What is Cash Flow and How Cashflow Management Drives Growth?

May 2024

Cash flow is the heartbeat of your business, and without it, growth is impossible. Every decision you make, whether it’s hiring, expanding, or investing, depends on knowing how much cash is in the pipeline. However, managing cash flow isn’t just about tracking what comes in and what goes out. It’s about ensuring you have sufficient liquidity to keep things running smoothly while capitalising on new opportunities.

Effective cash flow management ensures you’re never caught off guard by unexpected expenses or late payments. It gives you the control you need to plan for growth, avoid cash shortages, and boost profits. For businesses of all sizes, mastering cashflow-management is the key to financial stability and long-term success, enabling you to accurately predict how much money will be available.

In this blog, we’ll dive into how managing cash flow can directly impact your profits and keep your business on track.

What Is Cash Flow and Why Does It Matter?

Cash flow is the movement of money into and out of your business over a given period of time. It’s what you earn from operations and what you spend to keep things running. Tracking this flow provides clear insight into your financial health, enabling your business to stay agile and resilient. Understanding cash flow is key, but now let’s explore why it truly matters for your business.

1. Cash Flow During Tough Times

In uncertain times, cash flow can make or break your business. Proper management ensures you have enough to cover late payments, shifting customer needs, and unexpected challenges. A solid cash buffer helps you stay flexible and proactive.

Setting aside at least a month’s cash gives you the peace of mind to renegotiate terms or explore funding options. Staying ahead of cash flow trends keeps your business resilient, no matter what comes your way.

2. Cash Flow Management for Business Growth

Growth is exciting, but it can pressure your cash flow. New customers, larger orders, and increased inventory require upfront capital, which can strain your resources. Without cash flow planning, your expansion efforts can hit roadblocks.

Monitoring operating cash flow ensures that your working capital remains balanced as sales increase. Aligning payment terms and inventory purchases helps your business scale efficiently. The first step in ensuring strong cash flow for growth is comprehending it as the foundation.

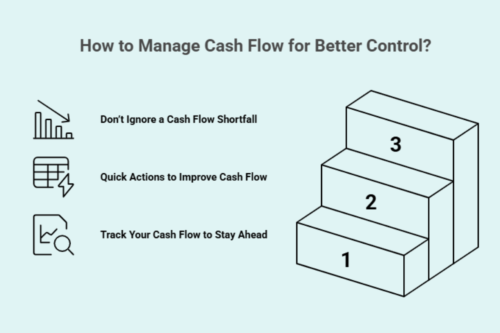

How to Manage Cash Flow for Better Control?

Effective cash flow management is all about knowing where your money is going and coming from. Let’s explore how to manage and improve your cash flow for stronger business health.

1. Track Your Cash Flow to Stay Ahead

Regularly monitoring cash flow helps you stay ahead of issues before they escalate. Keeping track of your inflows and outflows ensures you have the liquidity to meet obligations and capitalise on opportunities.

Keep your cash flow on track with these simple best practices:

- Monitor inflows and outflows regularly to spot trends.

- Adjust forecasts to match real-time data.

- Identify patterns that could signal future cash flow issues.

Staying proactive gives you control and allows you to act quickly when needed.

2. Quick Actions to Improve Cash Flow

Acting fast to improve cash flow helps your business maintain stability. By following up on overdue invoices and adjusting terms with suppliers, you can alleviate financial pressure and maintain a smooth operation.

Here's what you need to do:

- Follow up on overdue invoices for quicker collections.

- Negotiate better terms with suppliers for extended deadlines.

- Offer early payment discounts to encourage faster payments.

- Rent equipment instead of buying to cut upfront costs.

These steps give you the flexibility to reinvest and grow.

3. Don’t Ignore a Cash Flow Shortfall

Ignoring cash flow shortages can lead to more significant problems down the line. When cash is low, it’s vital to act fast.

Explore these available options to secure the funds necessary to keep your business running:

- Explore credit options, such as loans or lines of credit.

- Consider debt factoring by selling invoices for immediate cash.

- Sell and lease back assets, such as equipment.

- Renegotiate terms with creditors to ease the pressure.

Addressing shortfalls early keeps your business on track.

What's the Difference Between Cash Flow and Profit?

Cash flow and profit are often confused, but they serve different roles. Cash flow is the money coming in and out of your business, while profit is what's left after expenses. Cash flow keeps operations running, and profit shows overall health.

Why Positive Cash Flow Doesn’t Always Mean Profit

While positive cash flow is a good sign, it doesn’t always mean your business is profitable. For example, extra cash might come from loans, financing, or the sale of goods at discounted prices rather than from genuine earnings.

If your operating cash flow is low, your business may struggle with long-term cash flow challenges. Keeping an eye on cash flow statements helps distinguish between free cash flow and actual profit, ensuring that short-term inflows do not mislead you.

Common Misconceptions About Cash Flow and Profitability

Misunderstanding cash flow and profit can lead to costly mistakes. Here's what many business owners get wrong:

- Positive cash flow equals profit: Having extra cash doesn’t mean your business is profitable.

- Poor cash flow often results in low sales: Late payment fees, strained supplier relationships, or poor timing can cause cash flow issues, even with strong sales.

