Cash Flow Solutions: Smart Restaurant Accounting for Growth

May 2025

Running a restaurant in the UK comes with constant financial pressure, like tight margins, rising costs, and complex VAT and payroll rules. Without clear visibility into your numbers, it’s easy to lose control of finances

That is where effective accounting comes into play by giving you that clarity. It shows where your money is going, keeps you compliant, and helps you make decisions that protect your profit.

In this guide, we will break down the essentials of restaurant accounting for UK owners, from daily expense tracking to VAT management and improving cash flow. So, let's dive in.

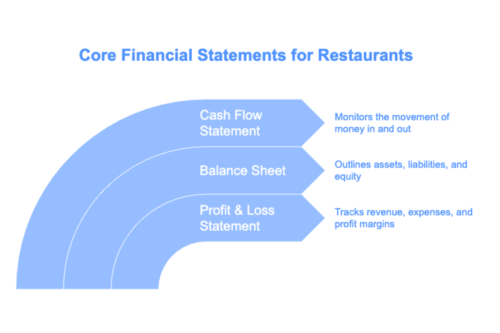

What are the Financial Statements You Need to Know?

To manage your restaurant’s finances effectively, you need to understand three core financial statements. These give you a clear view of where your money is going and where problems may be building.

1. Profit & Loss (P&L) Statement

Also known as the income statement, this shows your revenue compared to all operating expenses. It also helps you track profit margins, spot rising costs, and understand if your business is actually making money.

2. Balance Sheet

This outlines what your restaurant owns (assets), what it owes (liabilities), and what’s left over (equity). It’s useful for checking your financial stability and deciding whether you can afford to invest, expand, or need to cut back.

3. Cash Flow Statement

The cash flow statement tracks the movement of money in and out of your business. Even profitable restaurants can run into trouble without steady cash flow. This statement helps you monitor liquidity and plan for upcoming expenses.

Using these three statements together gives you a full picture of your financial health. They’re key tools for budgeting, forecasting, and making smart day-to-day decisions.

How is Restaurant Accounting different from other sectors?

Restaurant accounting comes with challenges most businesses don’t face. Here's how: Seeking professional advice can help mitigate these challenges.

| Aspect | General Business Accounting | Restaurant Accounting | |

|---|---|---|---|

| Inventory Tracking | Monthly or periodic reviews | Weekly tracking due to food perishability | |

| Accounting Periods | Monthly or quarterly | Four-week cycles to better reflect weekly revenue patterns | |

| Sales Patterns | More consistent sales flows | Fluctuating sales, busy weekends, slow weekdays | |

| Cost Sensitivity | Stable cost structure | Tight margins; small cost changes can impact profitability | |

| Payroll Complexity | Regular salaries | Mix of hourly wages, variable shifts, and tips (requires tax tracking) | |

| Expense Management | Predictable fixed expenses | High and frequent variable costs (e.g. ingredients, staff hours) | |

| Tip Handling | Typically not applicable | Must be tracked, reported, and taxed correctly | |

| System Requirements | Standard bookkeeping tools | Tailored systems to track costs, margins, and compliance in real time |

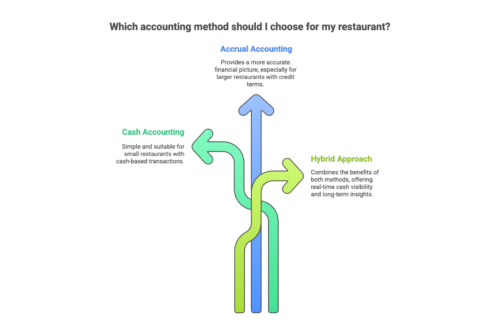

How to Choose the Right Accounting Method?

Picking the right accounting method affects how clearly you see your restaurant’s financial performance. Each method has its pros and cons, depending on your size and setup.

1. Cash Accounting

With this method, you record income when you receive payment and expenses when you pay them. It’s simple and works well for small restaurants that rely mostly on cash or card payments without offering credit. It also helps you clearly see how much money is available at any given time.

