How to Improve Cash Flow in Retail and Drive Faster Growth

May 2025

If you’ve ever struggled to pay a bill during a slow sales week or had to turn down a growth opportunity due to tight funds, you’re not alone. Poor cash flow, which can lead to negative cash flow and business failure, not lack of profit, is one of the top reasons retail businesses experience cash flow problems and fail. From covering rent and payroll to keeping shelves stocked, every part of your operation depends on having cash available when you need it.

But with rising interest rates, delayed supplier payments, and unpredictable customer demand, staying cash-positive is harder than ever.

In this blog we will break down practical, no-fluff strategies to help you take control of your cash flow. So, whether you’re running a single store or a growing retail chain, these tips will help you improve financial stability, plan better, and unlock more flexibility in your business.

What Is Cash Flow in Retail?

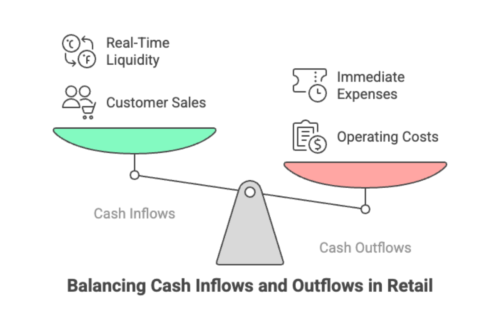

Cash flow is the net amount of money moving in and out of your retail business during a given period. It reflects how much cash you actually have on hand, not just what you’ve earned on paper.

In retail,

- Cash inflows come from customer sales (online and in-store)

- Cash outflows include rent, payroll, inventory purchases, utilities, and other operating costs.

These are tracked through a cash flow statement, which gives a real-time view of your liquidity.

Unlike net profit, cash flow shows your ability to cover immediate expenses. You might show a profit but still face cash shortages if revenue is tied up in card settlements or unpaid invoices.

Why Cash Flow Management Matters in Retail

In retail, cash flow problems don’t just slow you down—they can shut you down. If cash isn’t available when it’s needed, you risk missing supplier payments, falling behind on rent, or being unable to restock key inventory.

Managing cash flow helps you:

- Invest in growth—whether that’s new stock, store upgrades, product development, or marketing, which can also be classified as a business expense.

- Avoid late fees and strained supplier relationships

- Plan for seasonal fluctuations and unexpected costs

- Invest in growth—whether that’s new stock, store upgrades, or marketing

It also gives you more control. When you can predict your cash position, you can make better decisions about spending, saving, and scaling—without unnecessary risk.

How to Improve Cash Flow in Retail: 18 Proven Strategies to Get You Started

Enhancing cash flow requires intentional actions that address both cash inflows and outflows. Let’s break down these methods.

Strategy 1: Audit Inventory Regularly

Identify slow-moving or obsolete items. Discount or remove them to recover cash and free up storage space. Regular audits help avoid tying up cash in unsellable stock and keep your inventory lean.

Strategy 2: Prioritise Bestsellers

Use sales data to focus on high-performing products. Reduce orders for items that don’t sell well. This ensures your capital is invested in stock that turns over quickly and drives revenue.

Strategy 3: Try Just-in-Time (JIT) Inventory

Order stock only when needed. This reduces holding costs and avoids overstocking. It lowers storage costs and reduces the risk of obsolete inventory.

Strategy 4: Use Inventory Management Tools

Platforms like Square or Zoho Inventory offer real-time stock insights, helping you make faster, data-driven decisions. These tools increase accuracy and save time compared to manual tracking.

Strategy 5: Set Clear Payment Terms

Keep credit terms short and follow up on overdue invoices promptly. Offer early payment discounts to encourage faster payments. Clarity in payment expectations helps maintain healthy cash inflows.

Strategy 6: Offer Flexible Payment Options

Accept digital payments and offer instalments. These reduce barriers and speed up cash inflows. Customers are more likely to complete purchases when given multiple ways to pay.

Strategy 7: Actively Monitor Receivables

Track unpaid invoices with accounting software. Send reminders to prevent payment delays. Staying proactive prevents overdue payments from affecting your liquidity.

Strategy 8: Negotiate Supplier Terms

Ask for extended payment windows, ideally 30–60 days, so you can sell inventory before the bill is due. Long payment terms can ease pressure on working capital.

Strategy 9: Streamline Payables

Use approval systems to avoid missed or late payments. Staying on top of bills maintains supplier trust and may unlock discounts. Timely payments strengthen relationships and may lead to more favourable terms.

Strategy 10: Automate Forecasting

Forecasting tools show you where cash is coming in and going out. Spot shortfalls early and plan ahead with confidence. Automation reduces errors and saves valuable time for business planning.

Strategy 11: Integrate POS with Accounting

Connect your POS system with accounting software for real-time tracking of sales, expenses, and cash flow, no manual data entry needed. Integration boosts accuracy and improves financial visibility.

Strategy 12: Enable Fast Electronic Payments

Use mobile or card payment systems that offer same-day or next-day settlement. Faster access to funds = better liquidity. Quicker settlements help improve your operational cash flow.

