What Is a Fractional CFO and Do I Need One?

Oct 2023

As your business grows, so do the complexities of your financial operations. Navigating the ever-changing landscape of business can be daunting, particularly when it comes to financial management. This is where a Fractional CFO comes into play. While many are familiar with Chief Financial Officers (CFOs), the concept of a fractional CFO may be new to some. But what exactly does it entail, and do you need one for your business?

In this blog, we’ll dive into what a Fractional CFO is, explore the benefits of hiring one, and help you decide whether it's time for your business to bring one on board.

What is a Fractional CFO?

A Fractional CFO is a highly experienced financial executive who provides the same strategic services as a full-time CFO, but on a part time, temporary, or project-based arrangement. Unlike a traditional CFO, a Fractional CFO works for your business only as needed, saving you the cost of hiring a full-time employee.

They can work on a flexible schedule, whether it’s a few days per week, a few days per month, or for a specific project. A fractional CFO can help startups, smaller businesses and those with fluctuating financial needs access expert-level financial guidance without committing to a full-time hire.

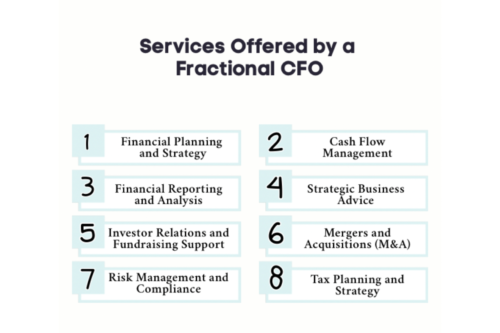

What Services Does a Fractional CFO Offer?

A Fractional CFO provides high-level financial expertise without the cost of a full-time executive. Here’s a look at the core fractional CFO services for startups:

1. Financial Planning and Strategy

A Fractional CFO helps create budgets and financial forecasts that align with your business goals. They also conduct scenario analysis to assess potential risks and opportunities. Their strategic planning ensures that your financial decisions drive long-term success.

2. Cash Flow Management

Effective cash flow management is crucial for business survival. A Fractional CFO helps develop cash flow projections to avoid shortages and optimise working capital. They also provide guidance on managing debt and improving liquidity to ensure financial stability.

3. Financial Reporting and Analysis

A Fractional CFO prepares accurate financial statements and tracks key performance indicators (KPIs) to assess business health. They analyse variances between budgeted and actual performance, identifying areas for improvement. Their insights allow you to make data-driven decisions.

4. Strategic Business Advice

Beyond managing finances, a Fractional CFO offers guidance on business growth and profitability. They assist in crafting strategies for market expansion, product development, and operational efficiencies. Their expertise helps you navigate complex business challenges and seize new opportunities.

5. Investor Relations and Fundraising Support

For businesses seeking investment, a Fractional CFO aids in developing fundraising strategies and managing investor communications. They ensure your financials are in top shape for due diligence, helping you secure funding. Their expertise strengthens relationships with investors and potential partners.

6. Mergers and Acquisitions (M&A)

A Fractional CFO plays a vital role in mergers and acquisitions, providing valuation support and advising on deal structuring. They assist with post-deal integration, ensuring the transition is smooth. Their insights help businesses make informed decisions about growth through acquisitions.

7. Risk Management and Compliance

A Fractional CFO helps identify financial risks and develops strategies to mitigate them. They ensure compliance with tax laws, regulations, and industry standards. Their focus on internal controls protects your business from fraud and inefficiencies.

8. Tax Planning and Strategy

A Fractional CFO provides tax planning advice to minimise liabilities and optimise returns. They ensure your business complies with tax regulations and filings, reducing the risk of penalties. For businesses with international operations, they offer guidance on managing cross-border taxes.

Looking for more ways to strengthen your business’s financial health? Check out our proven strategies for improving cash flow in startups.

Why Would a Business Opt for a Fractional CFO?

As your business grows, managing your finances becomes more complex. Hiring a Fractional CFO could be the perfect solution for many reasons:

1. Cost-Efficiency

Hiring a full-time CFO is expensive. It includes a high salary, benefits, and other overheads. Many small to medium-sized businesses (SMEs) or startups simply can't afford this. A Fractional CFO offers the same expertise without the full-time cost, enabling you to scale your business more efficiently.

2. Flexibility

Businesses often experience changing financial needs as they grow. A CFO fractional services allows you to tailor the services you want to your exact needs, adjusting the level of involvement based on the current stage of your business.

3. Expertise on Demand

Whether you’re navigating a period of growth, dealing with complex financial issues, or preparing for funding, a Fractional CFO provides the strategic insights that you need, precisely when you need them.

What are the Benefits of Hiring a Fractional CFO?

Here are some of the key benefits that come with hiring a Fractional CFO:

1. Strategic Financial Guidance

As your company expands, managing finances becomes more intricate. A Fractional CFO provides strategic insights that help guide business decisions, identify growth opportunities, and manage financial risks.