- Cash flow and profit are the same: Cash flow processes are about liquidity, while profit is a performance indicator of your business’s health.

Recognising these misconceptions helps you avoid mistakes and manage your business's finances more effectively.

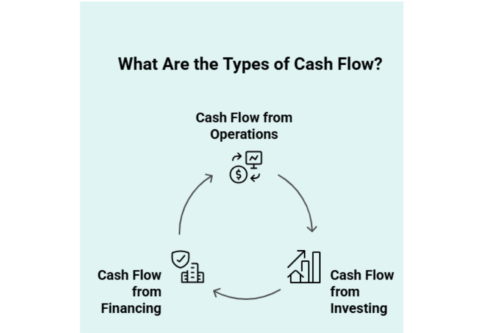

What Are the Types of Cash Flow?

There are three main types of cash flow: operating, investing, and financing. Each one helps a business understand how money moves in and out, ensuring it can pay bills and meet needs.

1. Cash Flow from Operations (CFO)

Operating cash flow indicates whether a company generates enough cash from its core activities to cover its expenses. Monitoring cash inflows (such as sales) and cash outflows (including salaries and operational costs) helps maintain daily operations.

2. Cash Flow from Investing (CFI)

Cash flow from investing refers to the flow of cash spent on assets or generated from investments. A positive CFI indicates healthy growth, while a negative cash flow may signal poor cash flow management. Forecasting helps address future financial challenges linked to capital investments.

3. Cash Flow from Financing (CFF)

CFF covers cash raised from equity or debt, including loans and the issuance of stocks. Effective cash flow forecasting enables finance teams to anticipate future financial challenges, ensuring the business has sufficient liquidity for both long-term objectives and day-to-day expenses.

Real-World Examples of Cash Flow Management in Action

Understanding how cash flow works is key to business success, especially when managing working capital and ensuring the amount of money is available. Below are two scenarios that illustrate how cash flow can impact your operations, as well as the steps you can take to ensure your business remains financially healthy.

| Scenario | Context | Recommended Action | |

|---|---|---|---|

| Struggling with Cash Flow | A small business has £50,000 tied up in inventory, while receivables are due in 60 days, but payables must be settled in 30 days. | Renegotiate terms with creditors or accelerate debt recovery to avoid a cash shortfall. | |

| Excess Cash Flow | A manufacturing company has a 60-day payment policy with creditors, a 30-day credit line for customers, and holds inventory for 10 days. | Use excess cash for growth initiatives, reinvest in operations, or reduce outstanding debt to increase profitability. |

Tired of Cash Flow Struggles? Let Accountancy Cloud Help

Managing cash flow can feel like a never-ending battle. You’re juggling expenses, invoices, and projections, but it often feels like there’s not enough time or clarity. At Accountancy Cloud, we take the complexity out of cash flow management. Our expert team of bookkeepers and financial advisors ensures that your cash flow is under control, allowing you to focus on growing your business without the stress.

From accurate forecasting to real-time financial insights, Accountancy Cloud offers tailored solutions to meet your specific needs. Now, stop letting cash flow concerns hold you back. Get in touch with us today to see how we can help you streamline your finances, reduce headaches, and make confident, data-driven decisions for the future.

Cash Flow: The Key to Unlocking Your Business’s Future

Cash flow is more than just numbers; it’s what keeps your business alive. Mastering cash flow means making informed decisions, maintaining financial stability, and capitalising on growth opportunities. Whether it’s managing day-to-day operations, investing wisely, or securing funding, the way you handle cash flow determines your success.

With solid cash flow management, you’ll reduce financial stress, improve strategic partnerships, and keep your business agile. Don’t let poor cash flow hold you back; take control, plan ahead, and set your business up for a thriving future.

Frequently Asked Questions

How can a business improve its cash flow quickly?

To improve cash flow, focus on collecting all the money people owe you. Try to communicate with people and adjust your payment terms as needed. It helps to improve cash inflows. You can also work on your receivable systems so that money comes in faster. Offer early payment discounts to encourage people to pay sooner. Reduce your costs by implementing effective cash management strategies.

What are typical cash flow problems for UK SMEs?

Typical problems include poor cash flow, late fees, and changes in cash flow trends that cannot be predicted ahead of time. These problems typically occur when people pay late or when receivable processes are not efficient. This can make working capital tighter and increase cashflow risk management on the financial side of things.

Why is cash flow forecasting important?

Cash flow forecasting is a powerful tool that helps any organisation. It gives you peace of mind because it shows what your money needs may be in the future. With cash flow forecasting, it becomes easier to face financial challenges. It allows you to prepare for any unexpected issues and ensures you have sufficient funds for your day-to-day expenses.

How does cashflow management UK affect long-term profitability?

Effective cash flow management helps you maintain steady, long-term profits. It allows you to balance key tasks and ensure there is enough money for what matters most. If you have a strong cash position, it protects your financial health. This also helps you make good choices for the day-to-day and long-term success of your company.

What is a cash flow loan used for?

Cash flow loans help cover short-term financial needs, such as working capital. With automated processes, such as AP automation, companies can reduce the time spent on manual tasks. This lets people focus on other important goals. It also helps strengthen and secure the company’s financial situation.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.