Bookkeeping and Accounting: What's the Difference?

Dec 2022

You’re juggling invoices, expenses, and tax deadlines, yet every time someone mentions bookkeeping or accounting, it feels like the lines blur. Do you need both? Are they two sides of the same financial coin? For small business owners, startup founders, or anyone managing company finances, understanding the difference isn’t just nice to know; it’s critical.

The wrong choice can mean compliance issues, missed growth opportunities, or paying for services you don’t actually need. This blog will break it down in plain terms and help you figure out what’s right for your business.

What Is Bookkeeping and Why Does It Matter?

Bookkeeping is the foundation of any sound financial system. It’s the day-to-day task of recording financial transactions, everything from sales and purchases to receipts and payments. For small business owners, it’s the front line of financial clarity, ensuring that cash flow is tracked accurately and that financial decisions are based on solid data.

Well-maintained books not only help you stay compliant but also set the stage for practical accounting, tax filing, and strategic growth planning.

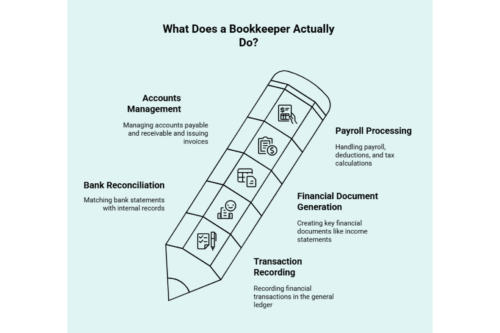

What Does a Bookkeeper Actually Do?

Bookkeepers manage the everyday financial activity that keeps your business moving. This includes:

- Record all transactions in the general ledger (journal entries).

- Reconcile bank statements to match your internal records.

- Generate key financial documents, such as income statements and balance sheets.

- Manage accounts payable and receivable and issue accurate invoices.

- Handle payroll processing, including deductions and tax calculations.

A good bookkeeper doesn’t just record; they help detect inconsistencies early and support better financial habits over time.

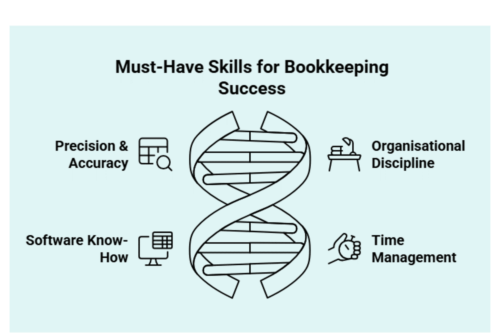

Must-Have Skills for Bookkeeping Success

Bookkeeping isn’t just data entry; it requires a blend of discipline and tech fluency. Here’s what makes a bookkeeper effective:

- Precision & Accuracy – Every figure matters. Even small errors can skew entire financial reports.

- Organisational Discipline – Keeping records neat and up to date helps ensure faster audits and better business forecasting.

- Software Know-How – Tools like Xero, QuickBooks, and Zoho Books are standard in today’s bookkeeping landscape.

- Time Management – Bookkeepers juggle recurring tasks and reporting deadlines, often under pressure.

Skilled bookkeepers don’t just keep things running; they spot red flags before they turn into financial roadblocks.

What Is Accounting and Why Is It Crucial?

Accounting goes beyond bookkeeping; it’s about interpreting numbers to guide smarter decisions. Accountants transform raw financial data into structured insights, preparing essential documents such as balance sheets and income statements. They assess a business’s financial health, ensure regulatory compliance, and offer forecasts that help business owners plan for growth, manage risks, and stay tax-efficient.

Where bookkeeping records, accounting reveals the bigger picture.

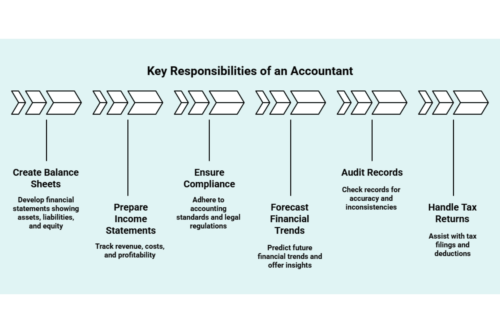

Key Responsibilities of an Accountant

Accountants help shape business plans and compliance through:

- Creating accurate balance sheets that show assets, liabilities, and equity.

- Preparing income statements to track revenue, costs, and profitability.

- Ensuring compliance with accounting standards and legal regulations.

- Forecasting financial trends and offering actionable business insights.

