How to Streamline Cafe Accounting for Maximum Profit?

May 2025

Opening a café is exciting, but many new owners underestimate the importance of financial control.

Cash flow issues, underpriced menus, and surprise tax bills are common reasons small cafés in the UK struggle or shut down.

Without basic financial literacy, it’s easy to lose track of where your money’s going. But with clear accounting systems, you can control costs, plan better, and grow confidently.

In this guide, we’ll show you how to take charge of your café’s finances — and why it’s non-negotiable for long-term success.

What are the Basics of Café Accounting?

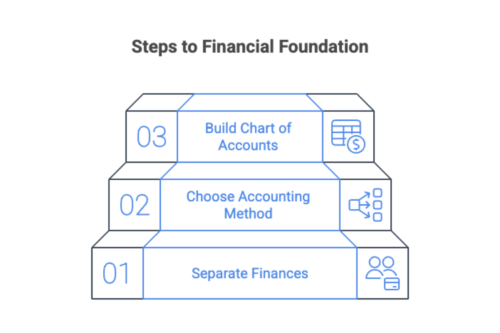

Building a strong financial foundation starts with understanding café accounting essentials. Let's take a look at them:

1. Separate Business from Personal Finances

Keeping your personal and business finances separate is essential from day one. Here's how you can do it:

Start by opening a business bank account exclusively for your café. This keeps all income and expenses in one place and makes it easier to track performance, manage cash flow, and prepare for tax filings.

Next, register your café correctly with HMRC. This ensures you're compliant with UK business regulations and set up to manage VAT and other obligations from the start.

Use a business debit or credit card for all purchases. This helps you track spending accurately and prevents personal transactions from complicating your records. It also builds your business credit profile, which can be useful when applying for loans or financing later.

Separating finances now saves time and avoids confusion later, especially when working with accountants or submitting returns. It also lays the groundwork for clear, reliable bookkeeping.

2. Choose the Right Accounting Method

When setting up your café’s finances, it’s important to choose an accounting method that fits your business.

- Cash accounting- This is a simple method where you record money only when it’s actually received or paid. It’s ideal for small cafés because it gives a clear view of cash flow and is easy to manage day-to-day.

- Accrual accounting- This method records income and expenses when they happen, even if the money hasn’t been received or paid yet. Moreover, Accrual accounting offers a more accurate picture of your café’s financial health, especially if you deal with suppliers on credit or have multiple expenses and sales happening at once.

Which Method Is Best?

- Small cafés often start with cash accounting for its simplicity

- If you plan to grow, hire staff, or deal with complex transactions, accrual may be more suitable

Tip: Use the Right Software

- Choose accounting software that supports both methods

- Look for tools that are HMRC-compliant and “Making Tax Digital” ready

Hence, investing in good software reduces manual work and helps you switch methods as your café grows

3. Build a Solid Chart of Accounts

A chart of accounts is the backbone of your café’s bookkeeping. It’s a structured list that groups all your financial transactions into categories, making it easier to track where your money comes from and where it’s going.

For cafés, common categories include:

- Sales – income from food, drinks, and other items

- Cost of Goods Sold (CoGS) – ingredients, packaging, and other direct costs

- Labour – wages, benefits, and payroll taxes

- Overheads – rent, utilities, insurance, and equipment

You can also add subcategories for specific areas, such as marketing, repairs, or VAT payments. This level of detail helps you spot trends, control costs, and quickly prepare accurate profit and loss statements.

Why is it important?

Using accounting software makes building and maintaining a chart of accounts much easier. It can automatically sort transactions into the right categories and generate reports for you.

A well-organised chart of accounts keeps your records clear, helps with tax returns, and gives you a better view of your café’s financial health.

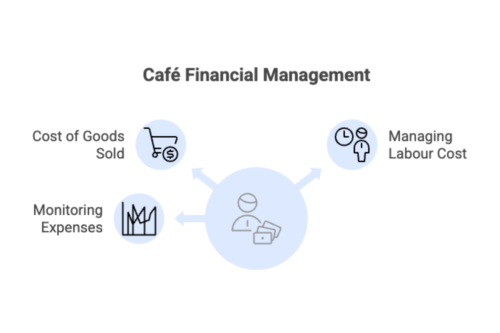

How to Handle Café-Specific Financial Challenges?

Cafés operate under unique financial pressures. Managing fluctuating demand, staff costs, and food ingredient expenses can challenge profitability.

Such unique challenges also require equally competent solutions. Let's discuss them:

1. Cost of Goods Sold (CoGS)

Cost of Goods Sold (CoGS) refers to the direct costs of producing the food and drinks you sell. This includes ingredients, packaging, and any other materials used to prepare menu items.