2. Accrual Accounting

Here, income and expenses are recorded when they’re earned or incurred, not when money changes hands. This gives a more accurate picture of your financial position, especially if you deal with invoices, supplier credit terms, or delayed payments. It’s often required if your annual revenue exceeds £1 million.

3. Hybrid Approach

Some restaurants use a mix of both methods. For example, using cash accounting for daily operations and accrual accounting for inventory or payroll. With the right software, you can automate parts of both, giving you real-time cash visibility and long-term insight.

Whichever method you choose, set up a clear chart of accounts from the start. This helps you categorise income and expenses consistently, making it easier to track performance, spot issues, and stay compliant.

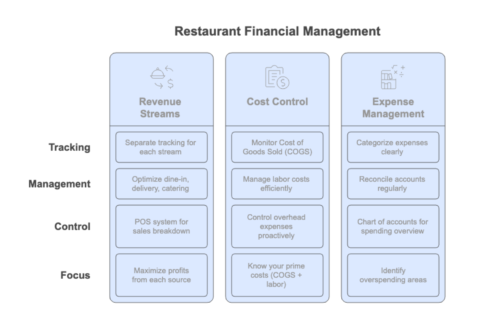

How to Manage Income and Expenses for Restaurant Accounting?

The success of your restaurant hinges on keeping your finances in check. A robust accounting system can simplify revenue tracking and provide actionable reports for smarter decisions. Here's how:

1. Exploring Revenue Streams in the Restaurant Industry

Restaurants don’t rely on just one source of income. Most earn money through a mix of dine-in service, takeout, delivery, catering, and sometimes private events. Each one brings in money differently, and some are more profitable than others.

That’s why it’s important to track each revenue stream separately. For example,

- Dine-in orders might bring higher profits thanks to add-ons like drinks or desserts.

- Delivery can boost reach, but fees from third-party apps can cut into margins.

- Catering jobs often bring in large payments, but they also come with higher upfront costs.

A good Point of Sale (POS) system makes this much easier. It breaks down your sales by category and connects directly to your accounting software. This gives you accurate numbers so you know what’s working and what’s not.

2. Controlling Costs

Keeping costs under control is one of the biggest challenges in running a restaurant, and it’s essential for maintaining the restaurant’s profits and staying profitable.

1. Track Your Cost of Goods Sold (COGS)

COGS includes all the food and drink you buy to make your menu items. Monitor these costs closely. Use inventory tracking to reduce waste, avoid over-ordering, and make sure high-cost ingredients are priced right on your menu.

2. Manage Labour Costs

Labour is one of your largest ongoing expenses. Use sales forecasts to schedule staff more efficiently, provide more coverage during busy hours, and fewer during slow periods. Cross-train team members so you can stay flexible without being overstaffed.

3. Control Overheads

Fixed costs like rent and utilities can eat into your profits if left unchecked. Simple actions, like turning off unused equipment or reviewing energy suppliers, can make a difference. Regularly check bills and contracts to ensure you’re not overpaying.

4. Know Your Prime Costs

Your prime costs (COGS + labour) should be your main focus. Together, they take up the biggest part of your budget. Keeping these in check gives you more room to invest in marketing, equipment, or new staff when needed.

By tracking and adjusting these key cost areas regularly, you’ll protect your margins and make smarter day-to-day decisions.

3. Expense Categorisation and Reconciliation

To stay on top of your restaurant’s finances, you need two things: clear expense categories and regular account checks.

Start by setting up a

- Chart of Accounts—This is just a list of categories where you group your spending. For example: food and drink supplies, payroll, utilities, rent, marketing, and repairs. When everything is properly labelled, it’s easier to see where your money goes and spot areas where you might be overspending.

Next,

- Make reconciliation a routine task. This means comparing your bank statements with your sales and expense records to make sure everything matches. It helps you catch errors early, like missed payments, double charges, or unrecorded income.

