How to Improve Cashflow Effectively

Jun 2024

Late client payments, rising costs, and poor forecasting can quickly lead to cash shortages that disrupt operations and damage growth. Even a short-term dip in net cash balance can mean missed payroll, delayed supplier payments, or the need to take on expensive credit.

The fix? Strong cash flow management. With the right strategies, you can stay ahead of problems, boost liquidity, and build long-term financial stability.

In this blog, we will share with you 12 smart, practical ways to improve your business cash flow, starting today.

What is Cash Flow?

Cash flow is the movement of money in and out of your business over a specific period, which helps keep your operations running smoothly.

When cash flow is positive, you’re bringing in more money than you're spending, giving you enough to cover expenses and reinvest in growth. But if it turns negative for too long, it becomes harder to pay bills, cover payroll, or manage daily operations.

That’s why healthy cash flow is key to maintaining working capital and financial stability.

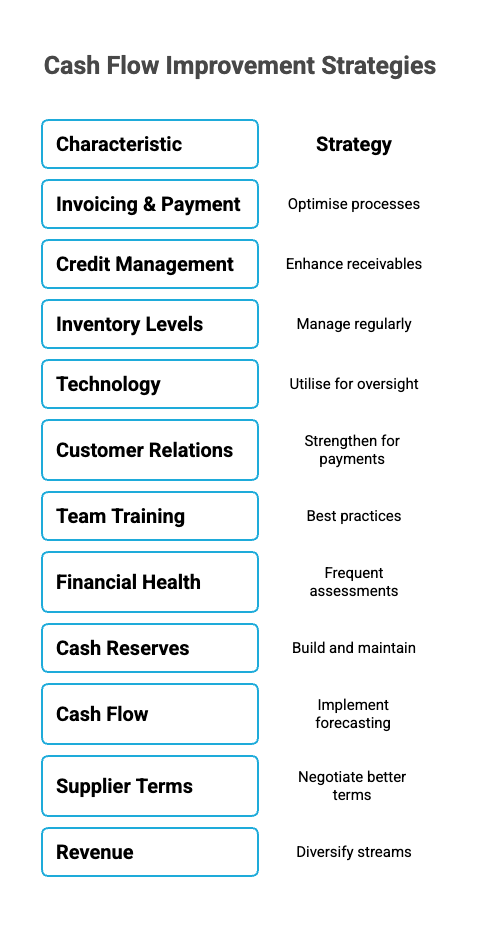

Best Cash Flow Management Strategies: 12 Ways to Improve Cash Flow

There are numerous reasons why businesses and startups face cash flow problems, especially during the first year. Creating a sustainable strategy for managing cash flow problems is, therefore, vital in maintaining business operations during market shifts and rising costs.

Below, we'll dive into ten must-know strategies aspiring business owners can harness to ensure effective cash flow management for their businesses.

1. Speed Up Your Cash Inflow: Optimise Invoicing & Payments

Your business gives clients 30 days to pay invoices, but many pay late. This hurts your cash flow and makes it harder to pay your own suppliers on time. Here's what you can do:

- Immediate Invoicing: Send invoices promptly upon delivery of goods or services. through an invoice finance company.

- Clear Payment Terms: Clearly state payment terms and due dates on invoices.

- Early Payment Incentives: Offer a 5% discount for payments made within 10 days.

- Late Payment Penalties: Implement a 2% late fee for overdue invoices.

- Follow-Up System: Set reminders to contact clients 5 days before and after the due date.

- Invoice Factoring: Sell outstanding invoices to a factoring company for immediate cash.

- Invoice Discounting: Obtain a loan against unpaid invoices to bridge cash flow gaps.

- Flexible Terms: Choose financing options with terms that align with your cash flow needs.

By incentivising early payments and penalising late ones, you can accelerate cash inflows and reduce overdue receivables.

2. Get Paid Faster: Tighten Credit Control

Often, delayed payments happen because credit is extended to clients without first checking if they’re likely to pay on time. To avoid this and manage outstanding debts effectively, it’s important to have a clear credit control process in place. Here’s how you can do that:

- Credit Checks: Conduct credit assessments for new clients before extending credit.

- Payment Terms: Offer shorter payment terms (e.g., 14 days) to high-risk clients.