To calculate CoGS, use this simple formula:

Opening Inventory + Purchases – Closing Inventory = CoGS

This shows how much you’ve spent on goods used during a specific period.

For example, if your:

- Opening Inventory: $5,000

- Purchases during the period: $12,000

- Closing Inventory: $4,000

Then, CoGS = $5,000 + $12,000 – $4,000 = $13,000

This means the cost of the goods sold during the period is $13,000.

In addition, tracking CoGS helps you understand how much it costs to deliver each item on your menu. If costs are too high, your profit margins shrink.

Thus, to improve margins:

- Review supplier prices regularly

- Reduce waste in food prep and storage

- Analyse which menu items have the best margins

- Adjust pricing or portion sizes where needed

Using accounting software or a POS system with inventory tracking makes it easier to monitor CoGS in real time, whereas keeping CoGS under control helps protect your profits and keeps your café financially healthy.

2. Managing Labour Cost

Staff costs are one of the biggest expenses in running a café. Managing them properly helps you stay profitable and meet legal requirements. Here's how to keep things on track:

- Use time-tracking tools to log staff hours accurately.

- Record breaks and overtime to ensure fair pay and avoid disputes.

- Link your scheduling system to your accounting software for real-time labour cost insights.

What Payroll Includes:

- National Insurance contributions

- Pension enrolment (if eligible)

- Holiday pay and sick leave

- Any bonuses or deductions

These all affect your tax calculations and reporting obligations to HMRC.

How to Monitor and Adjust Labour Costs?

- Review payroll reports regularly to track trends

- Identify if staffing levels match your busiest and quietest times

- Adjust staff rotas to stay within budget without affecting service quality

Proper labour cost management helps you plan better, reduce unnecessary expenses, and ensure you stay compliant with UK employment and tax rules.

3. Monitoring Your Fixed and Variable Expenses

Understanding your café’s expenses is key to staying in control of your finances. Expenses usually fall into two categories: fixed and variable. Tracking them separately helps you manage cash flow, set budgets, and improve profit margins.

Fixed Expenses (Stay the Same Each Month)

These costs don’t change much, regardless of how busy your café is. Examples include:

- Rent or mortgage payments

- Business insurance

- Internet and basic utility service charges

- Equipment leases

Variable Expenses (Change With Sales or Season)

These costs go up or down depending on how much you sell. Examples include:

- Food and drink ingredients

- Packaging and takeaway supplies

- Marketing campaigns

- Electricity or heating bills (can rise during colder months)

Budgeting Tips to Manage Overheads

- Review monthly spending reports to identify any rising costs

- Set spending limits for flexible categories like marketing and supplies

- Negotiate with suppliers or service providers for better rates

- Compare energy providers to cut down seasonal utility spikes

- Use historical data to plan for higher-cost months, like winter

Regular reviews allow you to catch problems early, reduce unnecessary spending, and make smarter financial decisions that support your café’s long-term success.

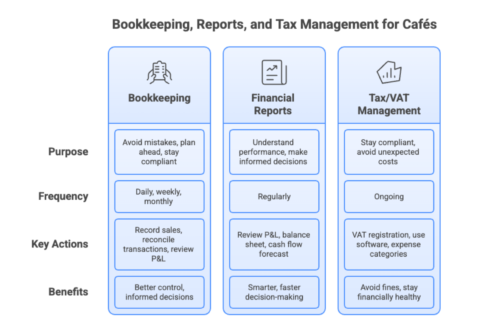

How to Manage Your Books Like a Pro?

Mastering bookkeeping is essential for café owners aiming for operational simplicity. This is because accurate and timely financial records prevent surprises in VAT submissions or payroll reporting.

Let's take a look at it:

Daily Tasks

Keeping this up daily gives you a clear view of how your café is performing.

- Step 1: Record all sales through your POS system at the end of each day.

- Step 2: Log receipts and invoices for any purchases or supplier payments.

- Step 3: Perform cash-ups to ensure the cash in the till matches what was recorded.

Weekly Tasks

Doing this weekly prevents errors from piling up and ensures your books stay accurate.

- Step 1: Reconcile bank transactions with your accounting records to catch any discrepancies early.

- Step 2: Review outstanding invoices to follow up on payments or unpaid supplier bills.

- Step 3: Track staff hours and check for payroll accuracy.

Monthly Tasks

Using accounting software can automate much of this process. It reduces manual work, keeps your records up to date, and provides real-time financial insights.