- Auditing records for accuracy and flagging any financial inconsistencies.

- Handling tax returns, helping with everything from deductions to corporation tax filings.

Accountants don’t just crunch numbers; they advise strategies and help businesses grow stronger financially.

What Qualifications Do Accountants Need?

A professional accountant typically holds key academic and industry credentials such as:

| Credential | Body | Purpose |

|---|---|---|

| AAT (Association of Accounting Technicians) | AAT | Entry-level qualification ideal for bookkeepers and junior finance roles. |

| ACCA (Chartered Certified Accountant) | ACCA | Globally recognised qualification for professional accountants in business and practice. |

| ACA (Chartered Accountant) | ICAEW | High-level UK qualification, often required for audit, tax, and advisory roles. |

| CIMA (Chartered Management Accountant) | CIMA | Focuses on management accounting, budgeting, and strategic planning in businesses. |

What Are the Core Differences Between Bookkeeping and Accounting?

| Aspect | Bookkeeping | Accounting |

|---|---|---|

| Main Role | Records daily transactions | Analyses and interprets financial data |

| Decision-Making | Routine tasks (data entry, invoicing) | Strategic (tax planning, forecasting) |

| Qualifications | Entry-level (AAT, ICB) | Advanced (ACA, ACCA, CIMA) |

| Business Impact | Ensures smooth operations | Drives growth with strategic insights |

| Compliance | Manages basic tax obligations (VAT, payroll) | Ensures tax law compliance and reporting |

If you’re running a business, knowing what's the difference between bookkeeping and accounting isn’t just helpful; it’s essential. Bookkeeping lays the groundwork by keeping your daily financial records accurate and up-to-date. Accounting builds on that, turning numbers into insights, reports, and strategies that can shape the future of your business.

Knowing where each role begins and ends helps you decide who you need and when, so your financial operations don’t just run, but run smart.

1. Bookkeepers Record, Accountants Analyse

At its core, the main difference is what they do with your financial data:

- Bookkeepers handle the day-to-day tasks, including recording sales, expenses, and bank reconciliations, while keeping your general ledger up to date and accurate. It’s about getting the numbers right consistently.

- Accountants step in to analyse: they look at those numbers, prepare financial statements, and interpret what the data actually means for your business growth, tax position, and profitability.

Think of bookkeeping as building the engine and accounting as tuning it for performance.

2. Decision-Making Power: Task vs. Strategy

The level of decision-making involved also separates the two:

- Bookkeepers stick to routine, detail-driven tasks. Their role involves maintaining accurate records, ensuring timely invoicing, and organising data.

- Accountants operate on a strategic level. They help you spot trends, flag risks, minimise tax liability, and provide guidance on long-term financial health.

If bookkeeping helps your business run smoothly, accounting helps it grow smartly.

3. Qualifications: Entry-Level vs. Advanced

The qualifications and career paths for bookkeepers and accountants differ significantly:

- Bookkeepers focus on entry-level certifications like AAT or ICB, honing practical skills in financial record-keeping and daily operations.

- Accountants pursue advanced qualifications such as ACA, ACCA, or CIMA, enabling them to take on broader financial strategy, tax planning, and business advisory roles.

While bookkeepers manage the numbers, accountants guide business growth with their advanced expertise.

4. Business Impact: Operational vs. Strategic

The impact on business operations is another key difference:

- Bookkeepers ensure smooth daily operations by handling tasks like transaction recording, cash flow management, and bank reconciliations.

- Accountants elevate the business by interpreting financial data to offer strategic insights, tax savings, and long-term planning for growth.

Bookkeeping keeps things running; accounting shapes the future.

5. Compliance: Routine vs. Complex

Compliance responsibilities also vary between the two roles:

- Bookkeepers handle the day-to-day compliance, ensuring VAT, payroll, and other routine financial obligations are met.

- Accountants tackle complex regulations, ensuring tax law compliance, preparing financial reports, and overseeing higher-level regulatory requirements.

While bookkeepers focus on the basics, accountants ensure your business meets all regulatory standards and avoids costly mistakes.

How Bookkeepers and Accountants Work Together?

Behind every financially healthy business is a team, or sometimes just two key roles, working in sync: the bookkeeper and the accountant. While one focuses on the numbers going in and out each day, the other turns those numbers into a bigger financial story. Here's what they do together:

Seamless Workflow for Small Business Success

Integrating bookkeeping and accounting services for small businesses is more than just a good idea; it’s a time- and money-saving move.

Here’s how this collaboration plays out in real-world operations:

- Real-time data updates keep your financial records accurate and ready for review.