Doing these two things regularly keeps your books clean, helps with tax reporting, and gives you a clear picture of your financial health, so you can make smarter decisions with confidence.

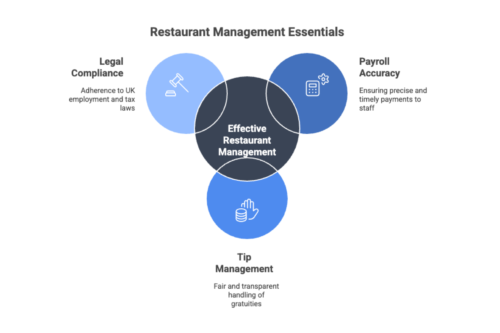

How to Ensure Effective Payroll and Tip Management for Restaurants?

Managing payroll and tips, as well as adhering to UK Laws in the restaurant industry, represents a unique challenge that is specific to the restaurant business.

1. Understanding Payroll in the UK Restaurant Sector

Running payroll in a restaurant isn’t always simple. With different shifts, overtime, and pay rates, it’s easy for mistakes to happen, but staying accurate is key to keeping your team happy and staying compliant with UK law.

- First, make sure every team member is paid at least the National Minimum Wage or National Living Wage, based on their age and role.

- If staff work extra hours, overtime pay must be calculated correctly. Don’t forget to factor in things like bonuses and statutory sick pay when needed.

- You’ll also need to handle National Insurance contributions and report all payments to HMRC using Real Time Information (RTI) each time you run payroll.

When payroll runs smoothly, staff get paid correctly and on time. That builds trust, and a team that wants to stick around.

2. Managing Tips and Gratuities

Tips and gratuities are a big part of pay for many restaurant staff, but managing them properly is essential to stay fair and legal.

Start with a clear policy on how tips are handled. Will they be kept by the individual, pooled and shared, or distributed through a tronc system? Whatever you choose, it must follow UK laws. As of the Employment (Allocation of Tips) Act, tips must go directly to staff and be shared fairly.

You also need to understand the tax rules. Tips given in cash are usually taxed through self-assessment by the employee. But if you control how tips are shared, like through payroll or a tronc, they must be reported and taxed through PAYE.

Track all tips and keep records. This helps avoid disputes, ensures HMRC compliance, and gives you insight into team performance and customer satisfaction.

When tips are handled transparently and fairly, staff morale improves and so does service.

3. Compliance with UK Employment and Taxation Laws

Staying compliant with UK tax and employment laws is essential for running a restaurant legally and profitably. Here are the key areas to understand and why they matter:

- Value Added Tax (VAT)

- What it is: A tax added to most food and drink sales. Different items may be taxed at different rates (e.g., dine-in vs takeaway).

- Why it matters: Incorrect VAT handling can lead to fines and skewed pricing, while accurate VAT tracking helps you set the right menu prices, stay compliant, and manage cash flow better. It’s also helpful to work with an accountant who can keep you informed of any changes in VAT law that may affect your business, such as the introduction of new reliefs or exemptions.

- Self-Assessment

- What it is: Self-Assessment is for sole traders or partnerships to report income and pay tax.

- Why it matters: Late or incorrect filings can lead to penalties. Staying on top of this keeps your business records clean and helps you plan for growth.

- National Insurance Contributions (NICs)

- What it is: Payments made by both employers and employees that fund UK benefits like pensions and sick pay.

- Why it matters: You’re legally responsible for deducting and paying NICs correctly. It impacts payroll accuracy, employee rights, and your overall labour costs.

By keeping these areas in check with proper systems and regular reviews, you’ll avoid compliance issues, reduce financial risk, and run a smoother, more transparent operation.

