What Retailers Must Know About Retail Tax in 2025?

May 2025

Do you know exactly what taxes your retail business is responsible for in 2025? If not, you're not alone and it's time to get clear.

Whether you run a local boutique, a high-street chain, or an online store, retail businesses in the UK face a wide range of tax obligations they must address with the appropriate tax authority. These include VAT, corporation tax, business rates, PAYE, and more, which directly affect your cash flow, pricing, and profit margins.

However, retail tax isn’t a one-size-fits-all system, especially considering local sales tax regulations related to the sale of tangible personal property and the general sales tax on goods and services.

Your obligations depend on your structure, revenue, location, and even how you sell; whether online, in-person, or both. And while tax rules haven’t necessarily changed in 2025, knowing what applies to your use and how the sale of goods works can save you from costly errors and missed opportunities.

In this blog, we break down the key taxes retailers need to understand in 2025, so you can stay organised, compliant, and ahead of the game.

What Is Retail Tax in 2025?

Running a retail business in the UK means managing more than just sales. You’re also responsible for core retail taxes that directly impact your bottom line.

Retail tax in 2025 isn’t a single line item; it’s a mix of core taxes that every UK retail business must manage to stay compliant.

From Corporation Tax on profits to VAT on sales, National Insurance and PAYE obligations, and Business Rates on your premises, these taxes impact everything from your pricing strategy to your cash flow.

Understanding how each works is critical, whether you're a sole trader, a limited company, or a scaling brand.

Let’s break them down, one by one.

Corporation Tax for Retailers in 2025

All limited companies in the UK pay Corporation Tax on their taxable profits, including profits from trading, investments, and the sale of assets. If you’re a sole trader, you won’t pay Corporation Tax, but you’ll still pay personal income tax on profits through Self Assessment.

In 2025, the Corporation Tax rate depends on how much profit your business makes:

- 19% for earnings up to £50,000

- 25% for earnings over £250,000

- A marginal relief system applies for profits between £50,001 and £250,000

Your taxable profits are calculated after deducting allowable business expenses, such as rent, stock, salaries, and utilities.

To file Corporation Tax, you’ll need to submit two things:

- Company accounts – your statutory financial statements

- Company Tax Return (CT600) – a detailed report to HMRC of your profit and tax due

Timely and accurate filing is essential to avoid penalties.

How to Calculate Your Annual Company Accounts?

Filing your annual accounts isn’t just a legal formality; it’s how your retail business proves financially sound. Limited companies must submit key financial documents to Companies House each year, including a balance sheet, a profit and loss account, and, in most cases, a directors’ report.

Here’s what each includes and why accuracy matters.

1. Balance Sheet: A Snapshot of Your Business

Your balance sheet shows your business's financial position at year-end. It covers cash, debts owed and owing, stock, equipment, and any funding on the books.

You’ll also need to account for depreciation: the drop in value of vehicles, machinery, or store fittings. A simple method? Subtract the expected resale value from the purchase price and divide it by the asset’s useful life. This impacts your taxable profit, so get it right.

2. Profit and Loss: Your Year in Numbers

This statement outlines your earnings and expenses over the year: sales, other income, and operating costs like rent, payroll, and supplies.

Make sure it’s clean:

- VAT-registered? Report figures excluding VAT.

- Not registered? Keep VAT included.

Got high-volume sales? Use accounting software or export to spreadsheets to save time and avoid errors. Your P&L directly affects how much Corporation Tax you owe.

3. Directors’ Report: A Legal Must-Have

You’ll need a signed directors’ report unless you're a micro-entity. It must include:

- Names of directors

- A short business overview

- A compliance statement confirming the accounts meet UK rules

Small businesses meeting micro-entity thresholds are exempt, but everyone else must file.

How to File Your Tax Return?

Filing your tax return starts once your profit and loss statement is ready. Here's what you'll need to include:

- Turnover from trading activities

- Profits or losses for the tax year

- Losses brought forward, if any

- Other income, like interest, investment gains, or property sales

- Deductions such as capital allowances, business expenses, charitable donations, or reliefs from asset disposals

Once the figures are in, use HMRC’s online portal or compliant accounting software to submit your return. It’ll calculate what you owe and what you might reclaim.

If you’ve sold business assets like equipment or property at a gain, Capital Gains Tax applies. For example, if you bought something for £150,000 and sold it for £200,000, expect tax on the £50,000 profit.

File accurately. Missed details can mean missed relief or unnecessary tax.

Tax as a Sole Trader or Partnership

If you’re a sole trader or in a partnership, you won’t pay Corporation Tax, but that doesn’t make tax responsibilities lighter.

Since there is no legal separation between you and your business, profits are treated as personal income and taxed through the Self-Assessment system.

You’re taxed progressively:

- Up to £12,570 – 0%

- £12,571 – £50,270 – 20%

- £50,271 – £125,140 – 40%

- Over £125,140 – 45%

Even though filing is more straightforward than for limited companies, you’ll still need to calculate turnover, profit, and expenses similarly. Use accounting software to stay accurate and compliant, especially when dealing with high-volume retail sales tax.