- Early Payment Discounts: Provide a 3% discount for payments made within 7 days.

- Collection Procedures: Establish a structured follow-up system for overdue accounts.

Implementing stringent credit controls and incentivising timely payments can significantly improve your cash flow and reduce bad debts.

3. Free Up Hidden Cash: Streamline Inventory Management

Excess inventory doesn’t just take up space—it ties up valuable cash and increases storage costs. To keep your operations lean and your cash flow healthy, it's essential to manage inventory proactively. Here are some key steps to help you do that:

- Inventory Audits: Conduct monthly inventory reviews to identify slow-moving items.

- Just-in-Time Ordering: Implement a just-in-time inventory system to reduce storage costs.

- Supplier Negotiations: Negotiate with suppliers for flexible delivery schedules.

- Promotional Campaigns: Offer discounts on slow-moving stock to accelerate sales.

With efficient inventory management steps in place, you never have to worry about freeing up cash and reducing unnecessary expenses.

4. Let Tech Do the Heavy Lifting: Automate Financial Tracking

Manual financial tracking can lead to major slip-ups, errors and inefficiencies. Investing in the steps mentioned below can be your go-to solution in such instances:

- Accounting Software: Implement cloud-based accounting software for real-time financial tracking.

- Automated Invoicing: Use automated invoicing systems to streamline billing processes for your cash needs, helping to address different trading conditions and different scenarios that may arise.

- Cash Flow Forecasting: Utilise forecasting tools to predict future cash flow needs.

- Expense Tracking: Monitor expenses regularly to identify areas for cost reduction.

Leveraging technology enhances accuracy and efficiency in financial management.

5. Build Stronger Client Relationships

Taking customer and investor relationships for granted can lead to delayed payments and strained communication. A satisfied, well-informed client base is key to a thriving business. To build trust and encourage timely payments, focus on the following practices:

- Clear Communication: Discuss payment terms and expectations upfront.

- Regular Updates: Keep clients informed about order statuses and any potential delays.

- Flexible Arrangements: Offer payment plans for clients facing financial difficulties.

- Loyalty Programs: Implement programs to reward timely-paying customers.

Building strong client relationships fosters trust and encourages timely payments.

6. Make Cash Flow Everyone’s Job: Train Your Team

When employees don’t understand how their actions affect cash flow, it can lead to serious issues. Things like offering extended payment terms, over-ordering inventory, or delaying invoice follow-ups can create bottlenecks in receivables, drive up costs, and reduce your available working capital.

Without cross-functional understanding, even small decisions can disrupt cash positions and increase reliance on external financing, such as bank loans. Hence, these steps mentioned below play such an important role in highlighting the importance of cash management:

- Staff Training: Conduct workshops on cash flow management for all relevant departments.

- Role Clarity: Define roles and responsibilities related to cash flow management.

- Performance Metrics: Establish key performance indicators (KPIs) to monitor cash flow activities.

- Regular Reviews: Hold monthly meetings to review cash flow performance and identify areas for improvement.

No wonder an informed and proactive team contributes to better cash flow management.

7. Spot Trouble Early: Do Regular Financial Health Checks

When businesses fail to regularly assess their financial health, especially cash flow statements and working capital, minor issues often go unnoticed until they become serious problems.

This lack of timely insight can result in missed payment deadlines, accumulating debt, or unexpected shortfalls that disrupt operations and damage supplier or client relationships. Conducting regular and different types of assessments is, therefore, the solution to these problems:

- Monthly Reviews: Analyse financial statements monthly to assess cash flow status, including a monthly cash flow forecast across different industries.

- Variance Analysis: Compare actual performance against forecasts to identify discrepancies.

- Scenario Planning: Develop contingency plans for potential cash flow challenges.

- Professional Advice: Consult with financial advisors quarterly to gain external insights.

Regular financial assessments enable the timely identification and resolution of cash flow issues.

8. Stay Ahead of Red Flags: Track Key Cash Flow Metrics

A business with growing revenue can still struggle to pay suppliers on time due to financial red flags, like increasing overheads or aged receivables that are often overlooked without routine analysis.

You can take care of these gaps with:

- Monthly Reviews: Evaluate cash flow statements, profit margins, and net reserves at least once a month.

