Corporation Tax in the UK: Everything You Need to Know

Jun 2025

Whether you're just setting up your limited company or running an established business in the UK, corporation tax is something you can’t afford to overlook. More than a legal requirement, it directly impacts your profitability and financial planning.

In this guide, we’ll break down everything you need to know: what corporation tax is, how it’s calculated, when and how to pay it, and the common pitfalls to avoid.

Let’s make sense of corporation tax, minus the jargon and confusion.

What is Corporation Tax?

Corporation tax is a tax on the taxable profits made by companies and certain organisations in the UK. It applies to:

- Private limited companies.

- Foreign companies with a UK branch or office.

- Clubs, co-operatives, and other unincorporated associations.

If you’re a sole trader or in a partnership, you don’t pay corporation tax. Instead, you pay corporate income tax on your profits.

Corporation tax is paid directly to HM Revenue & Customs (HMRC) and must be calculated and paid annually.

Current UK Corporation Tax Rates (2025)

The corporation tax rate depends on your taxable profits. As of 2025, these are the applicable rates:

Taxable Profit | Corporation Tax Rate |

|---|---|

£50,000 or less | 19% (Small Profits Rate) |

£250,000 or more | 25% (Main Rate) |

Between £50,001 and £249,999 | Marginal Relief applies |

Smaller companies with lower profits pay less tax, while higher-profit businesses pay more. If your profits fall in between, you’ll receive marginal relief, which gradually increases the effective tax rate.

You can view the official rates here.

How is Corporation Tax Calculated?

Corporation tax in the UK is charged on your taxable profits. This includes money your company makes from:

- Trading activities (e.g. selling goods or services)

- Investment income (e.g. interest, dividends)

- Chargeable gains (e.g. selling property or assets for more than they cost)

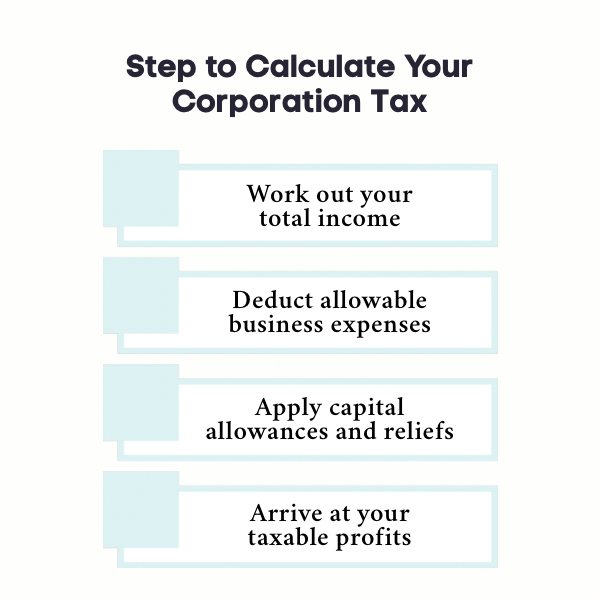

Step to Calculate Your Corporation Tax

Here’s how you calculate what your company owes:

1. Work out your total income

Begin by calculating all the taxable income your company has generated during the accounting period. This includes revenue from:

- Sales of goods or services (your core business operations).

- Interest earned on business savings or investments.

- Rental income from company-owned properties.

- Dividends received from other companies.

- One-off gains such as the sale of assets.

This total income figure forms the foundation for calculating your taxable profits. Be sure to account for all income streams, even those outside your primary trade.

2. Deduct allowable business expenses

These are costs incurred “wholly and exclusively” for the purpose of running your business. Examples of business expenses include:

- Staff wages and salaries

- Office rent and utility bills

- Business travel and fuel

- Insurance and professional fees

- Equipment and software

3. Apply capital allowances and reliefs

You may be eligible to deduct:

- Annual Investment Allowance (AIA)

- Research and Development (R&D) tax relief

- Loss reliefs from prior years

- Patent Box profits

4. Arrive at your taxable profits

Now that you have your taxable profits, apply the appropriate corporation tax rate based on how much profit your company made:

- Profits up to £50,000- taxed at 19% (known as the Small Profits Rate).

- Profits over £250,000- taxed at the full 25% (the Main Rate).

- Profits between £50,001 and £249,999- qualify for Marginal Relief, which gradually increases the tax rate from 19% to 25%.

Marginal Relief effectively smooths the jump between the small and main rates, ensuring companies don’t face a sudden spike in tax liability when profits rise slightly above £50,000.

Example Calculation: Profits of £120,000

Let’s say your company made the following in the 2024–2025 tax year:

- Trading income: £220,000

- Allowable expenses: £80,000

- Capital allowances: £20,000

Step 1: Calculate taxable profit

£220,000 (income) − £80,000 (expenses) − £20,000 (allowances) = £120,000 taxable profit |

|---|

Step 2: Determine your rate

If £120,000 falls between £50,001 and £250,000, then marginal relief applies.