- Step 1: Review your profit and loss statement to see how your café is doing financially.

- Step 2: Check cash flow and compare actual spending with your budget.

- Prepare and file any VAT reports, if registered.

- Back up your financial records, if not done automatically.

Regular bookkeeping gives you better control over your finances and helps you make informed decisions as your café grows.

What Financial Reports Should Every Café Owner Know?

Keeping an eye on your financial reports helps you understand your café’s performance and make informed decisions. Here are the three key reports every café owner should review regularly:

1. Profit & Loss Statement (P&L)

This report shows your total income, costs, and expenses over a specific period. It tells you whether your café is making a profit or a loss. By reviewing your P&L, you can identify which costs are too high and where you might improve your margins.

2. Balance Sheet

The balance sheet gives a snapshot of your café’s financial position. It lists your assets (what you own), liabilities (what you owe), and your equity (the value left after liabilities). This helps you assess financial stability and your ability to handle unexpected costs or invest in growth.

3. Cash Flow Forecast

This report helps you predict how much cash you’ll have in the future. It shows money coming in (from sales) and going out (for rent, wages, supplies, etc.). A cash flow forecast helps you plan ahead, avoid shortfalls, and ensure you always have enough money to run your café.

Reviewing them regularly gives you control over your finances and supports smarter, faster decision-making.

Tax Planning and VAT Management Tips You Cannot Miss

Good tax planning helps your café stay compliant and avoid unexpected costs. Here’s what you need to know:

VAT Registration in the UK: If your café’s taxable turnover exceeds £90,000 in a 12-month period (as of 2024), you must register for VAT with HMRC. You can also register voluntarily if it benefits your business, for example, to reclaim VAT on supplies.

Use Accounting Software for VAT Returns: Use HMRC-compliant software that supports Making Tax Digital (MTD). The software will automatically calculate VAT, generate reports, and submit returns on time. Additionally, it also reduces manual errors and helps keep your records organised.

Stay Organised with Expense Categories: Separate VAT-eligible purchases from non-VAT items. This helps you track what you can claim back and ensures accurate returns.

Plan Ahead

- File returns before the deadline to avoid penalties.

- Review VAT obligations regularly, especially if your sales are growing.

- Set aside money for tax bills to avoid cash flow problems.

Keeping VAT under control with proper tools and planning helps your café avoid fines and stay financially healthy.

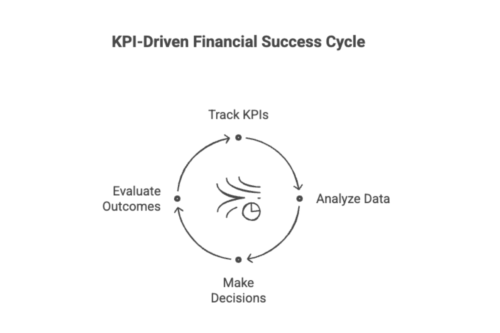

How to Research Key Performance Indicators (KPIs) for Financial Success?

Monitoring key financial KPIs helps you spot profit dips, manage cash flow, and uncover inefficiencies before they impact your business. With real-time data from accounting tools, you can make confident, informed decisions to protect margins and plan for growth.

Here are the most important ones to monitor regularly:

1. Labour Cost as a % of Sales:

This shows how much of your revenue goes towards wages, with the ideal range for cafés being 25–35%. This metric is tracked weekly to adjust staffing based on sales, since high labour costs may signal overstaffing or low productivity.

2. Gross Profit Margin:

Calculated as:

(Revenue – Cost of Goods Sold) ÷ Revenue × 100

It shows how profitable your menu is after covering direct costs. So, aim for a 60–70% margin depending on your pricing and ingredients. Here, low margins may mean your prices are too low or costs too high.

3. Break-Even Point:

This tells you how much you need to earn to cover all your costs and set realistic sales targets, including promotions, pricing, and cost control.

The formula is Break-even = Fixed Costs ÷ Gross Profit Margin.

4. Cash Flow:

This metric monitors inflows and outflows regularly to avoid shortfalls. Hence, a positive cash flow ensures you can cover rent, wages, and supplies.

Use accounting and POS systems to track these KPIs automatically. Reviewing them often helps you stay profitable and adapt quickly when costs or sales change.

How to Choose the Right Accounting Software?

Choosing the right accounting software can streamline operations and save time in a busy café environment. Here's what to focus on:

- Real-Time Reporting: Look for software that provides up-to-date financial reports. This helps track cash flow, monitor expenses, and make informed decisions quickly.