Being exempt from Corporation Tax doesn’t mean you're exempt from scrutiny. Stay on top of reporting to avoid penalties and ensure tax efficiency.

National Insurance and Payroll Taxes

Running payroll brings further responsibilities as you will have to stay compliant with HMRC requirements, manage deductions, and keep your records watertight.

If you employ staff, you must contribute to the Employer’s National Insurance (NI) for any employee earning above the weekly threshold (£175/week as of the 2025 threshold). On top of this, you’re responsible for collecting and reporting employee income tax, NI, student loan repayments, and pension contributions through PAYE.

Dividend Tax Rates for 2025

| Tax Band | Rate | ||

|---|---|---|---|

| Dividend allowance | 0% on first £1,000 | ||

| Basic rate | 0.0875 | ||

| Higher rate | 0.3375 | ||

| Additional rate | 0.3935 |

Besides, every month, you must:

- Run payroll using HMRC-compliant account software (e.g. QuickBooks, Xero)

- Submit a Full Payment Submission (FPS) by the 22nd of each month

- Pay your PAYE balance to HMRC by the same date

What About Tips?

- Direct tips (given by customers to staff): Must be declared as personal income

- Service charges or pooled tips: Must be added to payslips and taxed through payroll

Accurate payroll = fewer HMRC risks + happier employees.

Automate, document, and stay ahead.

VAT and Sales Tax in 2025

If your retail business earns over £90,000 in taxable turnover (as per the updated 2025 threshold), you’re legally required to register for VAT with HMRC. But even below this threshold, voluntary registration can help reclaim VAT on business purchases, making it a strategic move for growing retailers.

Once registered, you must:

- Charge VAT on all taxable sales

- Display your VAT number on invoices and receipts

- File a digital VAT return through Making Tax Digital (MTD)-compliant software every quarter

Understanding VAT Rates

Retailers typically deal with zero-rated, reduced, and standard-rated goods. Knowing which rate applies is essential for correct pricing and compliance:

| Item Category | VAT Rate | Example Products | |

|---|---|---|---|

| Zero-rated | 0 | Children’s clothing, books, babywear | |

| Reduced rate | 0.05 | Mobility aids, smoking cessation products | |

| Standard rate | 0.2 | Most retail goods and services |

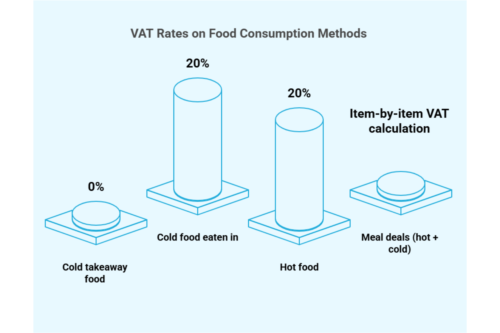

Food & Drink: VAT Can Be Tricky

Retailers selling food must apply VAT carefully based on the consumption method:

- Cold takeaway food: 0%

- Cold food eaten in: 20%

- Hot food (kept hot or advertised as hot): 20%

- Meal deals (hot + cold): Item-by-item VAT calculation

Key VAT Compliance Tips for 2025

- Issue VAT invoices with the correct date ("time of supply")

- Track all purchases & sales in a dedicated VAT account

- Submit VAT returns quarterly via HMRC’s Government Gateway

- Keep VAT records for 6 years (10 years if using VAT MOSS)

- Use accounting software like Xero, QuickBooks, or Sage to simplify compliance

New Online Sales Tax Developments for E-Retailers

You're not exempt from tax if you run an online retail business through your website or an online store platform like eBay, Etsy, or Depop. Even in the digital space, tax compliance is non-negotiable.

If you’re self-employed, you must:

- Register with HMRC

- File a Self-Assessment tax return annually

- Separate business income from personal sales (e.g. clearing old clothes ≠ trading income)

You can earn up to £1,000 per year tax-free under the trading allowance, but anything above that is taxable.

What Taxes Might Apply to Online Retailers?

Depending on your business structure and size, you may need to pay:

- Income Tax or Corporation Tax

- National Insurance Contributions (NICs)

- VAT (if turnover exceeds the £90,000 threshold)

- PAYE (if you employ staff)

- Business Rates (if operating from business premises)

What’s New in 2025?

While no formal policy has been rolled out yet, here’s what’s on the radar:

- A potential 2% online sales tax is still under government review. This tax is intended to level the playing field with high-street retailers.

- Delivery surcharge proposals may add a tax on home deliveries to reduce environmental impact and discourage excessive returns.

These measures haven’t been implemented, but staying alert to changes is critical as the retail tax landscape evolves.

Business Rates

If your retail business operates from a commercial property, like a shop, office, warehouse, or pub, you’ll likely need to pay Business Rates. These are local taxes applied to most non-domestic properties and are billed annually by your local council, typically in February or March for the upcoming tax year.

However, not all businesses are liable. If you run your retail operation from home, you’re usually exempt unless you’ve converted part of your home into a commercial space or regularly host customers in real estate transactions.

