Year End Accounts Checklist: How to Stay Compliant in 2025

Feb 2020

Year-end accounting often arrives with more chaos than clarity. From missing invoices and unreconciled bank feeds to looming tax deadlines and HMRC penalties, it’s a time when financial blind spots can turn into costly mistakes. For founders and finance teams alike, not having a structured process can lead to rushed filings, missed reliefs, and decisions made in the dark.

However, the process of closing your accounts at the end of the financial year is an essential task that should be approached with care and precision. Beyond ensuring that your business complies with tax regulations, year-end accounts offer valuable insights into your financial health, performance, and future opportunities. This is your chance to identify improvement areas, uncover revenue and expense trends, and make data-driven decisions to propel your business forward.

Whether you're managing a small business or overseeing a growing enterprise, having a clear and organised approach to year-end accounting is crucial. A thorough review not only helps prepare for tax filings but also allows you to evaluate the financial stability of your operations and plan effectively for the upcoming year.

Following a well-structured checklist can streamline this process and ensure your business enters the new year on solid financial footing.

Switch to us today.

- Powerful software

- Finance experts

- Cost effective

- Easy to switch

What Is Year-End Closing in Accounting?

ear-end closing, or "closing the books," is the process of reviewing and finalising your company’s financial records for the year.

It involves:

- Reconciling accounts

- Making necessary adjustments

- Preparing financial statements for tax filings, investors, and regulators.

This step ensures that all transactions are reviewed, discrepancies are addressed, and the company’s financial health is accurately represented. It's crucial for accurate reporting and informed decision-making.

Though essential, year-end closing can be complex, requiring collaboration across finance, operations, accounting, and IT. A smooth process ensures solid financial data, setting the stage for the next year’s strategy.

With many accountants juggling heavy workloads, a well-organised company accounts checklist is key to avoiding errors and ensuring a seamless and precise year-end close.

Why Is Year-End Closing So Difficult and How to Make It Easy?

Closing the books at year-end can feel overwhelming due to several challenges:

- Inaccurate or Missing Documentation: Without clear records of financial transactions, the process becomes tedious and prone to errors.

- Manual Processes: Relying on manual entry can slow things down and increase the chances of mistakes.

- Audit and Compliance Pressure: With audits often happening at year-end, companies must ensure their records meet strict standards within tight deadlines.

While year-end closing may seem daunting, it doesn’t have to be. You can simplify the process by implementing a well-structured checklist and embracing modern accounting software.

Using a platform like Accountancy Cloud gives you real-time visibility, streamlined workflows, and fewer errors, without the stress.

These tools streamline tasks and reduce the risk of errors, ensuring accuracy and compliance.

With the proper planning and technology in place, what once seemed like a stressful hurdle can become a more manageable and efficient task, setting your business up for a smooth transition into the new year.

Why Is the Accounts Year End Checklist Important?

A year-end accounting checklist simplifies the financial close process and ensures you don’t lose important information from previous years. With numerous tasks to manage, it ensures everything is completed on time, reducing errors and boosting accuracy.

1. Ensuring Compliance and Accuracy

A checklist helps maintain accuracy and compliance in your financial records. With many transactions throughout the year, mistakes can happen.

It ensures every entry is correct, helps calculate tax liability, and manages accruals. The checklist guarantees you’re fully compliant with legal and regulatory standards, preventing costly mistakes and maintaining investor trust.

2. Streamlining Financial Review and Audit Processes

A well-organised checklist simplifies audits and financial reviews. It ensures every transaction is accounted for, reducing discrepancies.

With up-to-date invoices and receipts, reconciliation becomes easier, speeding up the audit process and potentially lowering costs. An organised record also boosts investor confidence, especially if you want to raise capital.