- Inventory Management: Integrated inventory tracking lets you monitor stock levels, reduce waste, and manage reorders efficiently—key for managing perishable goods in cafés.

- VAT and Tax Compliance: Choose software that supports automatic VAT calculations and is compatible with Making Tax Digital (MTD). This ensures accurate, timely tax submissions and reduces the risk of errors.

- Cloud-Based Access: A cloud system allows you to manage your accounts from anywhere—ideal for café owners who split time between the floor and the office.

- POS Integration: Ensure your POS system integrates with the accounting software. This automates sales data entry, reduces manual work, and minimises input errors.

- Automation Features: Look for tools that automate invoicing, bank feeds, and payroll. Automation cuts down on admin time and boosts accuracy.

By focusing on these features, you’ll find a system that fits your café's needs, supports growth, and simplifies financial management.

When Should You Hire a Professional?

As your café grows, managing finances on your own can become overwhelming. Knowing when to bring in a bookkeeper or accountant can protect your business and free up your time. Here's what to watch for:

1. Signs You Need Professional Help

- You're spending too much time on bookkeeping instead of running your café.

- Tax deadlines are becoming stressful or confusing.

- Payroll is growing more complex.

- You’re unsure how to track profitability or plan for growth.

- You need to apply for loans or deal with HMRC.

2. What a Hospitality-Focused Accountant Offers?

Accountants who specialise in cafés and hospitality understand the industry’s unique challenges—like fluctuating stock, seasonal demand, and tip handling.

You can expect them to:

- Manage VAT returns and ensure Making Tax Digital compliance.

- Handle payroll, pensions, and CIS if relevant.

- Offer cash flow forecasting and cost control advice.

- Help with pricing strategies and margin improvement.

- Prepare interim reports and support funding applications.

Hiring a professional doesn’t mean giving up control. It means having expert support for key financial tasks, so you can focus on delivering great service and growing your café.

Take Control of Your Café’s Finances with Expert Support from Accountancy Cloud

Running a café comes with unique financial challenges—fluctuating sales, stock management, payroll, and tax compliance. That’s where Accountancy Cloud comes in.

With over 10 years of experience helping startups and small businesses thrive, we offer specialist accounting, bookkeeping, CFO, and tax services tailored specifically for the food and beverage sector.

Why Cafés Choose Accountancy Cloud?

- Industry-Specific Expertise

We understand cafés. From managing daily transactions to tracking seasonal stock and tips, our team knows what it takes to keep your finances in check. - All-in-One Financial Hub

Simplify your accounting, bookkeeping, payroll, tax, and year-end accounts with a single provider, so you can focus on running your café. - Flexible, Scalable Services

Whether you’re just starting out or expanding to multiple locations, our services grow with you. - Access to a Fractional CFO

Get expert insights and financial strategy without the cost of hiring full-time. Perfect for planning growth, managing cash flow, or securing funding. - Tax Made Simple

Never miss a deadline. We handle VAT, MTD compliance, and even help reduce your tax bill—with specialist support for R&D tax credits if you innovate with recipes or processes.

Get a custom quote today and see how Accountancy Cloud can help your café grow—stress-free, error-free, and future-ready.

Conclusion

In summary, effective café accounting is essential for the success and sustainability of your business.

By mastering the basics, identifying key financial challenges, and employing the right tools, you can significantly improve your financial management. Additionally, regular monitoring of your key performance indicators will enable you to make informed decisions that enhance profitability and growth.

Remember, it's not just about keeping the books; it’s about understanding the financial health of your café and making strategic adjustments as needed.

Frequently Asked Questions

How often should I update my financial records?

Update your financial records daily for routine bookkeeping accuracy. Weekly and monthly bookkeeping tasks, such as reconciliation, enhance reliability. Regular updates ensure seamless tax submissions and financial accuracy while minimising risk.

What are the common financial pitfalls for new cafes?

New cafes often fall into financial pitfalls such as underestimating start-up costs, neglecting inventory management, and failing to track cash flow. Additionally, overlooking pricing strategies can lead to reduced profitability, making it crucial for owners to maintain diligent financial oversight from the outset.

What is Banking Reconciliation?

Banking reconciliation matches your financial accounts with bank records. It identifies discrepancies between incoming and outgoing transactions in your bookkeeping. Regular reconciliation ensures error-free records, safeguarding tax accuracy.

How to finance a cafe?

To finance a cafe, consider options such as personal savings, small business loans, crowdfunding, or investors. Evaluate each method's pros and cons, ensuring it aligns with your business plan. Proper financial management will help sustain operations and promote growth long-term.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.