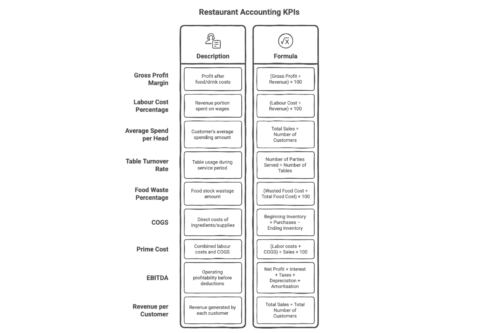

What are the Key Performance Indicators (KPIs) to Check for in Restaurant Accounting?

Regular financial reporting gives restaurant owners a clear picture of performance and supports smarter, data-driven decisions. Similarly, timely, consistent reports help spot trends, plan growth, and secure funding with confidence.

By leveraging real-time financial data, owners can identify trends, address seasonal fluctuations, and ultimately enhance the restaurant's profits while ensuring tax compliance and effective cash flow management.

1. Gross Profit Margin:

Shows how much profit you make after covering food and drink costs, key for pricing and cost control.

Formula: (Gross Profit ÷ Revenue) × 100

2. Labour Cost Percentage:

Indicates what portion of your revenue goes to staff wages; helps manage staffing costs.

Formula: (Labour Cost ÷ Revenue) × 100

3. Average Spend per Head:

Reveals how much each customer spends on average, helping you track upselling and pricing effectiveness.

Formula: Total Sales ÷ Number of Customers

4. Table Turnover Rate:

Measures how many times a table is used during a service period; higher rates mean more sales per shift.

Formula: Number of Parties Served ÷ Number of Tables

5. Food Waste Percentage:

Shows how much of your food stock is wasted, helping reduce costs and improve sustainability.

Formula: (Wasted Food Cost ÷ Total Food Cost) × 100

6. Cost of Goods Sold (COGS):

Tracks the direct costs of ingredients and supplies, helping monitor menu profitability.

Formula: Beginning Inventory + Purchases – Ending Inventory

COGS Ratio: (COGS ÷ Sales) × 100

7. Prime Cost:

This combines labour costs and COGS, your two biggest expenses, to assess overall cost efficiency. Formula: (Labor costs + COGS) ÷ Sales × 100

8. EBITDA:

Shows your restaurant’s operating profitability before interest, taxes, and depreciation, ideal for financial evaluation.

Formula: Net Profit + Interest + Taxes + Depreciation + Amortisation

9. Revenue per Customer:

Tells you how much revenue each customer brings in, useful for tracking spending behaviour and setting targets.

Formula: Total Sales ÷ Total Number of Customers

By reviewing these KPIs consistently, you can make data-driven decisions to adjust pricing, improve efficiency, reduce costs, and ultimately boost profitability..

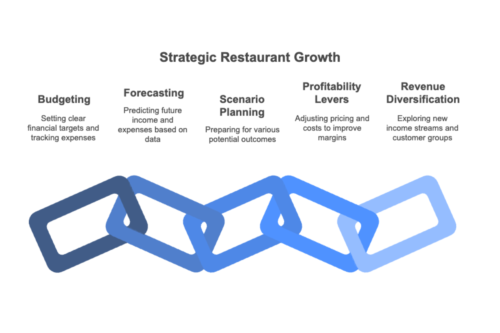

How to Plan and Grow Your Restaurant with Smart Budgeting and Financial Strategy?

Good financial planning helps you stay in control today while setting your restaurant up for future growth. It starts with making strategic decisions in building a strong budget and continues with realistic forecasting and targeted strategies to boost profitability.

1. Create a Practical Restaurant Budget

- Set clear revenue and expense targets based on past performance and expected sales.

- Break down costs like wages, supplies, rent, and utilities to see where your money goes.

- Allocate funds for marketing, equipment maintenance, and unexpected repairs—don’t overlook these.

- Use accounting software to track spending in real time and compare it to your budget regularly.

2. Forecast for Future Success

- Use historical sales data to predict future income and expenses.

- Adjust your forecasts to reflect seasonal trends, local events, or market shifts.

- Regularly update your numbers to stay accurate and avoid surprises.

3. Prepare for Different Scenarios

- Plan for best-case, worst-case, and most likely outcomes.