- Track KPIs: Monitor metrics like days sales outstanding (DSO) and net operating cash flow.

- Use Scenario Forecasting: Model risks like a 10% increase in utility bills or a 15-day customer payment delay to gauge impact.

With these steps, you can catch issues early, before they escalate into liquidity crises, allowing you to take corrective action promptly.

9. Build a Financial Safety Net: Create Cash Reserves

Seasonal revenue drops in Q1 can leave the company cash-strapped.

A company reliant on high holiday sales sees a sharp decline in revenue during the first quarter.

Without proactive cash flow planning or sufficient reserves, it struggles to cover fixed costs like salaries, rent, and supplier payments, leading to operational strain and potential borrowing at high interest rates just to stay afloat.

This is where a cash buffer helps cover expenses when income slows.

- Set a Target Reserve: Aim for 3–6 months of operating expenses. For example, if your monthly outgoings are £40,000, aim for at least £120,000 in reserves.

- Automate Transfers: Allocate a fixed percentage (e.g. 10%) of monthly net profits into a high-interest savings account.

- Review Quarterly: Adjust your reserve goal based on turnover fluctuations and fixed cost changes.

You stay liquid during downturns, cover emergencies without borrowing, and finally remain better positioned for strategic investments.

10. Stay Liquid and Prepared: Master Cash Flow Forecasting

A business scales quickly, increasing sales and headcount, but fails to align cash flow planning with its tax and payroll obligations.

As VAT bills and payroll dates approach, the lack of available liquid funds creates financial pressure, risking late payments, penalties, and employee dissatisfaction despite healthy top-line growth. That is why you should:

- Create Monthly Forecasts: Use 90-day rolling forecasts that account for known payables and expected receivables.

- Incorporate Scenario Testing: Model events like a 20% drop in sales or supplier price hikes.

- Use Tools Like Float or Futrli: These integrate with accounting software (e.g. Xero, QuickBooks) to automate insights.

Reliable forecasts reduce surprises and improve capital allocation for growth, tax obligations, and supplier payments.

11. Negotiate Better Payment Terms with Suppliers

When customers take 30 days to pay but you’re required to pay suppliers within 14 days, your cash outflows outpace inflows.

This average time between payments creates a timing mismatch that puts constant pressure on working capital, forcing you to dip into reserves or seek finance companies for short-term financing just to stay afloat, even when your business is profitable on paper and you may have enough money to cover immediate expenses.

Hence, understanding these types of cash flow, including trade creditors, is essential for effective financial management.

Here are some ways you can handle this:

- Extend Payables: Negotiate 30- to 45-day terms to better match receivable cycles.

- Split Payments: Suggest paying 50% upfront and 50% after delivery to ease pressure.

- Consolidate Orders: Offer bulk or long-term contracts in exchange for more favourable terms.

This means if you're spending £20,000/month on raw materials, shifting to net 45 can free up an extra £20,000 short-term. Moreover, it leads to improved working capital and stronger supplier relationships without disrupting operations.

12. Protect Your Revenue: Diversify Your Client & Income Streams

Relying on one client for 70% of your revenue leaves the business vulnerable if that client delays payments or experiences financial issues. When payment delays occur, your entire operation falls at risk, leading to cash flow instability and potential disruption of business activities.

Diversifying your client base or exploring new markets and services can mitigate this risk and ensure smoother, more resilient cash flow. For example, if your average client brings in £5,000/month, onboarding just two additional clients from a new industry could boost cash inflow by £120,000/year.

To combat this situation, you can:

- Add Services: For instance, if you offer accounting software, introduce training or compliance packages.

- Explore New Markets: Enter adjacent sectors or geographical regions where your offering adds value.

- Leverage Digital Channels: Sell products or services online to generate passive income streams.

With smoother cash flow, resilience in lean periods, and scalable revenue potential, you never have to worry about delayed payments from one particular client

Take Control of Your Cash Flow Today with Accountancy Cloud

Strong cash flow is the lifeblood of any business, and without it, your startup will fall apart. It ensures you can meet day-to-day financial obligations like paying employees, suppliers, and covering overheads, without stress. More than that, healthy cash flow allows you to reduce debt, reinvest in growth opportunities, and handle unexpected expenses with confidence.

