How to Prepare Management Accounts: A Step-by-Step Guide

Jul 2025

Feeling swamped by spreadsheets and deadlines when preparing management accounts? This guide will transform that stress into clarity, with simple, actionable steps, from gathering and reconciling data to crafting a professional executive summary.

You’ll learn how to spotlight trends, flag risks and steer confident decisions. Read on to streamline your reporting and gain real-time insight into your business’s performance.

What are Management Accounts?

Management accounts are internal reports offering timely insights into a company’s financial health and operations. They typically include profit and loss summaries, cash flow trends and balance sheet snapshots, combined with key operational metrics.

By revealing trends, flagging risks and measuring progress against targets, management accounts enable smarter decision-making, clearer communication with stakeholders and more effective strategic planning.

Who Needs Management Accounts?

Management accounts provide valuable insights for various stakeholders within and outside the business. Here's a breakdown of who typically needs them:

- Business Owners and Senior Leaders: Use management accounts to assess overall performance and guide strategic decisions.

- Department Heads: Rely on management accounts to manage budgets and track team performance.

- Investors and Lenders: Often request interim figures to evaluate financial stability and assess growth potential.

- External Advisers: Accountants, tax specialists, and consultants use timely reports to provide guidance on efficiency, funding, and risk management.

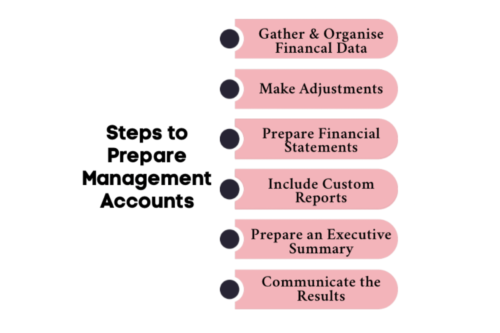

A Step-by-Step Guide to Preparing Management Accounts

Preparing management accounts requires careful planning and attention to detail. A typical monthly or quarterly cycle should include comprehensive financial statements, relevant operational metrics and any other pertinent information. Below, we’ll look at how to prepare monthly management accounts:

Step 1: Gather and Organise Financial Data

Collect all necessary figures, such as bank statements, supplier invoices and stock valuations, and reconcile them with your accounting software. Classify transactions into clear groups (for example, revenue, expenses and liabilities) to streamline reporting. Where possible, use an automated accounting system to reduce manual errors. However, always verify critical balances, such as your bank position, to ensure complete accuracy.

Step 2: Make Adjustments

Adjustments ensure that your figures present a true and fair view. Include accruals for tax liabilities, deferred expenses and any depreciation or amortisation. These adjustments not only provide a clearer picture of net performance, but also highlight potential risks, such as unusual expense patterns, that may require investigation.

Step 3: Prepare Financial Statements

Compile the core statements:

- Income Statement: Lists all income and expenditure, revealing net profit for the period.

- Balance Sheet: Shows assets, liabilities and equity at a specific date, reflecting the company’s financial position.

- Cash Flow Statement: Cash flow statements track cash movements across operating, investing and financing activities, confirming whether you have sufficient liquidity for day-to-day needs.

Step 4: Include Custom Reports

Tailor additional schedules to your organisation’s unique requirements. Examples might include:

- Trend Analysis: Sales, cost and customer-behaviour trends to inform future planning.

- Customer Satisfaction Metrics: Net Promoter Scores or survey results to gauge client sentiment.

- Operational Metrics: Production output or inventory turnover to identify areas for efficiency gains.

Step 5: Prepare an Executive Summary

Distil the key findings into a concise overview. Highlight critical KPIs, such as gross profit margins or turnover ratios, and note any significant variances from the previous period. A departmental breakdown can further help team leaders see their performance at a glance, aligning everyone with the company’s strategic objectives.

Step 6: Communicate the Results

Present your findings in a format suited to the audience, whether that be the board, senior management or department heads. Use charts and graphs to clarify complex data and schedule regular review meetings to discuss variances and opportunities. By coupling clear visuals with strategic recommendations, you ensure that management accounts drive informed decision-making throughout the business. These recommendations might include investing in growth areas or mitigating emerging risks.