Strategy 13: Use Real-Time Analytics

Tools with built-in analytics can highlight trends, such as slow-selling stock or peak sales periods, helping you adapt faster. Data-driven decisions help you stay agile in a dynamic market.

Strategy 14: Review Past Financials

Use historical income and expense data to identify cash flow trends and predict seasonal patterns. Looking back helps you forecast more accurately and avoid surprises.

Strategy 15: Build a Forecast

Create a rolling 12-month cash flow forecast. Include fixed costs (like rent and payroll) and variable ones (like inventory). Regular forecasting supports smarter budgeting and long-term planning.

Strategy 16: Create a Cash Buffer

Save during profitable months to cover leaner periods or emergencies—no need to rely on loans. A financial cushion can prevent disruptions during unexpected downturns.

Strategy 17: Plan for Seasonal Swings

Prepare for high-sales periods with extra stock or staff. Cut back on non-essentials during slower times. Adapting to seasonality keeps operations efficient year-round.

Strategy 18: Eliminate Unnecessary Costs

Review regular expenses and look for ways to save—renegotiate contracts, switch suppliers, or cancel unused services. Cutting waste helps redirect cash towards growth opportunities.

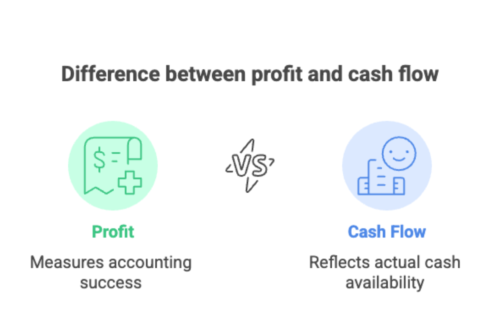

What is the Difference Between Cash Flow and Profitability?

Before diving deeper, it’s important to understand that cash flow and profit are not the same.

Profit is an accounting measure. It represents the amount left after subtracting all expenses from your total revenue. It shows whether your business is making money on paper, but it doesn’t reflect the actual cash available in your account.

How to Calculate Net Profit?

To measure profitability, you need to calculate your net profit margin. This shows how much profit you make from every pound of revenue.

Here’s the formula:

Net Profit (%) = (Net Profit ÷ Total Revenue) × 100

This percentage gives a clearer picture of how efficiently your business turns revenue into profit.

Struggling with Cash Flow? Let Accountancy Cloud Help You Take Control

Retail businesses run on tight margins, and poor cash flow can hold back your growth. At Accountancy Cloud, we help UK startups and small businesses like yours manage cash better—so you can focus on running your store, not chasing payments or juggling spreadsheets.

With all your financial services under one roof, we make it easy to streamline your accounting, optimise your cash flow, and plan for growth, without the high cost of in-house finance teams.

Why Retailers Choose Accountancy Cloud:

- End-to-End Bookkeeping & Accounting: Stay on top of your cash position with real-time tracking of income, expenses, and invoices.

- CFO-Level Insight, Without the Full-Time Cost: Our fractional CFOS help you forecast, budget, and plan with precision.

- Expert Tax Strategy: Reduce your tax burden and never miss a deadline, with tailored support from startup tax specialists.

- Smart Automation + Expert Support: Our unique blend of technology and personal service gives you accurate numbers and proactive advice.

Whether you're scaling an e-commerce brand or running a busy high street shop, our team knows the retail landscape—and we’re ready to help you stay cash-flow positive all year round.

Keep Your Cash Flow Strong with Smart, Consistent Moves

Improving cash flow isn’t about one big fix, it’s about making small, consistent improvements across your business. Managing inventory carefully, speeding up payments, using the right tools, planning ahead, and reducing financial risks all contribute to a stronger cash flow position.

Start by identifying where your cash gets tied up or delayed, and apply the strategies that best fit your current needs. Even simple changes—like negotiating better terms for payment or running tighter inventory checks—can make a big impact on the cash flow that eventually hits your bank account.

With a clear plan and the right systems in place, you’ll keep your retail business financially stable, flexible, and ready to grow.

Frequently Asked Questions

What is the fastest way to improve cash flow in retail?

You can enhance cash flow by optimising inventory management, streamlining payment processes, leveraging technology for automation, and monitoring expenses effectively. These measures, combined with improved customer service, increase operational cash flow and free up working capital liquidity for other essential activities.

How can technology impact retail cash flow management?

Technology streamlines billing, accounting, and forecasting through automation and data analytics. Real-time reporting enhances accuracy in cash flow statements, ensures cash inflows align with expenses, and improves operational efficiency. Tools like electronic payment platforms provide faster cash receipts while optimising payment terms.

What is cash flow in retail?

Retail cash flow involves tracking all cash inflows from sales and cash outflows for operational activities, ensuring business sustainability. It aids in financial planning, balancing liquidity for expenses like supplier payments, and maintaining a steady cash flow situation, crucial for the amount of cash flow analysis and FCF analysis growth.

What are the five rules of cash flow?

The 5 rules include maintaining liquidity for operational needs, keeping a strict eye on spending to prevent negative FCF, anticipating cash needs through robust planning, efficiently managing lines of credit to avoid interest expense and performing regular reviews of cash flow statements for accuracy.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.