- On-time tax filing becomes easier when your numbers are already clean and reconciled.

- Payroll adjustments and cash flow forecasts become faster and more reliable with shared access to up-to-date reports.

When your back-end systems talk to each other, you avoid last-minute scrambles and start making smarter decisions earlier.

Why This Combined Approach Works?

When bookkeeping and accounting aren’t treated as silos, the benefits multiply:

- Clearer Financial Visibility – Bookkeeping ensures accurate, up-to-date transaction records, while accounting interprets this data to provide insights into your financial health and forecast future trends.

- Stronger Planning – Bookkeepers track daily transactions, while accountants use that data for budgeting, financial forecasting, and creating long-term investment strategies.

- Smarter Compliance – When bookkeeping is handled correctly, accountants have accurate, well-organised data to file taxes, avoiding errors and missed deadlines.

- Proactive Insights – Accountants can analyze the real-time financial data provided by bookkeepers to identify patterns, opportunities, and potential risks, helping you make informed decisions.

- Streamlined Decision-Making – Bookkeepers ensure all financial data is recorded accurately, while accountants translate this into meaningful reports, helping management make timely decisions based on solid financial ground.

- Improved Cash Flow Management – Bookkeepers track incoming and outgoing payments, while accountants assess and adjust cash flow strategies to keep the business running smoothly.

- Efficiency in Financial Reporting – With both functions aligned, the financial reports generated by accountants are easier to prepare, ensuring timely submission and reducing the risk of inaccuracies.

Instead of just tracking money, you’re now using your finances as a roadmap to growth. That’s the power of collaboration done right.

Accountancy Cloud: Where Bookkeeping Precision Meets Accounting Insight

Struggling to bridge the gap between daily number crunching and big-picture financial strategy? Accountancy Cloud unites expert bookkeeping and advanced accounting under one roof, allowing your business to enjoy seamless data flow, real-time clarity, and actionable advice.

Our team doesn’t just keep your records spotless; rather, we translate every transaction into insights that drive smarter decisions and long-term growth.

With Accountancy Cloud, you get more than compliance; you get a financial partner who ensures your books are always accurate and your accounts are always insightful.

Whether you need meticulous transaction tracking, strategic forecasting, or both, we deliver the complete package, empowering you to focus on running your business while we handle the numbers. Got any questions? Get in touch with us now!

Conclusion: Why Knowing the Difference Matters for Your Business

Figuring out the key differences between bookkeeping and accounting can transform the way you manage your business. Bookkeeping roles focus on capturing daily financial information; it’s the first part of the accounting process that ensures accuracy and consistency.

But to unlock real insights, you need accounting. Accountants take that data and zoom out to see the bigger financial picture, offering guidance for financial planning and helping to forecast future business trends.

When both roles work together, they form a comprehensive and robust financial system, one that not only maintains order but also actively supports long-term growth and stability. Thus, aligning your bookkeeping and accounting teams isn’t just smart; it’s essential. And it could be the excellent starting point your business needs to reach the next level.

Frequently Asked Questions

Do I need both a bookkeeper and an accountant for my business in the UK?

Yes, when you combine both roles, you can manage business finances more effectively. Bookkeepers do essential bookkeeping tasks. They record all the money in and out. Accountants provide guidance that helps you plan effectively. They also guide you through the accounting process. This is particularly helpful when you need to take care of tasks such as business tax returns.

Can bookkeeping and accounting be self-taught?

Yes, you can learn bookkeeping and accounting on your own if you have the right habits and follow best practices. There are affordable online courses available for individuals seeking to enter this field. The Association of Accounting Technicians offers these courses, and they are a good way to start.

What software is commonly used by bookkeepers and accountants?

Programs like Xero and QuickBooks significantly assist with the bookkeeping process and financial analytics. These technological advances make financial operations much simpler. They give you tools that help improve business performance by making many tasks automatic and easy to do.

How often should bookkeeping and accounting tasks be performed?

Bookkeeping should be done daily to track transactions accurately, while accounting tasks like financial reporting, tax preparation, and strategic reviews are best performed monthly or quarterly to guide informed decisions.

Is there a significant cost difference between hiring a bookkeeper and an accountant?

Yes, accounting jobs usually give you higher earning potential because they cover a wider range of tasks. Bookkeepers do crucial basic work. However, accountants make decisions that contribute to job security and long-term growth.

Educational content just for startups. As a member, you’ll get unlimited access to an extensive range of guides, blogs and advice to help you run and grow your business.