Business Rates Relief Schemes

Facing high overheads? You may qualify for Business Rates relief to reduce your financial burden. Here's what’s available in 2025:

| Relief Type | Who Qualifies | ||

|---|---|---|---|

| Small Business Rate Relief | Properties with a rateable value under £15,000. Full relief for values up to £12,000, tapering off to £15,000. | ||

| Rural Rate Relief | Retailers in rural areas with under 3,000 people. You may get 100% relief if you’re the only shop, post office, or pub. | ||

| Hardship Relief | Businesses that can prove financial hardship and demonstrate community value. Decided case-by-case basis by the local authority. | ||

| Retail, Hospitality & Leisure Relief | As of 2025, eligible retail properties may receive up to 75% relief, capped at £110,000 per business. Check your council’s rules. |

Applying for relief is handled through your local council, and eligibility can vary based on location, business size, and use of premises.

Keeping your business rates in check isn’t just about saving money; it’s about staying cash flow-positive and avoiding unnecessary strain on your operating budget.

Simplify Retail Tax with Accountancy Cloud

Managing retail tax in 2025, from Corporation Tax to VAT, payroll, and year-end filings, demands more than compliance. It requires precision, planning, and the proper accounting partner.

Accountancy Cloud delivers modern accounting services tailored to UK startups, scale-ups, and growing retail businesses. We help you stay compliant, reduce admin time, and unlock valuable insights that support smarter financial decisions.

Here’s how we support your retail business:

- Digital-first accounting: We provide a streamlined, cloud-based platform that keeps your finances organised and accessible

- Dedicated accountants: Get paired with certified experts who understand your sector and support your business all year round

- Full tax management: From VAT registration to Corporation Tax filings, PAYE submissions, and more - we handle it all.

- Real-time financial reporting: Make decisions confidently with up-to-date insights on profit, cash flow, and tax positions

- Seamless year-end close: Our structured process ensures you stay ahead of HMRC deadlines and avoid penalties

If you're ready to manage your retail tax obligations without stress, Accountancy Cloud is built to help. Contact us today!

Retail Tax in 2025: Don’t Let Compliance Catch You Off Guard

As 2025 unfolds, the UK retail tax landscape is becoming more complex and more navigable for businesses that stay ahead. From evolving Corporation Tax rules to VAT thresholds, payroll obligations, and local business rates, every area demands attention and accuracy.

Retailers who take tax planning seriously by keeping accurate records, leveraging the right accounting tools, and staying on top of deadlines won’t just remain compliant, they’ll gain a competitive edge. Each tax component, from annual accounts to VAT returns, is an opportunity to tighten operations and uncover financial efficiencies.

In a sector defined by tight margins and shifting consumer habits, smart tax management isn’t optional; it’s essential. The retailers that succeed in 2025 will treat tax as part of their growth strategy, not just a year-end chore.

Stay informed. Stay prepared. And turn compliance into confidence.

Frequently Asked Questions

How much tax do you pay in retail?

The amount you pay in taxes as a retailer depends on multiple factors, including your business type, profits, income, applicable federal income tax and sales tax rate schemes, including your zip code and use tax rates. Taxes include Corporation Tax, National Insurance, VAT, and Business Rates.

Is VAT the same as tax?

VAT is a type of consumption tax placed on a product whenever value is added at each stage of the production process and supply chain, including the process where end consumers pay VAT when businesses collect VAT from their customers, to the point where they pay VAT on final sale. It is a specific type of tax.

What is the retail VAT scheme?

The retail VAT scheme allows small businesses to account for VAT based on the selling price of the goods they sell rather than on the purchase of individual items.

What are the main challenges retailers face with retail tax in 2025?

Challenges in retail tax for 2025 include adhering to new online sales regulations, the rising need for automating tax returns, the complexity of updating annual company accounts, and effectively managing payroll taxes.

How can retailers prepare for the upcoming changes in retail tax?

Retailers can prepare for retail tax changes by staying informed about evolving regulations, maintaining proper financial records, using accounting software, optimising tax calculation, filing timely tax returns, and adopting effective sales tax audit planning strategies.

What are the penalties for non-compliance with new retail tax laws?

Complying with new retail tax laws may result in penalties, fines, or even legal prosecution, depending on the extent and nature of the non-compliance. It may also cause severe disruptions in business operations.

Do UK retailers need a physical presence to trigger tax obligations abroad?

Not always. With the rise of marketplace facilitators and digital platforms, some countries now apply tax rules based on the amount of sales or the number of sales, not just physical presence. If you sell cross-border, always check each particular state’s or country’s tax thresholds.

How do point-of-sale rules affect UK retail tax?

In the UK, VAT is typically applied at the point of sale for most sales of goods. However, businesses selling through third-party marketplace facilitators may have different VAT obligations, especially when selling to international customers.

How do UK taxes differ from U.S. sales and local tax systems?

Unlike the U.S., where local governments and states like New Hampshire or the District of Columbia set state sales tax or individual income tax rules, the UK operates under a centralised system. HMRC manages VAT, real property taxes, and business tax, so retailers face fewer variations in tax rules by region.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.