Step 3: Estimate corporation tax due

Without relief:

£120,000 × 25% = £30,000 (this is the max you'd pay at the main rate of corporation tax)

With Marginal Relief: Using HMRC’s Marginal Relief formula, your effective corporate tax rate is slightly below 25%, meaning you might owe approximately £28,250–£29,500, depending on the exact marginal relief figure.

To simplify:

- Small profit (£50k): 19% = £9,500

- Large profit (£250k): 25% = £62,500

- Mid-range profit (£120k): ~23.5–24.6%

You can use HMRC’s Corporation Tax Marginal Relief calculator or speak to your accountant for a precise figure.

When and How to Pay Corporation Tax?

Paying your corporation tax on time is a legal obligation and helps you avoid unnecessary interest or penalties. Unlike VAT or PAYE, HMRC doesn’t issue a bill. Instead, you’re expected to work out how much you owe, file your return, and make the payment yourself.

When is Corporation Tax Due?

Corporation tax must be paid within 9 months and 1 day after the end of your company’s accounting period.

For example: If your company’s accounting year ends on 31 March 2025, your payment deadline is 1 January 2026.

It’s important to note that filing your Company Tax Return (CT600) has a later deadline, which is 12 months after your accounting year-end. However, the corporation tax payment itself is due much earlier.

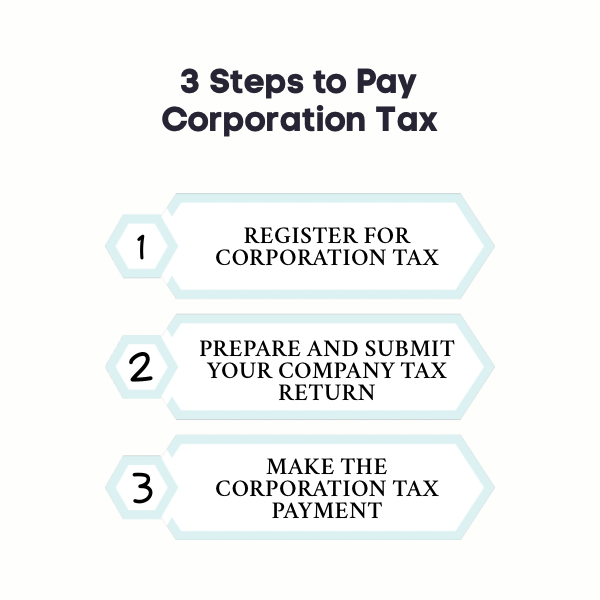

3 Steps to Pay Corporation Tax

Paying corporation tax isn’t just about transferring money to HMRC; it involves a series of key actions to ensure everything is properly registered, reported, and paid on time. Here’s a clear breakdown of the process:

Step 1: Register for Corporation Tax

Once your company starts trading (selling, advertising, or earning any income), you must register for corporation tax with HMRC. This must be done within 3 months of starting business activity. You can complete the registration online via the GOV.UK website.

Step 2: Prepare and Submit Your Company Tax Return (CT600)

After your financial year ends, prepare your Company Tax Return using HMRC-approved software or with help from an accountant.

This return includes details of your income, expenses, profits, and any reliefs or allowances. You must also submit your statutory accounts and a tax computation to HMRC.

The CT600 must be filed within 12 months of the end of the accounting period.

Step 3: Make the Corporation Tax Payment

Once your return is complete, you need to pay the tax owed by the earlier deadline, which is 9 months and 1 day after your year-end. There are several payment methods available:

- Bank transfer using Faster Payments, BACS, or CHAPS

- Online or telephone banking

- Direct Debit (single or recurring setup)

- Corporate debit or credit card (personal credit cards are not accepted)

Be sure to use your 17-character Corporation Tax payment reference, which is unique to your company and helps HMRC allocate the payment correctly.

What Happens if You Pay Late?

If your payment is late, HMRC will charge interest from the day after your deadline until the payment is received. Additionally, persistent late payments or failure to file returns may lead to penalties and trigger an HMRC enquiry.

To avoid these issues, consider setting reminders, using accounting software that tracks deadlines, or working with a professional accountant who can manage the process for you.

Want to make tax even easier? Check out our guide on How to Make Tax a Doddle and simplify your process further.