Poor cash flow, on the other hand, can stall operations and limit your ability to scale, even if you're profitable on paper.

That’s where Accountancy Cloud comes in with features such as:

- Real-time financial visibility – Know exactly how much is coming in and going out with smart, automated bookkeeping.

- CFO-level guidance – Access on-demand strategic advice without the cost of a full-time CFO.

- R&D Tax Credit support – Free up cash by unlocking government incentives, managed end-to-end by our tax specialists.

- Streamlined invoicing and expense tracking – Stay on top of payments and avoid late fees or missed bills.

- Forecasting made simple – Get cash flow projections and actionable insights tailored to your business stage.

- Expertise in your industry – Whether you’re in Tech, SaaS, E-commerce, or Consumer Goods, our team understands your specific needs.

- Fully digital, fast and responsive – Manage everything from one intuitive online platform, with quick access to expert help.

So, don’t wait for a cash flow crisis to act.

Start managing your finances smarter with Accountancy Cloud today!

Conclusion: Take Charge of Your Cash Flow for Sustainable Growth

Improving cash flow is essential for the sustainability and growth of any business. By implementing the 12 strategies to achieve positive cash flow discussed, you can take proactive steps to optimise your financial health with the right finance options, including green finance and generating extra income.

Holding too much stock or a high balance can impact your cash flow and your ability to meet financial obligations. Hence, from optimising invoicing processes to diversifying revenue streams, each strategy plays a crucial role in creating a robust cash flow management system.

Remember, regular assessments and adjustments to your approach are vital to staying ahead in today's dynamic market and economic situation.

Start applying these strategies today to unlock the true potential of your business's cash flow and set yourself up for a prosperous future.

Frequently Asked Questions

1. What are the first steps to improving cash flow?

Start by analysing inventory costs and stock costs, optimising payment terms, and employing a structured credit control system to manage your trade debtors with significant trade flows, thereby reducing overdue payments for trade loans and tying up lots of cash. Additionally, consider renegotiating your overdraft facility to improve your cash management. Creating a forecast aligned with accurate bookkeeping and planned capital expenditure, which should be part of your regular monthly finance activity and encompass necessary reporting requirements, on top of your usual bookkeeping and financial reporting, helps identify potential cash flow issues early and improves liquidity management effectively.

2. How can technology impact cash flow management?

Automating processes like invoicing and payroll through advanced tools enhances operational accuracy and efficiency. Access to real-time data enables consistent tracking of inflows/outflows, improving cash flow forecasting. Overall, technology streamlines management, ensuring you’re better equipped to handle financial risks.

3. What are the common mistakes businesses make with cash flow?

Failing to track cash activity adequately, neglecting cash reserves, and poorly planning budgets frequently lead to cash crises. Ignoring frequent forecasting or sidestepping overdue debtor collections further strains financial resilience during critical operational stages and makes it harder to cope during difficult periods.

4. Can improving customer relations actually enhance cash flow?

Absolutely. Clear communication fosters trust and addresses internal issues, ensuring timely payments while reducing payment delays, which is essential for a small company dealing with much larger corporations. Customers with strong rapport have a better chance of being more reliable, providing a dependable revenue source, and helping your business thrive even in fluctuating economic conditions.

5. What is the role of proper financial planning in cash flow?

Sticking to structured budgeting and consistent forecasting simplifies managing expenses and ensuring liquidity. Proper planning provides a roadmap, mitigating risks such as higher staff costs and aligning resources strategically to boost financial security during adverse conditions, while also allowing you to assess the potential impacts on your overall strategy.

6. Why is cash flow important?

Cash flow is crucial because it ensures your business can meet day-to-day expenses like payroll, rent, and supplier payments. Healthy cash flow supports stability, growth, and protects against unexpected financial shocks.

7. How strategic financial planning supports cash flow improvements

Through targeted strategies, strategic planning ensures financial stability by syncing operational requirements with anticipated inflows/outflows. It safeguards businesses against unforeseen shortfalls while unlocking potential growth opportunities aligned with evolving market conditions.

See what Accountancy Cloud can do for you

- Get the best value for bookkeeping, CFO, and tax services

- UK's award-winning startup accountant

- Trusted by over 100 clients with 5-star reviews

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.