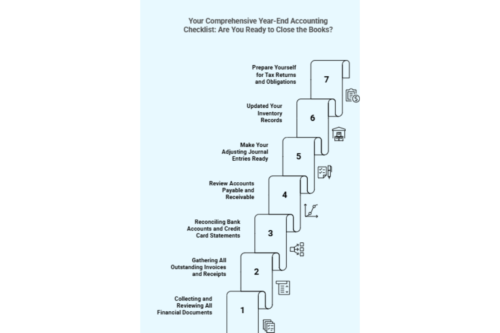

Your Comprehensive Year-End Accounting Checklist: Are You Ready to Close the Books?

The end of the financial year can feel like a mountain of paperwork and endless reconciliations. But with a well-structured checklist, you can turn chaos into clarity. Whether you’re running a coffee shop, managing a food manufacturing business, running an online store, or navigating the FMCG sector, year-end accounting matters. Here’s how to stay on top of your tasks and keep your financials in check.

1. Collecting and Reviewing All Financial Documents

Before examining the numbers, gather every financial document for the fiscal year: bank statements, credit card statements, sales records, payroll data, and business loan information.

Think of it as taking stock of your business’s financial health. Spot a discrepancy? Address it now to avoid accounting headaches later. After all, the accuracy of these records sets the stage for a smooth close.

2. Gathering All Outstanding Invoices and Receipts

Every pound counts when it comes to accurate financial reporting. Are there any invoices still unpaid? Does a receipt back up every business expense?

Collecting outstanding invoices ensures your accounts receivable accurately reflect revenue earned. Securing receipts helps you account for every expense and potentially reduce your corporation tax liability. Missing a receipt could mean overstated income and higher taxes.

3. Reconciling Bank Accounts and Credit Card Statements

Reconciliation might not be the most thrilling task, but it’s crucial. Compare your bank statements and credit card statements against internal records. Are all transactions recorded?

Any discrepancies need to be investigated and corrected before you close the books. Unreconciled items can distort your financial statements and lead to inaccurate cash flow reporting.

4. Review Accounts Payable and Receivable

How much do you owe suppliers? And how much do customers still owe you? Reviewing accounts payable (AP) and accounts receivable (AR) helps you pinpoint outstanding obligations and expected cash inflows.

This step is crucial for maintaining cash flow visibility and ensuring an accurate balance sheet. Don’t let unpaid invoices slip through the cracks, as they could impact your liquidity and tax calculations.

5. Make Your Adjusting Journal Entries Ready

Adjusting journal entries are your final line of defence against financial inaccuracies. Have you recorded all accrued revenues and expenses? Have you accounted for prepayments and deferred expenses?

Making these adjustments ensures that your financial statements accurately reflect all income earned and expenses incurred, keeping you in line with GAAP or IFRS accounting principles.

6. Updated Your Inventory Records

Your inventory is a key asset if you’re in retail or food manufacturing. But have you verified your stock counts against recorded inventory levels? This step helps you spot discrepancies caused by shrinkage, theft, or damage.

Adjust your records to reflect actual stock levels, and consider how your valuation method, FIFO, LIFO, or weighted average, affects your financials, including depreciation. Accurate inventory records are essential for realistic asset valuation and tax reporting.

7. Prepare Yourself for Tax Returns and Obligations

Tax season is looming, but are you ready? Calculating corporation tax liability involves more than just tallying profits. Have you accounted for all allowable business expenses? Checked filing deadlines?

Consider deferring income or accelerating deductions strategically to manage your tax position effectively. Proper planning now can save you from unexpected tax bills or penalties down the road.

3 Best Practices to Simplify Year-End Closing

Year-end closing doesn’t have to be a headache. By adopting a few strategic practices, businesses can streamline the process and keep financials on point. Here’s how to get it done efficiently:

1. Leverage Advanced Accounting Software

Automated accounting software is a game-changer for year-end closing. Here's how:

- It reduces manual work, minimises errors, and keeps financial data organised and accessible.

- From reconciling bank accounts to processing invoices, automated systems handle routine tasks faster and more accurately than manual methods.