Want to streamline your small business finances? Explore our A Mini Guide to Accounting: Small Business Edition for tailored tips and best practices.

What are the Benefits of Management Accounts?

Management accounts provide numerous advantages that can significantly enhance a business's financial performance, decision-making, and strategic planning. Here are some key benefits:

1. Improved Financial Control

Regularly reviewing management accounts enables businesses to closely monitor cash flow, expenses, and profits. This helps maintain better control over financial resources, reducing the risk of overspending and ensuring that funds are allocated efficiently.

2. Informed Decision-Making

Management accounts provide real-time data that supports informed decision-making. By having access to up-to-date financial information, business leaders can make smarter choices about investments, budgets, and resource allocation, which helps steer the company towards its goals.

3. Identifying Trends and Issues Early

One of the main advantages of management accounts is their ability to highlight trends, anomalies, and potential issues early. Whether it’s an unexpected dip in sales or an increase in costs, identifying these patterns in time allows businesses to take corrective action before problems become bigger.

4. Enhanced Planning and Forecasting

With accurate, regularly updated financial data, management accounts provide a reliable basis for forecasting. This helps businesses plan for future growth, adjust to market changes, and prepare for challenges, making them more adaptable and strategic in their long-term planning.

5. Support for Investors and Lenders

Well-prepared management accounts offer transparency to investors, lenders, and other stakeholders. They present a clear view of the company’s financial health, helping build trust and confidence in the business’s ability to generate returns and manage risks, which is crucial when seeking funding or attracting investment.

6. Streamlined Business Operations

Management accounts go beyond financial metrics and offer valuable operational insights. By identifying inefficiencies and areas for improvement, businesses can streamline operations, optimise processes, and ensure that every department is working efficiently towards shared goals.

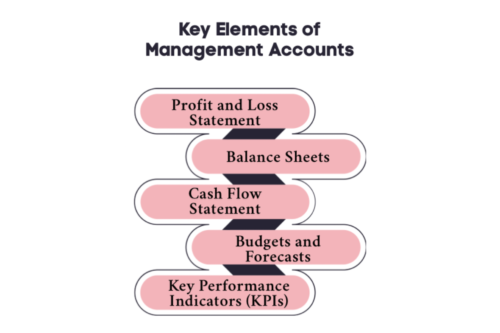

What should be included in management accounts?

Management accounts distil essential financial and operational data into clear, timely reports. They enable managers to monitor performance, spot trends and make informed decisions. They combine to form a comprehensive package. A robust management account typically comprises the following elements:

1. Profit and Loss Statement

This report summarises your trading performance over a set period. It starts with revenue, subtracts all expenses, including taxes and depreciation, and reveals net profit. Analysing gross profit margins over time helps you spot rising costs or under-performing areas, and ensures forecasts are grounded in accurate figures.

2. Balance Sheet

A snapshot of your financial position at a specific date, the balance sheet lists assets (what you own or are owed), liabilities (what you must pay) and equity. Delivered regularly, often via automated dashboards, it helps you assess solvency, capital structure and working-capital requirements.

3. Cash Flow Statement

This statement tracks how cash enters and leaves the business within a period. By showing operational, investing and financing cash flows, it clarifies whether you have sufficient liquidity for everyday expenses and supplier payments. Regular review safeguards against shortfalls and supports growth planning.

4. Budgets and Forecasts

A budget outlines expected income and expenditure, guiding strategic choices. Forecasts use historical results and current market insights to predict future flow of cash and identify risks. Together, they enable you to monitor performance, allocate resources wisely and adapt to change.

5. Key Performance Indicators (KPIs)

KPIs such as turnover ratios, gross profit margin or new-customer acquisition quantify progress towards your goals. Regular monitoring offers a clear view of financial health and operational efficiency. It also supports informed decision-making and demonstrates credibility to investors or lenders.