- Build contingency plans—like reducing hours or shifting your menu—so you can respond quickly if needed.

4. Focus on Profitability Levers

- Review menu pricing and portion sizes to protect margins.

- Negotiate with suppliers to lower costs without compromising quality.

- Train staff to upsell and promote high-margin items.

- Run loyalty programs to improve customer retention.

5. Expand and Diversify Revenue

- Explore new income streams like catering, private events, or delivery services.

- Test limited-time offers or seasonal menus to attract different customer groups.

- Look for opportunities to grow without taking on too much risk.

By combining clear budgeting with smart financial planning, you can manage day-to-day operations while building a stronger, more profitable future for your restaurant.

Take Control of Your Restaurant’s Finances with Accountancy Cloud

Running a restaurant is hard enough without juggling spreadsheets, tax rules, and payroll headaches. That’s why smart restaurant owners trust Accountancy Cloud—a startup-led, award-winning accounting partner that truly understands the fast-paced world of food and beverage.

From managing VAT and tip compliance to streamlining payroll and maximising cash flow, we handle it all, so you can focus on serving great food, not numbers.

With over a decade of experience helping startups and small businesses grow, our unique blend of hands-on financial expertise and intelligent software makes us the go-to choice for modern hospitality businesses.

- End-to-end restaurant accounting, bookkeeping, payroll & tax

- R&D tax specialists and year-end accounts managed for you

- Access to a fractional CFO—get strategic advice without the full-time cost

- Trusted by top food, SaaS, consumer, and e-commerce brands

- Scalable services that grow with your restaurant

Let Accountancy Cloud take the pressure off your books—so you can focus on what matters: growing a profitable, sustainable restaurant.

Conclusion

A thorough understanding of restaurant accounting is key to running a profitable and efficient hospitality business and a sound business strategy. When you understand your numbers, you can make smarter decisions every day—whether it’s adjusting menu prices, cutting waste, or managing staff costs more effectively.

Additionally, by using the right tools and staying on top of your finances, you gain clear insight into your cash flow, profit margins, and compliance responsibilities. This doesn’t just reduce stress—it helps you grow with confidence.

Start putting these best practices in place today and build a stronger, more successful restaurant for tomorrow.

Frequently Asked Questions

How often should financial audits be conducted in restaurants?

Financial audits in restaurants should ideally be conducted annually to ensure accuracy and compliance. However, quarterly or bi-annual audits are beneficial for identifying discrepancies early and maintaining financial health. Regular assessments help optimize operations and support informed decision-making for long-term growth.

Are there specific accounting challenges for multi-location restaurants?

Multi-location restaurants face unique accounting challenges, such as ensuring consistent financial practices across all sites, managing inter-entity transactions, and consolidating reports. Additionally, varying local regulations and tax obligations can complicate compliance and financial reporting efforts for these businesses.

How can restaurants optimise their tax deductions?

Restaurants can optimise tax deductions by keeping detailed records of all business expenses, utilising available deductions like food costs and employee wages, and consulting with a tax professional. Additionally, understanding local tax laws can ensure compliance while maximising potential savings.

What type of accounting is used in restaurants?

Restaurants typically use accrual accounting for accuracy in tracking revenue and expenses, though smaller businesses may use cash accounting for simplicity. Some adopt a hybrid approach.

What is the most common expense in a restaurant?

The two biggest expenses are usually labour costs and Cost of Goods Sold (COGS)—primarily food and beverage supplies.

How to Leverage Technology in Restaurant Accounting?

You can leverage technology in restaurant accounting by using POS-integrated accounting software, automating invoicing and payroll, and using real-time reporting tools to manage the restaurant's financial data. This reduces manual errors, saves time, and provides clearer financial insights for better decision-making.

How to calculate food cost?

To calculate, use the formula: (Beginning Inventory + Purchases – Ending Inventory) ÷ Total Food Sales × 100. This gives you your food cost percentage, a key metric for managing margins.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.