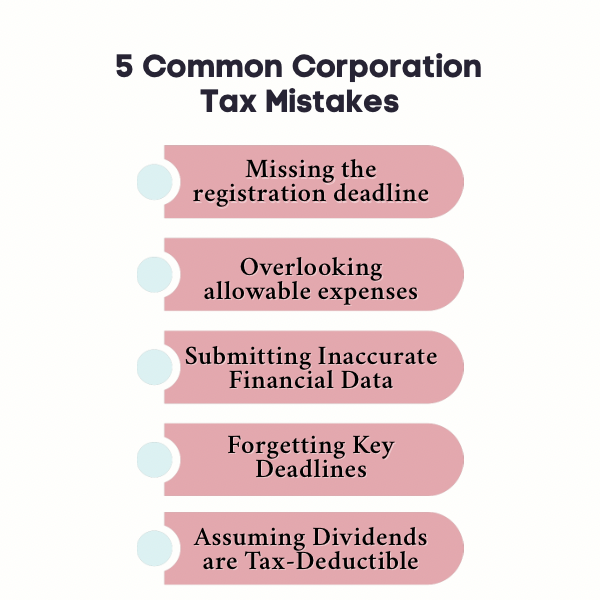

5 Common Corporation Tax Mistakes, and How to Avoid Them?

Even the most organised business owners can make mistakes when handling corporation tax, especially with changing rules and tight deadlines. These tax mistakes can lead to penalties, unexpected corporation tax bills, or lost opportunities to reduce what you owe. Here are some of the most frequent pitfalls to watch out for:

1. Missing the Corporation Tax Registration Deadline

You must register your company for corporation tax within 3 months of starting to trade. Many businesses delay this step, especially if they haven't started invoicing yet. However, even activities like marketing, buying stock, or signing contracts count as “trading” in HMRC’s eyes. Set a reminder to register as soon as you begin business activities.

2. Overlooking Allowable Expenses

Failing to claim all your eligible business expenses means you’ll likely pay more business tax than necessary. Don’t miss out on deductions like office costs, travel expenses, equipment, salaries, and professional services, all of which reduce your taxable profits.

3. Submitting Inaccurate Financial Data

Errors in your Company Tax Return (CT600), even unintentional ones, can raise red flags. Whether it's misreporting income or miscalculating reliefs, incorrect figures may trigger a tax enquiry or correction notice from HMRC.

Double-check your CT600 form for accuracy. Use reliable accounting software or hire an accountant to avoid mistakes.

4. Forgetting Key Deadlines

You must file your CT600 within 12 months of your company’s year-end, but remember, payment is due 9 months and 1 day after year-end. Confusing these two deadlines is a common (and costly) mistake. Set calendar reminders for both filing and payment deadlines.

5. Assuming Dividends are Tax-Deductible

Unlike salaries, dividends paid to shareholders are not allowable deductions for corporate tax purposes. Some business owners wrongly assume they can reduce profits with dividends, which can lead to miscalculations and underpayment. Consult an accountant to ensure you're claiming the right deductions.

Simplify Your Tax Journey with Accountancy Cloud

Managing corporation tax can be overwhelming, and that’s where Accountancy Cloud steps in. Our expert team offers comprehensive, digital-first tax solutions that ensure your business stays compliant and maximises tax reliefs. Whether you're navigating complex tax returns or claiming R&D credits, Accountancy Cloud has got you covered. Partner with us to streamline your tax processes and focus on growing your business.

Get in touch today to learn how we can help.

Conclusion

As the number of companies continues to grow in the UK, understanding the corporation tax system is essential. Whether your profits fall near the lower limit or approach the upper limit, knowing how and when to pay corporation tax keeps your business compliant and prepared.

Keep in mind that your fiscal year may differ from the calendar year, which can affect your filing and payment deadlines. Submitting inaccurate information can lead to penalties or trigger HMRC reviews, so accuracy is key.

By staying organised and informed, corporation tax becomes a routine part of running your business, and not a costly surprise.

Frequently Asked Questions

1. Do I need an accountant to handle corporation tax, or can I do it myself?

You’re not legally required to hire an accountant, but many businesses do. An accountant can help maximise deductions, ensure compliance, and avoid costly mistakes, especially if you're unfamiliar with UK tax rules.

2. How does corporation tax work for dormant companies?

If your company is dormant (not trading and not receiving income), you still need to notify HMRC. In most cases, you won’t need to file a full return or pay corporation tax, but official confirmation is required.

3. Are charitable organisations exempt from corporation tax?

Registered charities are generally exempt from corporation tax on most types of income and capital gains, provided the money is used for charitable purposes. However, commercial trading activities may still be taxable.

4. Can I amend my Corporation Tax Return if I realise there’s an error?

Yes, you can amend your CT600 within 12 months of the filing deadline. Corrections must be submitted through the same method used for the original return (e.g. HMRC online portal or approved software).

5. Can late corporation tax filing affect my company’s credit or reputation?

While HMRC doesn’t report directly to credit agencies, persistent non-compliance may raise flags during due diligence by lenders or investors and could affect funding opportunities.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.