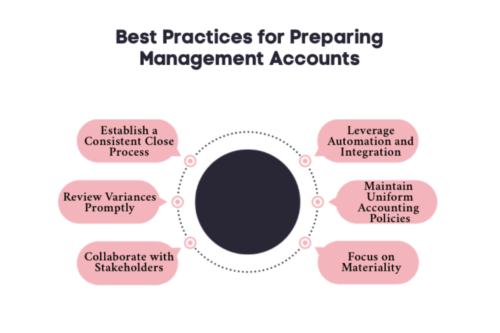

6 Best Practices for Preparing Management Accounts

Consider these best practices when setting up or refining your reporting process:

1. Establish a Consistent Close Process

Set a fixed timetable for month-end or quarter-end close activities. A reliable schedule reduces last-minute rushes, ensures all transactions are captured and builds confidence in the management reports.

2. Leverage Automation and Integration

Automate data imports from your bank, invoicing system and expense tools where possible. Integrations cut down manual errors, save time and keep your figures aligned across all platforms.

3. Maintain Uniform Accounting Policies

Apply the same recognition and measurement rules each period. Consistency in areas such as revenue recognition, depreciation methods and inventory valuation ensures comparability and prevents misleading variances.

4. Focus on Materiality

Prioritise significant amounts and trends. Rather than reporting every minor transaction, concentrate on those that materially impact profitability or liquidity. This keeps your accounts clear and decision-focused.

5. Review Variances Promptly

Investigate differences between actuals and budgets or forecasts as soon as the numbers are available. Early analysis of unexpected swings, whether in costs, sales or cash flow, allows you to take corrective action quickly.

6. Collaborate with Stakeholders

Involve department heads and operational teams when interpreting results. Their insights on unusual events or emerging issues will enrich your commentary and ensure recommendations are both practical and relevant.

Looking to streamline your financial processes even further? Find out why choosing business accounting services in London could be the smartest move for your company.

Want Smarter, Faster Accounting for Your Startup? Choose Accountancy Cloud

Say goodbye to clunky spreadsheets and missed insights. At Accountancy Cloud, we deliver real-time financial information, expert support and clear visibility into your financial performance, so you can make informed business decisions and scale with confidence. From seamless bookkeeping to proactive strategic advice, our online accounting service is built for high-growth startups like yours.

Ready to make smarter decisions? Book your free consultation today and discover the clarity you’ve been missing.

Final Thoughts

Finishing the work on management accounts is important for business owners, as it helps them make strategic decisions. A good set of management accounts gives the management team a clear look at the business’s financial health. The team gets to use key financial data, which helps a lot. When businesses follow the best ways of management accounting, they can see how well they are doing, spot any potential risks, save valuable time, and take chances for new funding. In the end, this way of working helps meet rules for statutory accounts and matches up with larger financial goals.

Frequently Asked Questions

1. How often should management accounts be prepared in the UK?

Ideally, management accounts are produced on a monthly basis to maintain close control over finances and address issues as they arise. Some smaller or less complex enterprises may find quarterly preparation sufficient, provided it still supports timely decision-making.

2. What information should be included in management accounts?

A robust set of management accounts brings together a profit and loss overview, a balance sheet snapshot and a cash flow statement, alongside detailed budgets, cash flow forecasts and key performance indicators. Custom reports tailored to your operations, such as sales trends or customer metrics, round out the picture and ensure you have all the insights needed to plan effectively.

3. Can management accounts help secure business funding?

Absolutely. Lenders and investors look for clear evidence of cash-flow stability, consistent profitability and sound financial management. Up-to-date management accounts supply that evidence, demonstrating your ability to meet obligations and highlighting growth potential.

4. How do management accounts benefit decision-making?

By delivering current financial and operational data, management accounts reveal emerging patterns, highlight areas for improvement and enable you to allocate resources more strategically. They also support ongoing monitoring of the performance of your business, so you can adjust tactics swiftly and stay on track against your objectives.

5. Should I use an accountant to prepare management accounts?

Appointing an accountant ensures accuracy, compliance with accounting standards and expert interpretation of complex figures. If your team lacks the necessary expertise or bandwidth, enlisting a professional will save time, reduce the risk of error and provide valuable strategic guidance.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.