- They also provide real-time financial insights, ensuring that reports are up-to-date and compliant with the latest tax regulations.

2. Schedule Regular Financial Reviews

Regular financial check-ins throughout the year prevent last-minute scrambles. Here's how:

- Monthly or quarterly reconciliations keep accounts payable and receivable, and bank statements accurate and up-to-date.

- This practice reduces the year-end workload and helps businesses stay on top of cash flow and spot discrepancies before they snowball into more significant problems.

- Accurate bookkeeping and financial statements make it easier to identify trends and make data-driven decisions.

3. Seek Expert Guidance

Professional accountants and financial advisors bring valuable expertise to the year-end closing process. With Accountancy Cloud, you’re matched with a certified accountant who knows your industry, responds quickly to your queries, and works through a simple, digital-first platform. Here's how:

- They can create tailored checklists, recommend the right accounting software, and provide strategic tax planning advice.

- Expert guidance ensures that financials remain accurate and compliant for growing businesses, even as operations expand or new revenue streams are added.

- Having a second set of eyes on the books also reduces the risk of missed deductions or costly errors.

Your Year-End Isn’t the End; It’s Where Accountancy Cloud Begins

Year-end isn’t just about wrapping up; it’s about setting up your next move. And that’s where Accountancy Cloud makes a real difference.

We go beyond compliance to deliver a strategic, fully connected accounting experience designed for modern UK businesses. From closing your books to planning the year ahead, our platform and services support every financial touchpoint, streamlining the essentials and delivering clarity where it counts.

Here’s how we help you stay in control before, during, and after your year-end close:

- Stay on top of cash flow and budget forecasts

- Identify tax-saving opportunities early

- Spot financial risks before they escalate

- Keep financial records accurate, organised, and ready for the next close

And most importantly, we make expert guidance accessible and efficient:

- Get matched with a certified accountant

- Receive quick responses to your questions

- Manage everything through a simple, fast, online platform

If you’re ready to turn year-end chaos into year-round clarity, talk to a team that does more than just accounting. Talk to Accountancy Cloud.

Close With Confidence, Plan With Precision

Year-end closing doesn’t have to be a headache. With the proper checklist, businesses can tackle it systematically, maintaining accuracy, staying compliant, and prepping for audits without the last-minute rush. Regular financial reviews, innovative accounting software, and expert guidance aren’t just best practices; they’re lifesavers.

But year-end isn’t just about wrapping up the books. It’s a launchpad for the next financial year. A smooth closing process gives you a clear view of your financial health, setting the stage for smarter planning and more decisive decision-making.

Stay proactive, stay organised, and turn this crunch time into a growth opportunity.

Frequently Asked Questions

What is the primary purpose of year-end closing?

The primary purpose of year-end closing is to finalise a company's financial records for the fiscal year. This involves reconciling accounts, making necessary adjustments, and preparing financial statements. The process ensures accurate reporting of a company's financial information to investors, regulators, and tax authorities.

What documents are essential for year-end accounting processes?

Crucial documents for year-end accounting include bank statements, credit card statements, loan information, sales records, and payroll records. Other essential documents include all outstanding customer invoices and receipts for business expenses. These documents form the basis for reconciling accounts and preparing financial statements.

How can technology help streamline year-end closing?

Technological advancements facilitate a more efficient and streamlined year-end closing process through:

- Automated processing of transactions reduces manual labour and the risk of errors.

- Real-time tracking of financial data aids timely decision-making.

- Ensuring compliance by staying updated with changes in tax laws and accounting standards.

What are the common challenges faced during year-end closing?

Common challenges during year-end closing include managing various tasks involved, inaccurate or missing documentation, heavy reliance on manual processes, and ensuring compliance with tax laws and regulatory requirements, including correctly handling expense reports. Implementing efficient strategies like preparing a detailed end of year accounts checklist and leveraging technology can help mitigate these challenges.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.