. Save Time, Energy, and Costly Mistakes

Handling accounts yourself takes hours you don’t have, and mistakes cost money. Let an expert take over so you can focus on what actually grows your business. Professional help means fewer errors and better results.

3. Strategic Financial Advice That Drives Growth

Accountants don’t just report numbers; they read them. They show you trends in revenue, cash flow, and costs, allowing you to make smarter decisions. This insight helps you in strategic planning for growth, not just surviving tax season.

4. Worth the Fee? Always, When Done Right

A good accountant pays for themselves by lowering tax bills and boosting efficiency. They help you avoid fines and spot hidden savings. What appears to be a cost now may often be a long-term benefit.

5. Stay Legally Safe, Every Step of the Way

Mistakes in tax filings can result in fines, audits, or even more severe consequences. A qualified accountant ensures your reports meet HMRC and Companies House standards. That means less stress and fewer legal risks.

6. They Know Your Industry’s Hidden Rules

From construction to eCommerce, each sector has quirks most people miss. A specialised accountant knows how to handle industry-specific deductions, reporting formats, and timelines, ultimately protecting both your cash and your credibility.

7. Support That Doesn’t Vanish After Filing

Good accountants don’t disappear after submission day. They're on hand for year-round advice, deadline reminders, and smart planning. That ongoing support helps you stay ahead, not just compliant.

8. Peace of Mind = Better Business Decisions

When a pro handles your books, your mind is free to focus on strategy. You won’t waste time second-guessing tax laws or spreadsheet formulas. You’ll run your business with more clarity and confidence.

Indeed, hiring an accountant is a smart move, but let’s be honest, the search is where most founders get stuck. One firm’s too expensive, another doesn’t understand your industry, and then there's no clear information provided. You waste time chasing quotes, sitting through sales calls, and still feel unsure if you’ve made the right choice. That’s exactly where Accountancy Cloud steps in, bringing together trusted experts, clear pricing, and startup-savvy support that actually delivers.

Why Accountancy Cloud Stands Out?

When it comes to understanding what you actually pay for annual accounts in the UK, Accountancy Cloud stands out by offering transparent, fixed-fee pricing with no hidden extras. Our services are built specifically for founders and fast-growing businesses who want to avoid the confusion of unpredictable quotes and bloated packages.

Besides, we are the finance partner behind some of the UK’s most ambitious startups. Our award-winning team combines hands-on expertise with powerful in-house software, providing founders with real-time financial dashboards and strategic support that scales as you grow.

Switching to Accountancy Cloud means you get a dedicated finance team, seamless online service, and proactive advice tailored to your sector. So, if you’re ready to move beyond basic compliance and unlock real business growth, book a call with us to see how we can help you elevate your finances.

Conclusion: Invest in the Right Accounting Partner for the Long Run

When it comes to filing your limited company accounts and managing your corporation tax return, the stakes are too high to go it alone. The cost of preparing accounts isn’t just about the monthly fee; it’s about getting real value across a range of services that protect your financial health and help you grow. Whether it’s handling VAT returns, optimising for tax efficiency, or staying on top of payroll services, the right limited company accountant makes all the difference.

However, not all accounting firms are built the same. Your specific needs depend on the size of your business, your annual turnover, and the volume of transactions you deal with. That’s why choosing a partner who understands your industry and offers scalable support beyond just financial reporting is key.

The right help isn’t an expense. It’s an investment in the long run.

Frequently Asked Questions

How can I reduce my accountancy fees?

To save money on accountancy fees, you can look for companies that have lower prices. You may want to choose a fixed fee so you always know what you will pay. You can also use software to help with your accounts. Try to review your financial plans regularly so you can find ways to save. This also helps ensure that you do everything necessary for taxes.

What happens if I file annual accounts late in the UK?

Filing annual accounts late in the UK can get you in trouble. You may have to pay penalties that get higher the longer you wait. This can also bring more attention from HMRC. If the delay persists, you may even face legal problems. Companies that fail to submit their annual accounts on time may lose tax benefits and damage their reputation with others. All these things make it harder for them to work or grow in the future.

How much does an accountant cost for a small limited company?

The cost of an accountant for a small limited company in the UK is usually between £200 and £1,500 each year. The price you pay can go up or down because of things like the business size, what the company does, how many services you want, and where your business is based. Having an accountant can give you valuable insights and help you stay in line with regulations.

What is the accountant's cost for self-employed individuals?

The accountant's cost for self-employed people in the UK is usually between £200 and £1,000 each year. The price can change based on the complexity of your finances and the services you require, including adherence to tax regulations. The experience and skills of the accountant also have a big effect on these fees.

How can businesses ensure they are getting a fair price for annual account services?

To make sure you get fair pricing for yearly account services, it’s a good idea to check quotes from more than one accountant who understands the complexity of your financial situation. You should ask about how they charge different fees. Take time to see what you get for the price of their services. You can also look up industry standards and read reviews from their clients. This can help you see if their prices are good or not.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.