If you're experiencing rapid growth, a Fractional CFO can ensure that your financial operations are in line with your growth trajectory, making it easier to scale successfully.

2. Improved Financial Systems

If your business is dealing with complex financial decisions, such as mergers, acquisitions, or large-scale investments, a Fractional CFO can help guide you through these processes.

They also help implement or improve financial systems and reporting processes, ensuring your financial operations run smoothly and accurately during these critical moments.

3. Investor Relations

If you're preparing for funding rounds (e.g., Series A, Series B, or Series C), a Fractional CFO ensures that your financial health is communicated clearly to investors.

They help build trust by ensuring transparent, timely, and accurate financial reporting, which can increase your chances of securing necessary funding.

4. Cost Control & Cash Flow Management

If financial responsibilities are falling on the shoulders of the CEO or other departments, it’s time to hire a Fractional CFO. A dedicated financial leader can help steer your business’s financial strategy, keeping a firm grip on cash flow, managing expenses, and ensuring the financial health of your business.

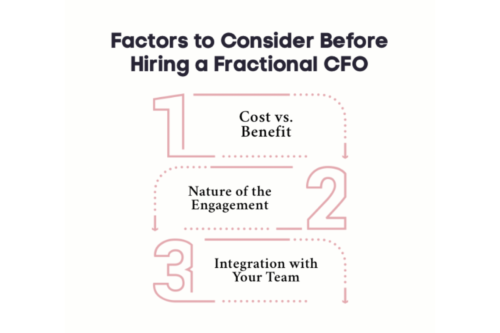

What Factors Should You Consider Before Hiring a Fractional CFO?

Hiring a Fractional CFO can be a great decision for your business, but it’s important to evaluate a few factors before proceeding:

1. Cost vs. Benefit

While a Fractional CFO is more affordable than a full-time CFO, it’s essential to assess the return on investment (ROI). Consider the value they bring in improving financial systems, reducing inefficiencies, and supporting growth to ensure the cost is justified.

2. Nature of the Engagement

Clarify whether the Fractional CFO will be needed on an ongoing basis or for specific projects. Defining the scope and duration of the engagement helps set clear expectations and ensures they meet your business's current needs.

3. Integration with Your Team

A Fractional CFO must work closely with your existing team members, particularly the finance department and leadership. Ensure they can integrate well with your company culture and collaborate effectively to implement financial strategies.

Unlock Your Business’s Financial Potential with Accountancy Cloud’s Expert CFO Services

Looking to take your business to the next level without the cost of a full-time CFO? Accountancy Cloud offers tailored CFO services designed specifically for startups and scale-ups. Whether you need cash flow forecasting, strategic financial advice, or help with budgeting and financial modelling, our expert team provides flexible, affordable solutions that grow with your business.

With a deep industry expertise and a proactive, hands-on approach, Accountancy Cloud empowers you to make informed decisions, navigate complex financial challenges, and achieve long-term success.

Ready to optimise your financial strategy and unlock your business's potential? Contact us today!

Conclusion

The role of a CFO has significantly evolved in recent years. Once a privilege reserved for large corporations, the expertise of a CFO is now accessible to business owners of small businesses, thanks to the rise of experienced fractional CFOs. For businesses at critical growth stages, navigating complex financial landscapes, or preparing to pitch to investors, a fractional CFO can be the key to unlocking improved financial performance.

It’s crucial for business owners to assess their specific needs, ensuring that both short-term financial goals and long-term growth strategies are aligned. Hire fractional CFO services for the right guidance and strategic insights necessary to drive success.

Frequently Asked Questions

What is the difference between a fractional CFO and an interim CFO?

A fractional CFO works on a part-time or project basis, while an interim CFO typically fills a temporary role, often during transitions such as a full-time CFO leaving. Both offer CFO services, but interim CFOs are generally intended for short-term periods.

What qualifications do fractional CFOs have?

Fractional CFOs are usually highly qualified professionals with significant experience in financial leadership. Many hold advanced certifications like CPA (Certified Public Accountant) or CFA (Chartered Financial Analyst), alongside years of senior financial management experience.

How do I know if I need a fractional CFO?

If your business is experiencing rapid growth, facing complex financial decisions, or requires expert financial guidance but cannot afford a full-time CFO, a fractional CFO could be the ideal solution.

Can a fractional CFO help with raising capital?

Yes! A fractional CFO is invaluable in preparing for funding rounds. They assist with optimising financial documents, ensuring accurate reporting, and helping to present your business effectively to investors.

How much does a fractional CFO cost?

The cost of a fractional CFO depends on the scope of work, their level of experience, and the engagement frequency. Typically, fractional CFOs charge on an hourly or project basis, making them more affordable than a full-time CFO.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.